Residential real estate – like most industries – enjoys the use of acronyms and abbreviations to get information across. That can make for challenging moments for consumers when attempting to track the home-buying and -selling process.

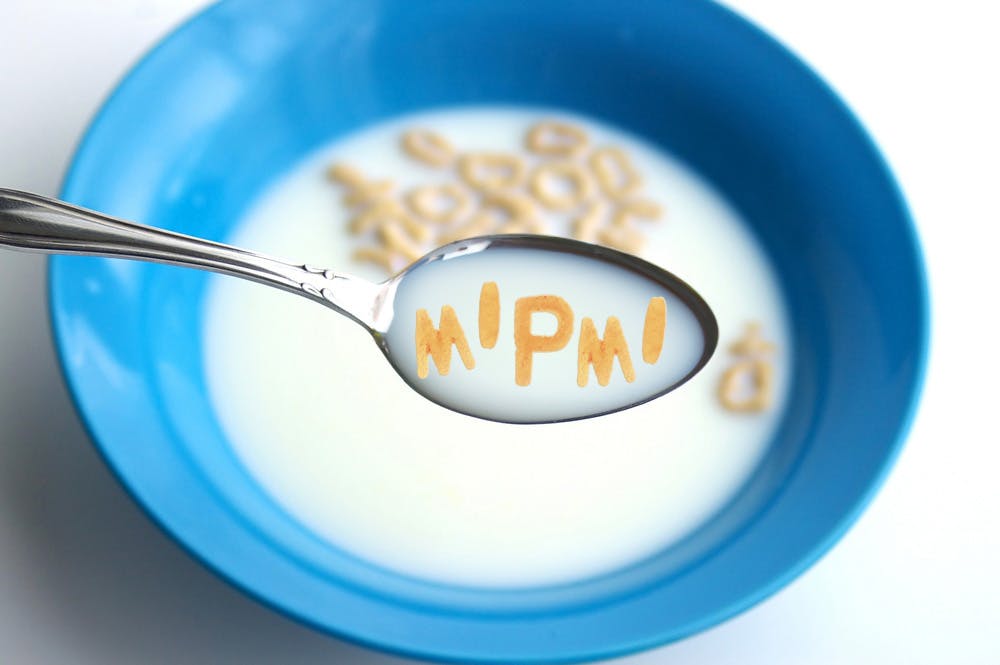

We have APR, CMA, CC&Rs and, of course, HOA – all commonly used terms to help “abbreviate” our conversations. Here are two more, perhaps lesser-known, terms worth noting – PMI and MIP. (Real estate terminologies.)

Continue reading →