Your closing date is now set and you are poring over something called a closing disclosure – the granular detail that itemizes who pays for what and how much. There is a lot to digest and your escrow representative is typically the main point of contact to explain each line. (All of your support network – real estate broker, lender, attorney – are there to help too.)

If you’re like me, your eyes are drawn to the so-called bottom line: How much do I need to bring to closing (also known as “signing day”) and how much the seller is making on the deal? It’s only natural to look at those figures before diving into each line of the document.

Don’t assume the closing disclosure – also known as a settlement statement – is accurate. Mistakes can happen and you are in the right to question anything. Some errors can require a compromise with sellers or, in a worst-case scenario, rescinding the offer.

In addition to the down payment – a figure you provided to your lender and escrow agent weeks ago – remember that closing costs include many other fees and typically come to approximately 3% of the purchase price.

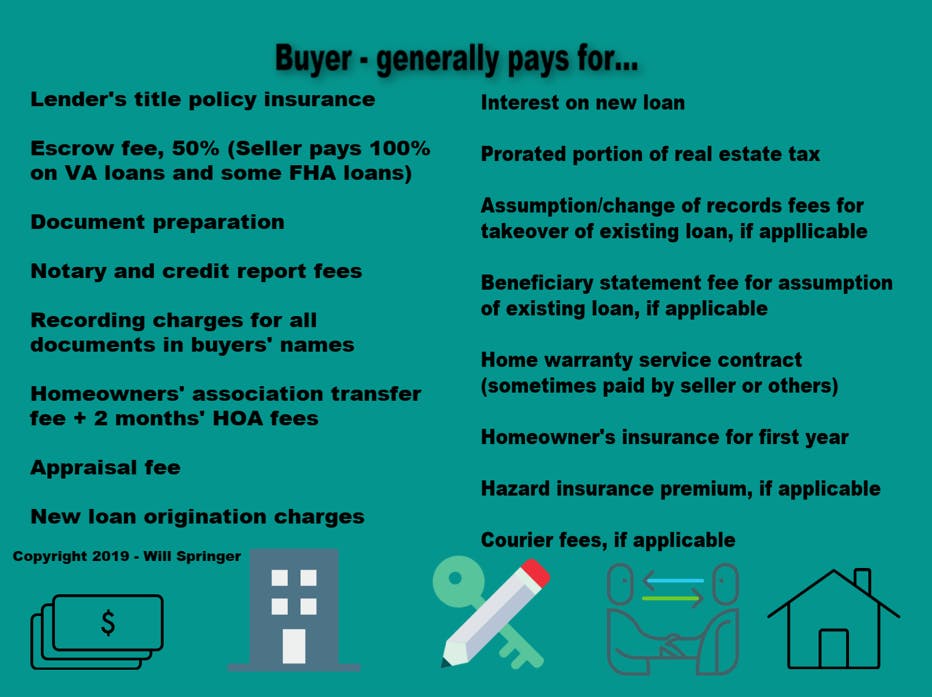

Here are some of the closing costs a buyer is responsible for (in no particular order):

Some notes about the list:

Lenders usually require borrowers pay the interest that accrues on the mortgage from the date of the settlement to the beginning of the period covered by the first monthly payment. That can be about a month to two months’ interest, so be thoughtful about the timing of your closing date.

If, for example, your settlement takes place on May 16 and your first regular monthly payment is due on July 1, you will be responsible at closing for interest on the loan between those two dates – or 45 days. The interest payment would be higher as you move further on the calendar from the start of your first mortgage payment; worst-case scenario: A May 1 closing also has an initial mortgage payment date of July 1, so buyers will be expected to pay 60 days’ interest up front.

While not listed above, buyers are – in most cases – also responsible for inspection fees. Those costs are paid on the day work is completed – not as part of closing costs.

It’s also common for the buyer to reimburse the seller for real estate taxes paid in advance. For example, King County will expect a homeowner to pay his/her property taxes by April 30 and Oct. 31 each year. The first tax payment covers the period between Jan. 1 and June 30. If a new buyer moves in on May 1, for example, the seller should receive a refund (or credit on the closing disclosure) from the buyer for the overpaid tax of two months.

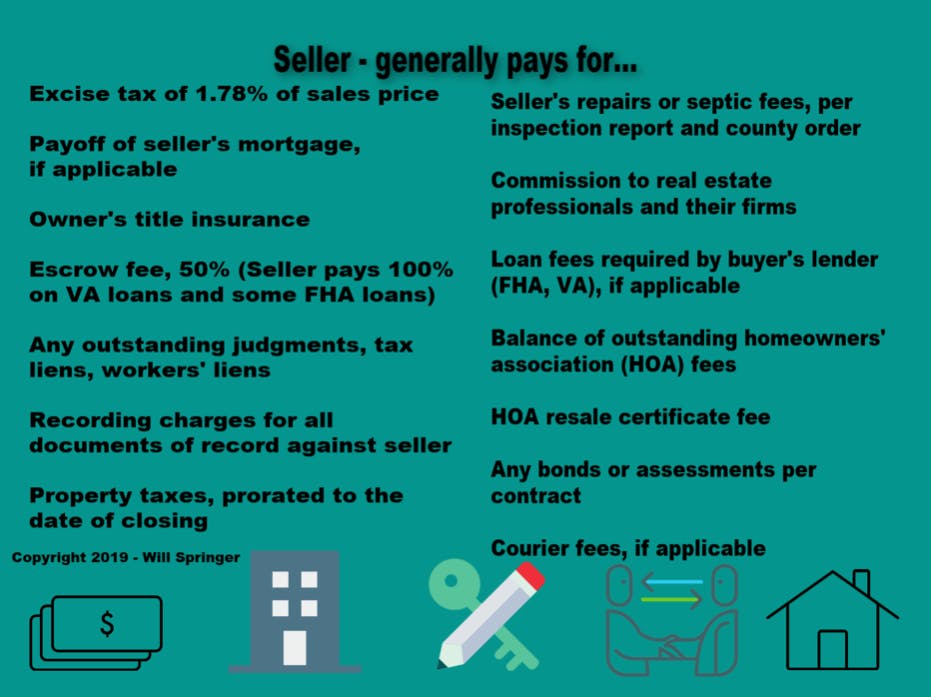

Now, here are some of the main closing-cost responsibilities for a seller:

Of course, both lists are a guide and certainly not etched in stone. Every transaction includes unique agreements between parties regarding payment of certain services or fees.

A real estate professional should offer buyers an early estimate of the closing costs once key factors are known; they include the agreed sales price, mortgage loan info and applicable fees, appraisal cost and a few other charges. While that’s helpful to give you a ballpark figure, only your escrow agent will have the official figures once the final loan details are supplied and closing disclosure is issued.

With this disclosure statement, you now know the exact amount to bring to closing…as the number of days dwindle before the purchase of your Seattle dream home.