Every December this blog provides an assessment of the year that was and provides a glimpse over the horizon. With annus horribilis all but in the rear-view mirror, I offer an in-depth picture of where we are economically and what may lie ahead for local housing and much more.

Welcome to the third annual Living the Dream blog predictions and projections in real estate and beyond.

Between the effects of the pandemic, the nation’s reckoning with its painful history of racial discrimination and the series of devastating natural disasters, 2020 has been among the most difficult years in American history.

The greatest health crisis in our lifetime has created one of the worst economic situations our country has ever seen, and it will take more than 12 months to overcome. But, as many great speakers have said and choirs sung, We Shall Overcome.

Forecasting where we are headed is challenging since the waters have been uncharted for some 9 months now. However, there is a solid consensus from economists that our interest-rate environment will remain at near-historic lows, with most experts predicting a 30-year conforming mortgage rate of about 3.1% – plus or minus 0.3 percentage point – and mortgage applications growing 8.5% in 2021, a slowdown from the current pace but good, nonetheless. [Rates are around 2.75% today, according to Freddie Mac, and 2.9%, according to the Mortgage Bankers Association (MBA).]

Low mortgage rates, which can reduce the monthly payment that comes with buying a house, have helped fuel the housing market – both here and nationally – through an otherwise-rough economic spell. Unlike the Great Recession of about a decade ago, housing activity – powered by a 27% surge in mortgage applications this year – will ultimately help lift the economy rather than deliver pain for millions.

Yet, the pandemic caused great damage to many on the economic fringes of society. Low income and households of color have taken a disproportionate hit. While about one-third of all homeowners reported losing income between March and September, the shares are as high as 49% among Hispanic owners and 41% for Black owners.

It is with all of this as a foundation that we share projections, forecasts and predictions, culled from reading the research, studies and spreadsheets:

Employment and Jobs

King County unemployment is now 4.7% (St. Louis Federal Reserve data, through October), down from its shocking peak of 14.9% in April. Unemployment is 7.1% across Seattle/Bellevue/Everett and is expected to slowly decline through 2021 to 5.5% in the Puget Sound region. Economists anticipate many of those unemployed are unlikely to return to their same jobs; if they do, it will be after there is a widely distributed vaccine, a majority of us are inoculated and businesses – the ones that have not closed permanently – opened up.

Employment across the county is expected to contract 5.9% in 2020, the most significant jobs reduction in any year since data has been collected. The good news: Economists project employment here will grow again in 2021, by 3.5%.

Many experts believe jobs, a primary driver of economic growth, will mostly recover by 2022 when national unemployment will be around 6.2% (down from 6.7% currently). Consumer confidence will return with those jobs and we should find ourselves on the upside of the economic optimism curve.

Comings and Goings, Ups and Downs

Population growth, which rose 1.6% in 2019, should continue but at a reduced pace of about 1.3%, with approximately 27,000 additional people arriving to King County in each of 2020 and 2021. (Our county has about 2.27 million residents today.) By a different measure, LinkedIn research shows there was an 11% drop in net arrivals to Seattle in 2020 (through August), the third-sharpest decline among U.S. cities after New York and San Francisco.

Inflation for Seattle is up 2.4% this year, which is little changed from 2019 and slightly worse than forecast (2.1%). Food and housing prices contributed to the rise. County-wide, inflation is likely to be a negligible 1.5% at year’s end before rising in 2021-2022 to around 2.5% each year. Nationally, inflation is currently 1.2% and is expected to remain low at around 1.7% in 12 months.

Real Estate / Consumer Trends

There are other trends beyond economic that are driving change in real estate. We are seeing evidence of urban flight, residents requiring more space to be productive for work and play and more Americans saving their money – in most cases, at a pace that appears to be accelerating.

A survey of 2,000 consumers conducted this summer said 46% of them were thinking about relocating within the next year. Twenty-seven percent say their current place is too small and they are considering a new home in their current area. When shopping for a new home, 15% said they are seeking places that can accommodate older adult relatives or young adults now living within the residence.

Builders of detached accessory dwelling units (aka mother-in-laws) – backyard houses that can serve as separate living quarters – are reporting a rapid rise in business since the pandemic began. Not sure if you want to build a permanent home? Urbaneer ADU, a New Jersey-based company, will install units for about $8,500 and charge a monthly lease of $2,000 for a minimum 5 years until the company removes the home.

Some homeowners are spending savings on remodeling, in a sign that households are staying put or, for some, in preparation of putting the home on the market. Home-project activity tends to slow during recessionary times but not this occasion. Consumer surveys show nearly eight in 10 households took part in a DIY home project in 2020, including landscaping and painting to general maintenance – and forecasts call for this to continue before easing by the end of 2021.

Construction Surge

The low interest rates are giving a boost to new construction. After a brief pause in April amid state lockdowns, new home starts in the U.S. rebounded to a 1.3 million annual rate by October, a 14% increase from a year earlier. Fannie Mae and the MBA predict single-family-home construction in 2021 will rise about 9%.

Building permits were around 1.5 million nationally, up 2.8% Year-on-Year (YoY), through October. Housing completions gained 5.4% from last year, to 1.3 million units. A national panel of experts forecast 2021 will see 1.5 million new homes started, surprisingly lower than the approximate 1.53 million starts this year. The higher cost of building materials and a shortage of qualified, skilled labor are factors for the lower production.

King County permits for single-family home construction are 10% lower (through September) compared to 2019, which is better than forecast. Multi-family permits in the county are down 20%, according to the U.S. Census Bureau. County officials said they expect the pace of housing permits to slow in 2021 by about 17% YoY (to 12,000) as builders pull back primarily from developing multi-family projects.

National home builders such as Toll Brothers and KB Home are projecting a 10% increase in new-home construction on their undeveloped land. Housing experts said the shift could also push the average U.S. home to roughly 3,000 square feet, or 37% larger than it was 20 years ago.

“We are currently experiencing the strongest housing market I have seen in my 30 years at Toll Brothers,” CEO Douglas Yearly Jr. told shareholders last week. “With our highest year-end backlog in 15 years and continued strong demand, we expect to deliver the most homes in our history in FY 2021 [approximately 9900 units].”

Demand for larger homes – to accommodate home-schooling, fitness routines or a Zoom room – will likely inflate building costs and eventually raise the overall median price of a home. That’s bad news for some buyers balancing their finances on an income that likely has not kept pace with prices.

Millennials – the largest generation in U.S. history – have been the dominant buying force for about 5 years now. In a survey of this generation (born 1981-1997) who are seeking to buy, 49% reported Covid-19 pushed them to purchase sooner than their original timeline and 63% of those buyers said they plan to get their own home because of the ability to work remotely.

Redefining the Seattle Burbs

The very definition of the Seattle suburbs is being redefined as a growing number of workers find themselves no longer needing to appear in the office – even after we all return to our “new normal.”

Locals are moving further afield – from Bellingham to Boise – as well as to places like the former coal town of Black Diamond in southeast King County. Builders are moving forward with plans to add 750 homes a year in the Ten Trails community, affordably priced from around $475,000, according to Puget Sound Business Journal.

Irene Garcia, president of the Kitsap County Association of Realtors®, said Seattle-area residents are among those jostling for homes in her market. Inventory is depleted and each listed home has five or six potential buyers ready to immediately sign an offer, she said.

Is the “residential repositioning” of 2020 temporary or permanent? It depends on the line of work you do.

In previous years, some companies that tried work-from-home options have had to call employees back into the office as productivity declined. Will this happen again? The answer will likely wait until Covid is squashed and businesses institute post-pandemic health & safety and remote-working policies.

Growing Desperation

Just as we have read about food insecurity, so too is there housing insecurity among a percentage of America. A recent analysis from the Federal Reserve said there has been as much as a 70% increase from last year in people paying rent on a credit card. And a survey released this month from the MBA reported a slight increase, to 5.5%, in the total number of loans in forbearance. (For context, about 8% of all loans were in forbearance at the peak of the Great Recession in early 2010.)

Those without adequate resources have faced not just the risk of eviction or foreclosure, but greater exposure to Covid-19 – a critical issue that will likely become more acute until vaccines are widely available. And federal or state assistance is either running out or gone for now, although there are signs of progress on a new stimulus package in D.C. but, unlike last spring, don’t expect a $1200 check in the mail this time.

The City of Seattle’s Office of Housing committed approximately $60 million to invest in 600 new units of permanent supportive housing in 2021, a proven long-term solution for those who are struggling to stay off the streets. Microsoft pitched in another $65 million in the local effort. As I reported earlier, some advocates are weighing the possibility of transforming dead and dying retail locations into housing. (The big box store Fry’s Electronics is reportedly leaving Renton in favor of a 1000-unit residential property.)

Garcia, of Kitsap County Realtors®, expects a very sharp market correction when the federal government supports that are helping many stay in their homes are eventually pulled away. “We are not going to get out of this without injury,” she predicted.

George Ratiu, Senior Economist with realtor.com, noted in late November: “There are still over 20 million Americans receiving unemployment benefits across programs and, worryingly, there are over 12 million of them scheduled to run out of benefits in December unless Congress takes action.”

City Infrastructure

As tax revenues drop amid a lack of commercial and retail sales, cities such as Seattle could face major fiscal pain for several years and impact future services. The National League of Cities reported up to 65% of U.S. cities could delay or cancel infrastructure investments. That may include the Washington State Convention Center expansion project, which is reported to be facing a $200 million shortfall heading into 2021.

It’s full steam ahead for the recently named Climate Pledge Arena under the iconic roof in Seattle Center. Construction on the $1 billion arena refit is moving apace, with an unofficial target opening of next October, in time to debut our newest pro team, the Kraken of the National Hockey League. The league is expected to start its pandemic-delayed 2020-21 season on Jan. 13, about 3 months later than normal, thus likely stalling puck-drop the following season on the Kraken debut until late 2021. (The WNBA’s Storm will also play home games in the rebuilt arena.)

Seattle’s waterfront redevelopment (a topic I previously covered) is a few years away from completion. Officials say the timeline for the private-public project remains on track for a 2024 opening, with this coming year featuring the first phase of the new Ocean Pavilion at Seattle Aquarium and ongoing improvements to Colman Dock and street and bike lanes along Alaskan Way.

Property owners in a section of Belltown, Denny Triangle, downtown and the waterfront are on the hook for a portion of the redevelopment costs. They will be given the option to pay off their assessment either in a lump sum in 2021 or with an installment plan in 2022.

In passing its Green New Deal in 2019, Seattle City Council embarked on a 10-year goal to make the city free of climate pollutants. This means shifting from using carbon dioxide, methane and other gases and halt selling gas-powered furnaces, hot-water heaters and range/ovens in single-family homes. This month, though, Mayor Jenny Durkan announced new legislation to only include commercial and multi-family buildings (apartments, condos). If passed by the council, the change could take effect this spring. (The mayor announced in December that she will not seek a second term.)

Condo Updates

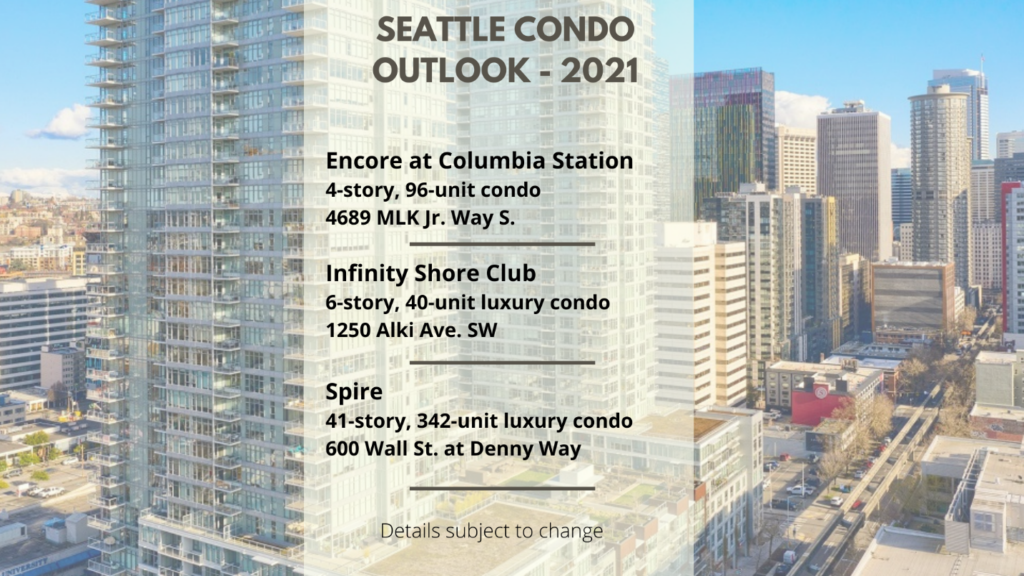

As The Emerald opens its doors this month at the foot of Pike Place Market, 2021 will feature another gleaming triumph in Spire, where Belltown and Denny Triangle meet (right next door to the former Pink Elephant Car Wash). Spire offers more than 300 luxury condo homes within its 41 stories, as well as a 2-story, top-floor fitness hub (PerSpire, anyone?). I love the 9-level, underground, auto-valet parking system – believed to be a first for a Seattle condo.

Both The Emerald and Spire have sold about a third of its inventory, indicating a significant slowdown since the pandemic hit our shores. All five of the penthouses at Spire are still on the market, priced between $1 million (1 bed/1 bath) and just shy of $3.5 million (3 bed/3 bath).

Spire is among three major condos expected to open in the coming year:

Signs point to a continued slowing of activity in the downtown/Belltown condo market, at least through early 2021, as some buyers remain skeptical about living in a high-density residential building in a health crisis.

Condo prices continue to appreciate, by about 9% YoY, even while inventories remain uncharacteristically high (4 months across the city and 7.5 months in downtown) compared with bare-cupboard listings for the rest of the region. Many experts, however, are optimistic that the distribution of the vaccine and eventual return of office workers will help reverse buyers’ absence from downtown.

“When this is over, people are going to be wanting to get back to the city and enjoy the lifestyle,” James Young, Director at the Washington Center for Real Estate at the University of Washington, told KING-5 News.

Housing Prices

Seattle metro (including King, Snohomish and Pierce counties) has experienced a jaw-dropping 83% increase in median home prices since 2010, or roughly a jump of $340,000, to about $750,000. Crazy, yes, and it is only expected to continue.

The Case Shiller price index for our region is up 10.1% YoY (through September). The local Multiple Listing Service indicates median sales prices gained 10% (through November) for single-family homes in King County, the smallest increase among any county in the region. There are no signs to indicate a slowdown of prices.

The forecast is less jarring nationally. MBA projects a 2.4% jump in home prices while Freddie Mac expects an increase of 2.6% across the U.S. in 2021. Lawrence Yun, National Association of Realtors’® senior economist, told John L. Scott Real Estate convention attendees in November that he believes prices will rise by 2%-3% in 2021. The outlier is realtor.com, which projects U.S. home prices to appreciate 5.7%.

Low interest rates will help soften the impact of higher prices, but it may mean buying a smaller home or accepting a slightly higher monthly payment.

[John L. Scott releases its 2021 local housing forecast later in the week. You can request a free copy of the report through me. Be sure to include which city/county report(s) – in Idaho, Oregon and Washington – you wish to receive.]

And, finally…

Washington State legislators open a new session – likely held all virtually – starting Jan. 11. It will be a busy one as lawmakers respond to the coronavirus, recession, worsening wildfire season, homelessness and the complexities of safely educating students in a pandemic. No specific housing proposals were available at the time of this writing, although the Seattle Chamber of Commerce hinted at Olympia possibly proposing a broadband infrastructure plan.

Speaking of technology, there is no question that the pandemic pushed real estate – and many other aspects of life – to evolve deeper and faster into new features and functionality. Technology kept “the trains running” in 2020, even under stressful and trying circumstances.

The average real estate transaction takes 181 steps from beginning to end, according to findings shared at a recent Realtor® conference. Real estate pros increasingly relied on virtual and 3-D tours, videoconferencing, augmented reality, automation, artificial intelligence, remote online notarizations and many other functions to complete business.

It’s only going to get better with the emergence of 5G technology, which is at least 100 times faster than 4G. (The time needed to download a 0.15 gigabyte PowerPoint presentation can decrease from 25.2 seconds in 4G to a mere 0.1 second in 5G, according to AT&T.) With 5G, people can live more remotely while still having more reliable high-tech access to healthcare, streaming entertainment offerings and real estate services. For example, drones that use 5G could provide home buyers easy-to-view video scenes of properties for sale before traveling to see them in person.

Tim Cook, CEO of Apple, put it well in describing how technology saved the day during the pandemic: “When it was crucial to remain apart, technology brought us closer together in ways unimaginable just a few years ago – helping families stay connected … helping us all stay productive, entertained and healthy.”

There so much promise ahead.

Sure, Seattle will struggle for two or more years before returning to pre-pandemic levels of growth. All cities are fighting this economic and health crisis but – here’s the thing – they will re-emerge as powerful hubs showcasing their strengths in finance, industry, commerce, entertainment, tech and education … and they will do it better than before.

I am seeing glimmers of hope and resiliency today as we adapt. Already, city planners are figuring out how to transform Seattle into a more livable, equitable place. Citizens are reporting petty crime, trash and graffiti in our city to the Find It, Fix It app, and the response time is generally good. They are growing public gardens, helping friends with food delivery and looking after their elderly neighbors.

It will get better.

Stay strong, stay informed, stay safe … and … celebrate the new year!

Data in this article were gleaned from reputable industry sources at the time the information was originally published or directly provided to me and is subject to change.