The region’s real estate scene in 2023 will be remembered for rising home prices and scant new listings. Buyers and sellers tiptoed through caution. As the year dims, all eyes fixate on 2024’s potential: a hopeful dance fueled by dreams of lower rates and a wave of new homes for sale.

Welcome to our sixth annual look back at the year that was and to predictions and projections for the coming 12 months in real estate for Seattle/King County and beyond.

We experienced yet another unusual year for residential real estate – high interest rates, leading to affordability challenges amid low inventory. Sprinkle in global uncertainty – in the Middle East, Ukraine, China and elsewhere – as well as the threat of U.S. job losses and we have another odd year now in our rear-view mirror. Um, bye-bye!

Prospective buyers and sellers watched this one out from the sidelines, leading to King County sales activity hitting lows not seen since 2010 at the heart of the housing crises. Affordability kept consumers in their current residences. More than 75% of homes on the market are deemed too expensive for middle-class buyers, according to a study from the National Association of Realtors® (NAR) and realtor.com.

Here are some of the big questions to ponder in 2024.

We asked this question in last year’s blog post and, perhaps not surprisingly, the answer is about the same today: It depends. Many economists are more optimistic than in 2023 that we will avoid a serious recession and some are of the belief we will land the inflation/interest rate balance softly without much pain.

There are several concerns that people smarter than me are watching as potential flashpoints that could send America into a recession.

“In the current market, there is a lengthy list with inflation, high interest rates, bank stress and tightening liquidity, among others,” it was noted in a recent report from The Counselors of Real Estate. “Any one of those risks could cascade into other parts of the market and tip the economy into recession.”

The effects on consumers of a recession could include decreased personal spending, job losses and greater scrutiny by lenders. In an economic downturn, the housing market typically experiences slower sales and lower prices.

Economists and investors have been upbeat about how the employment picture has remained mostly resilient in the wake of economic headwinds. The U.S. jobless rate is in its eighth consecutive quarter below 4.0%, with the latest figure at 3.7%. Many businesses – save some in the tech sector – continue to bolster their workforces, admittedly at a slower pace than a year ago. All this, coupled with a taming of the inflation rate, is leaving experts optimistic about the direction of our economy.

If a recession does occur in 2024, economists believe it would be short and have relatively minor impacts. Households generally are in much better circumstances than in a typical recession since many still have elevated savings from the Covid shutdowns and jobs remain plentiful.

Local experts forecast employment growth of 1.4% in King County for the 12 months ending Dec. 31 and another 1.2% increase by the end of 2024, according to data from the Western Washington University (WWU) economic forecast team. The unemployment rate in King will end this year at 3.2%, low despite layoffs at some tech companies, and the rate is expected to climb to about 3.7% by December 2024. The experts at WWU also see personal income growing by 4.9% annualized for 2023 but only 3.4% by the end of 2024.

While employment totals have now surpassed pre-Covid levels, King County job sectors remain uneven. Leisure & hospitality is the one still seeking backfill jobs lost from the pandemic, however, in 2023 it is said to have surpassed the information/tech sector for the most number of jobs in the county. New restaurants and bars are calling upon more help, as well, workers continue to benefit from both a healthy 280-plus cruise sailings, this year’s addition of Summit and its 1.5M sq. ft. to the expanded Seattle Convention Center, and a workforce of about 500 full- and part-time people for live events at Climate Pledge Arena.

Overall, many economists and real estate watchers feel the housing market will be less painful for buyers in 2024 after grappling with the worst affordability challenges since the early 1980s.

We experienced a whipsaw year for home prices, falling to as low as $603K in April, or down 8.6% Year-on-Year (YoY), before rebounding by the end of 2023 to up about 7% – a 15-plus-percentage-point swing in less than a year. The limited supply of homes for sale pushed prices higher despite fewer buyers in the market.

While still a high figure, the 7% increase is a break from the double-digit, percentage-price increases seen in recent years. A median priced home in King County today runs about $800K, or 32% more than in 2018 and a whopping 111% more than a decade ago.

Barring a major economic or employment setback, prices in Seattle/King County should continue to increase – though we believe the rise will be modest in 2024. Prices may rise even higher if unemployment remains quite low and local businesses expand at a greater pace than today.

Consumer prices are the key economic data under the microscope. If Americans feel they can spend less and save more, then consumer confidence improves and buying accelerates. The U.S. Consumer Price Index (CPI) rose 3.1% over the 12 months ending in November. That’s a slight improvement from October’s 3.2% reading and a sharp slide from 7.1% a year ago. Fannie Mae economists are forecasting CPI to end 2024 at about 2.5% – a potential trigger for lower financing costs and higher real estate sales as affordability improves.

In King County, where the 20-year inflation average is 2.7%, we are expected to end 2023 with a CPI of about 5.3% and it is forecast to conclude next year at roughly 2.8%, according to an economic forecast in mid-2023 from the county. WWU offers a Puget Sound regional CPI estimate of 3.4% by the end of December and forecasts an index of 3.0% at year-end 2024. (The university does not produce a CPI report for King.)

Our region often focuses on gas prices, which are historically above national figures. The average price for a gallon of regular unleaded gas in Seattle/King County today is roughly $4.50 and it is expected to sell in a range of $4.25 and $5.25 during 2024. (Gas prices peaked at $5.69/gallon in the spring.)

Supply and demand often dictate the direction of prices, whether it’s the cost of hummus or homes. And there is enough evidence – increased searching for homes online and a growing number of mortgage applications – to anticipate stronger demand in 2024 and through the rest of the decade.

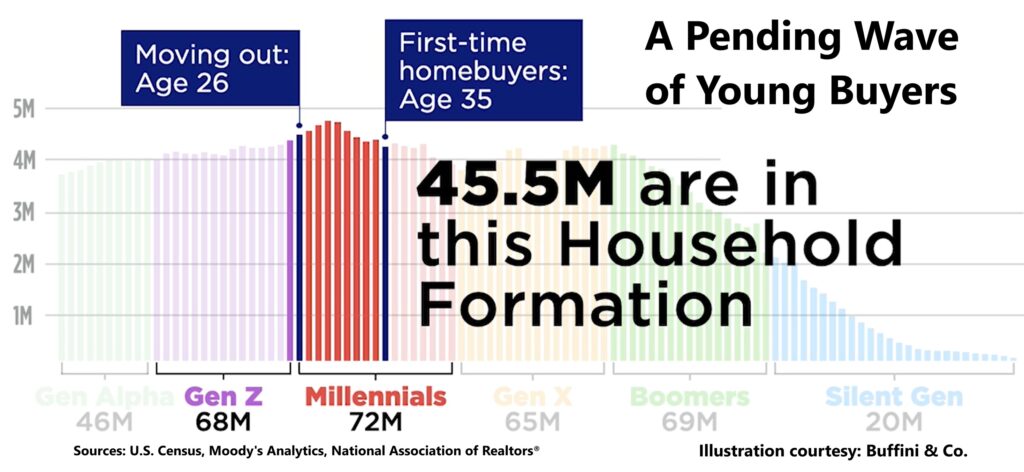

How can we forecast years out? Historically, people “leave the nest” at age 26 and spend about a decade renting while accumulating savings. That slice of the U.S. population – younger Millennials and a growing portion of Gen Z Americans – comprise about 45.5M people who should be preparing to buy a home. It’s the largest group of potential buyers in U.S. history.

The oldest Millennials are now in their early 40s. If they were homeowners at the same rate that Gen Xers or young Baby Boomers were at the same age, there would be 740,000 more homeowners in the U.S. That is a significant amount of pent-up demand, some of which is waiting for a drop in rates and more inventory.

We expect slightly more homes to hit the market in 2024 but supply will still be low, largely from the other big demographic cohort affecting the market – Boomers, who are staying in their homes longer. Sub-4% mortgage rates enjoyed by homeowners since the pandemic and a lack of homes to downsize into have contributed to fewer listings.

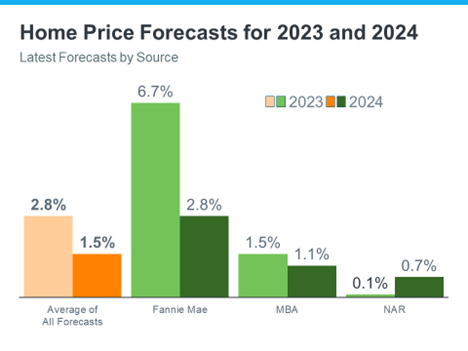

These – and other – factors are the reasons for a continuation of rising U.S. home prices in 2024:

Among other real estate-linked groups, Freddie Mac sees prices on existing homes rising 2.6% in 2024 and Wells Fargo’s economists expect prices to climb 2.3%, but a few industry experts project lower prices. Morgan Stanley forecasts a 3% drop nationally and realtor.com expects prices to slip 1.7% across the country – certainly not enough to make a significant impact on the affordability question.

Realtor.com offered a somewhat surprising forecast for the King and Pierce two-county market in 2024. It believes median prices will slip 1.0% for the year, while local real estate economist Matthew Gardner believes prices will inch 1.0% higher. Prices in King tend to peak in late spring/early summer – when we expect single-family homes will sell above the median $1M mark for the first time ever in our county as a whole – before cooling through the latter part of the year.

“We’re not going to see a major breakthrough in the logjam that has been the housing market over the last year or so, but 2024 will be a baby step in the right direction,” says Danielle Hale, chief economist for realtor.com. “It’s going to stop getting worse.”

The number of U.S. home sales – 3.79M on an annual basis through October – is at a low not seen since August 2010. John Burns Research and Consulting forecasts sales will improve in 2024 to around 4.1M homes – yes, still a seller’s market. Most activity will be driven by people who must sell their homes out of necessity, such as changing family dynamics, job change or retirement.

The gates holding back fresh inventory appear stuck, thanks to those stubbornly high rates and a general unwillingness for homeowners to move. Does anyone have WD-40 to help us out with those pesky gates?

“Pent-up sellers cannot wait any longer. People will begin to say, ‘Life goes on,'” opines a hopeful Lawrence Yun, chief economist at NAR. “Listings will steadily show up, and new home sales will continue to do well. Existing home sales will rise by 13% next year.”

NAR’s optimistic forecast is driven in large part by the assumption that 30-year mortgage rates will drop consistently below 7% by the 2024 spring selling season. Rates fell below that mark on Dec. 14 – the lowest since Aug. 10 – but it’s too soon to call it a trend.

Realtor.com disagrees with the NAR, believing sales will only increase by 0.1% YoY to about 4.07M units nationally, or a full 700K fewer than NAR’s estimate.

These figures pale in comparison to recent years, when, for example, 6.12M sales were recorded in 2021 during the pandemic push for homes and historically low rates. New home builders will benefit from a greater share of the overall sales market.

The Pacific Northwest, Seattle metro especially, is a place where people want to live. This, plus our strong, diverse economy makes the region a desirable place to settle, suggesting resilient activity for years to come. As such, realtor.com forecasts the King/Pierce market will experience sales growth of 3.9% YoY in 2024. We are on a pace for 18,300 home sales in 2023 across King County alone (condo, townhome and single-family sales combined), a hefty 35% drop from a year ago.

The Federal Reserve’s commitment to maintaining higher short-term interest rates to combat inflation has been the main obstacle to a housing recovery. For two years, the Fed has been chasing an inflation rate of 2.0%. As noted above, consumer prices are trending lower and most Fed watchers feel the central bank has stopped its persistent round of rate hikes. It increased the Fed funds rate 11 times between March 2022 and July 2023, essentially from 0.25% to 5.25%, on the interest that banks lend to each other.

The bond market is now pricing in about two to four rate cuts from the Fed over the course of 2024. Is the market getting ahead of itself? Possibly. Some economists tell me they could still see one or two Fed rate increases before cuts take place later in 2024 – though rate hikes appear less and less likely.

“The moment they [the Fed] turn, or announce they’re going to turn, is going to be a seismic moment,” cautions Larry Summers, the former Treasury Secretary and now Harvard professor. He told Bloomberg Television in early December: “For that reason, they probably need to be very deliberative and careful about getting to that point.”

It’s important to note that the Fed doesn’t directly affect mortgage rates – investors in mortgage-backed securities do. But, like all related aspects of lending, the central bank heavily influences the direction of financing for homes, cars and other expensive items.

Some economists also suggest that the housing market’s recovery may unfold gradually rather than as a sudden transformation. They believe that, while some buyers and sellers may re-enter the market amid slightly lower mortgage rates, the overall recovery is likely to be slow and steady.

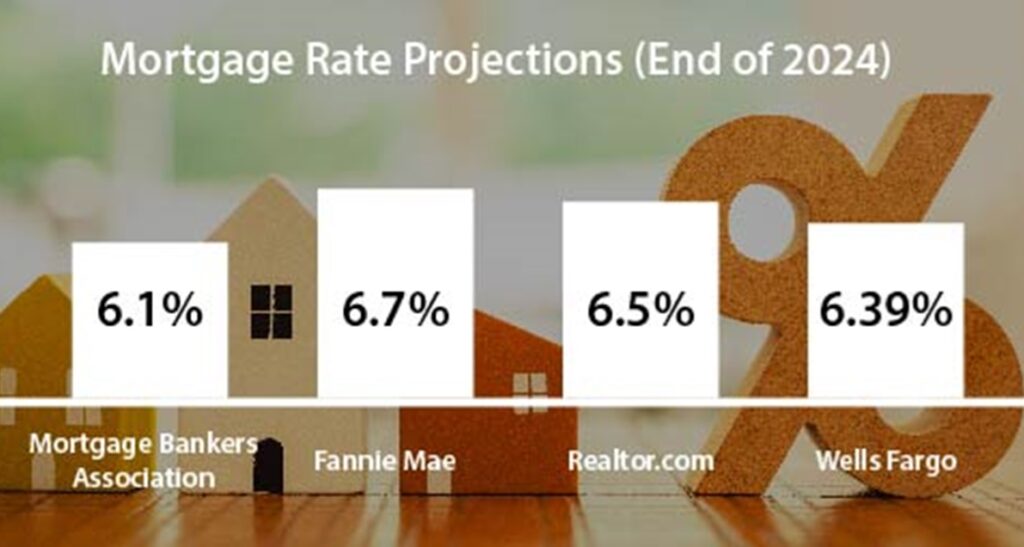

Mortgage rates aren’t expected to come down as dramatically next year as many experts had previously expected, which could keep home sales from rebounding or limit the strength of a housing recovery:

Among the others, the NAR believes rates will average 6.3% over the next 12 months and Freddie Mac is offering an optimistic forecast of 5.75% interest rates by the end of 2024 – in other words, a wide range of opinions.

Local lenders are betting on a rate of around 6.0% by December 2024 – though I think that may still be a little too optimistic.

When rates decrease, there is an improvement in affordability and that, in turn, welcomes more buyers into the market. This creates higher intensity for additional listings as the number of buyers in the market will outweigh available inventory, especially in the more affordable and mid-price ranges.

Mortgage rates need to drop significantly to entice a greater number of current owners to list their homes, as they will likely be losing their historically low financing costs. Either way, affordability will remain a significant challenge for many buyers, especially those without equity established from an existing home.

About two-thirds of homeowners with mortgages today have rates at or below 4.0%. These so-called locked-in owners may hit the market fast if rates experience a sharp decline. And today’s “locked-out” buyers will likely stampede the market when affordability and availability improve together. Then, watch out!

Depleted inventory and weaker sales volumes make for difficult forecasting. Prospective buyers are mostly window shopping today – creating fewer data insights for prognosticators – but some trends continue to hold.

First-time buyers, for example, are eyeing submarkets where prices are softening for single-family homes. That includes the Seattle neighborhoods of Georgetown, Columbia City and Beacon Hill, where median prices are $695K, down 4.8% since this time last year. The lowest prices today can be found in the South King County cities of Auburn ($554.5K) and Federal Way ($575.2K).

To address affordability concerns, state lawmakers this year passed several measures that could also boost our housing shortage. A new Accessory Dwelling Unit law reduces regulatory barriers for homeowners seeking to build affordable housing in their backyards and, in most cases, requires municipalities to allow up to two ADUs per residential lot in a majority of the state.

Another piece of legislation signed into law will require most cities, depending on population, to increase density in residential areas with duplex, triplex and fourplex homes where only single-family housing was permitted and even sixplexes within a quarter-mile of transit hubs and light rail stations.

The housing initiatives will take years to reap benefits for residents. Local governments will need time to weigh individual issues and create administrative support that will help provide homeowners with the correct information and guidance.

We can only hope local leaders will continue to ease their restrictive land-use policies and improve the permitting process. This should help reduce fees that are charged to builders; these costs are typically passed onto the home buyer and further impact affordability.

The results of today’s fewer sales have ripple effects across the region. One example: Real estate excise taxes charged on every property deal is forecast to finish 2023 at $7.5M in King County. That’s a 32% decline from a year ago and the 2024 forecast calls for only a mild increase to $7.9M in excise tax from property sales – much-needed revenue to local government budgets.

County economists forecast a 2024 decline in new construction, slipping to $9.9B worth of activity from an estimated $10.4B this year. Permits for single- and multi-family home construction were buoyant this year, up 15% from a year ago, based on Census data, but WWU economists forecast an 11% decline in King County permits to 19.8K for all of 2024. This reflects an adverse environment facing both buyers and builders.

Without exaggeration, 2024 may be the last productive condo year for a long time in our county.

Four luxury condominiums will be unveiled in the coming months – two each in Seattle and Bellevue. No other major condo projects are on our radar, meaning inventory for those gleaming, new high-rises will only shrink after 2024. Coming soon:

Avenue Bellevue – The first of two towers opened in November and the rest of the project, including the Pacific Northwest’s first InterContinental Hotel, will be unveiled over the first quarter of the new year.

Graystone – This beauty in a leafy First Hill neighborhood is scheduled to open by early 2024.

First Light – Arguably the most luxurious Seattle condo ever, the project will open in phases through 2024.

Mari – This Bellevue condo quickly sprouted from the ground in 2022-23 and plans to be ready by the end of 2024.

The pandemic threw a left hook and right uppercut to this area’s condo market, particularly in the heart of Seattle where many residents fled once offices and businesses shut. The city’s “reopening” has been slow, with Amazon workers returning at least three days a week this past year. Seattle residents who left do not appear to be moving back to cut their commuting times – at least not yet. At the same time, the shutting of Seattle-based online retailer zulily means the loss of about 300 jobs. The departure of big retailers – Nike, H&M, American Eagle, Abercrombie & Fitch, Forever 21, and Macy’s to name a few – continues to hurt downtown as a shopping destination.

Shopping for condos is a mixed picture. Sales are up about 4.7% YoY across the city but down 22% in downtown/Belltown, where an incredible 9 months’ inventory is on the market. That means it would take approximately 9 months to exhaust all the existing supply of homes for sale before needing to add more.

In addition, the cost of building condos is prohibitive. Seattle experts believe future projects will need to market their homes at least 30% above today’s prices. That’s because of the rising cost of materials, land, insurance, skilled labor and, most challenging, project financing.

We read and hear the inspiring plans to reinvigorate downtown, and many of us are hopeful of the mass change of leadership within the City Council. Seattle’s urban recovery is underway, no doubt, but it will take years to fix before we see a reshaped “normal.”

Elsewhere, townhome and apartment projects will fill out the landscape for another few years at least. These homes in smaller footprints, along with cottage-style ADU housing, will be in great demand to help address affordability concerns.

The Downtown Seattle Association keeps track of our activity in the center of the city. It reports that some 85,000 workers came to downtown offices in October, about an 18% increase from the same month in 2022. But this is still only about half the workers in the office compared with February 2020.

About four in 10 Washingtonians work part of the week from home. The Seattle/King County concentration of tech companies likely makes that figure higher here.

It doesn’t take a big leap to predict change in our cities is on the horizon. Governments are looking for ways to promote office-to-residential conversions in Seattle and elsewhere across the country.

To be sure, there would be significant structural considerations when redesigning a downtown office building. It starts with rezoning the provincial code of commercial-only buildings in many parts of Seattle’s urban core (and steps are being made to make that happen).

The financial challenge will be the highest hurdle. As noted, the cost to build new is extremely difficult, even more so when reimagining an existing structure fitted for office space. In other words, it just doesn’t “pencil” in today’s economy.

Banks have largely moved past the turmoil of last March that led to the collapse of four regional lenders, but federal bank regulators have been offering a cautious warning ever since about the financial standing of commercial building owners amid a smaller number of tenants in mostly shrinking office spaces.

We will be watching carefully whether commercial landlords struggle to pay off massive loans. And if they cannot, banks – large and small – could own underserved structures across this land, a topic covered in the July edition of my Living the Dream newsletter. (Interested in subscribing to this monthly report? Sign up here. You will not be added to any other mailing lists.)

You might argue that home shopping never really changes: You browse, select and buy the home of choice. But dig into the details of how you do any of those tasks today and pretty much everything is changing. Thank the pandemic for expeditiously delivering on those enhancements.

Since 2020, consumer expectations have accelerated and the real estate industry responded in kind. Real estate pros rely more on virtual and 3-D home tours, videoconferencing, augmented reality, artificial intelligence, remote online notarization and many other functions to complete business.

Technology will continue to evolve how the broker relationship works with buyers and sellers. Using AI and ChatGPT to streamline routine activities is another breakthrough. More services will be automated and provided directly to consumers seeking help with finding contractors, home inspectors and mortgage professionals.

Lenders – many of them fighting for their very existence in a down year – have introduced more creative loan options. They include a fee-based mortgage buydown to lower the prevailing interest rate and adjustable-rate mortgages that revise the interest amount in a few years when rates should be lower. Many lenders can smoothly close a deal within 10 days of a signed contract, thanks to streamlined tech and advanced approval of mortgage applicants.

Overall, most experts expect slow and steady sales activity as the residential market stabilizes.

As I noted in a recent blog post headline, this is not a housing environment for the faint of heart. There are still potential potholes along the journey back to a smooth housing market.

In fact, smooth sales activity may only be a warmup to what should follow – fast-paced activity with a return to multiple-offer scenarios and homes selling above the list price.

If mortgage rates keep falling (they dipped suddenly to about 6.75% as of Dec. 14), affordability and demand will likely both improve – though probably slightly.

The unknown is how will potential sellers react to these lower rates. Will they still feel “locked in” or dive in and sell their home and reap the financial windfall of appreciation?

My advice as a trusted real estate advisor: If prospective buyers are contemplating a home purchase, now is the time to negotiate that deal before the market heats back up again.

Remember, we saw the same thing happen this time last year. After a slow Q4 2022, buyer demand returned at the start of 2023 even though mortgage rates held flat.

Activity is muted for now … but for how much longer?

~~~~~~~~~~

John L. Scott Real Estate has been around for more than 90 years. Since opening its doors in Seattle, the brokerage has seen many ups and downs with the housing market; it grew and flourished in parallel with the success of this region. It’s the expertise and stability drawn from those years of residential real estate acumen that attract thousands of buyers and sellers to John L. Scott every year.

In a period of uncertainty like this, people seek out our insights and advisership. When looking for a trusted representative in the PNW, please consider knowledgeable and experienced John L. Scott brokers like me for your next real estate transaction. Thanks!