You’re thinking about buying a home but don’t know the costs surrounding the purchase. Well, I’m here to help.

There are many items with a price tag. The home itself of course is the biggest and, fortunately, mortgage lenders can help you with financing options. But, for this purpose, we are talking more about one-time costs than recurring payments.

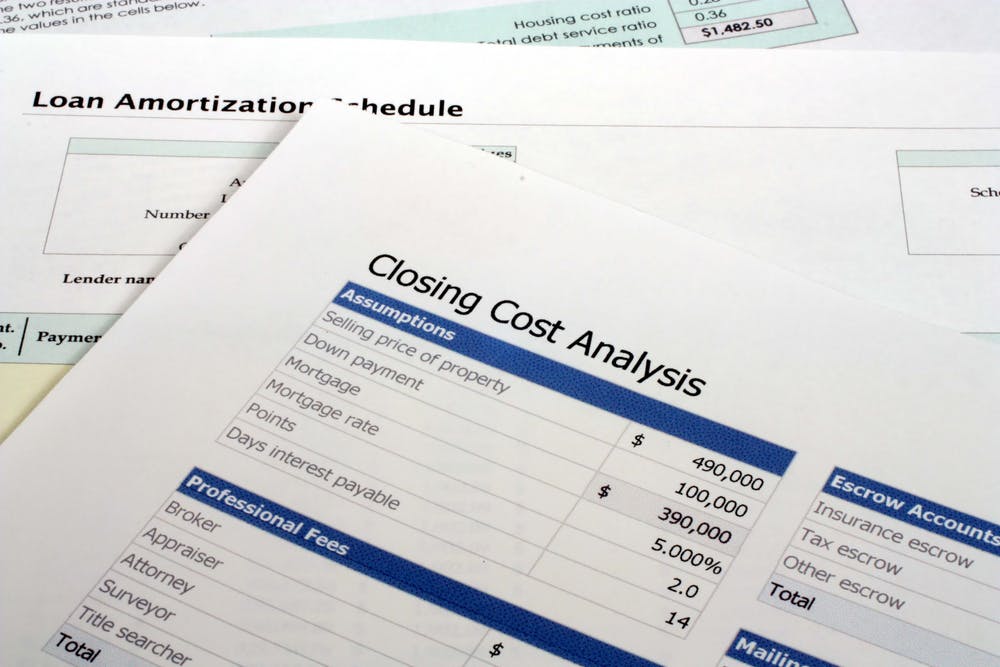

These are commonly known as closing costs, the fees for services from the time you begin your search for a home to the day of signing and completing the purchase. Services can be charged by a range of experts – mortgage lender, home inspector, pest consultant, mold inspector, appraiser, real estate attorney and others.

The common rule of thumb is that costs will run about 3% of the home’s purchase price, or $30,000 for a $1M home. The figure can be higher if buyers are also expected to pay some or all of the compensation to their real estate broker, though the seller typically covers most – if not all – of that cost.

What’s included in closing costs? The list runs nearly from A to Z – from Application Fees to Underwriting Fees – both related to the mortgage acquisition … and a dozen or so other items as well. Here is a more complete list (downloadable PDF).

There are a few fees that only apply in certain circumstances, including the services of an attorney, inspector or land surveyor, and they tend to be due separate from costs at closing. There may also be fees related to purchasing a condominium or co-op that would not apply to a single-family home or townhouse.

Closing costs are in addition to the down payment, which can be as low as 0% for a VA loan but is more likely 3.5% or higher. Buyers who put 20% or more of the purchase price toward their down payment are not required to pay private mortgage insurance (PMI) on the loan. That’s a nice savings and one less fee to worry about, even though PMI is usually wrapped into the mortgage payment.

As you can see, the cost of ownership can add up and buyers should avoid surprises. Know before you sign!

The key to a successful purchase experience is to speak with your mortgage consultant and real estate professional early in the process to review all costs – line by line. Some figures could change from the initial review to the closing and from one lender to another or from one title/escrow firm to another. Buyers are required to receive a closing disclosure statement (or settlement statement) from their escrow (closing) agent no fewer than three business days before the date of closing. (Some property sales – particularly East of the Mississippi River – use an attorney rather than escrow service to close a transaction.)

Knowing your mortgage outlay – and what’s included in that monthly payment – can often depend on the loan program and lender’s set of practices.

Some loans come with no upfront costs. Instead, the fees are rolled into the total loan amount and lenders typically cover that loss of immediate revenue by charging more interest.

Paying for the home with cash? Fees will be less without mortgage-related costs but buyers will still be on the hook for the services delivered by escrow, title and others.

Within a typical 10-year housing cycle, buyers can sometimes ask sellers to help pay for closing costs. Say, a buyer makes an offer $20K above the $1M asking price with the proviso that the owner – possibly struggling to sell the home – agrees to cover closing costs of $30K. That allows the seller to net $999,990 in a challenging market while the future owner is not saddled with costs other than the down payment – assuming the home is appraised at or below the offer price and the lender agrees to the financial arrangement.

Bottom line: It’s critical to know what costs will be required at the closing table on top of the down payment.