Consumers can be fickle. They can sometimes be found “wearing” rose-colored glasses to interpret the benefits of a purchase.

Buying a car can often fall into this category. The buyer’s head says Fusion but heart beckons the Mustang. The true cost of these Ford models differ widely after driving them off the lot. (Gas mileage may vary!)

It is also true for residential real estate. The real cost of a home is not the final sales price – far from it. There are other factors to consider before taking possession. Pity the buyer who fails to see the real financial toll.

Lenders are often the voice of reality. Buyers feel they can afford an $800,000 detached house – until the loan consultant takes other factors into account that ultimately places future owners into an affordable $600,000 townhome.

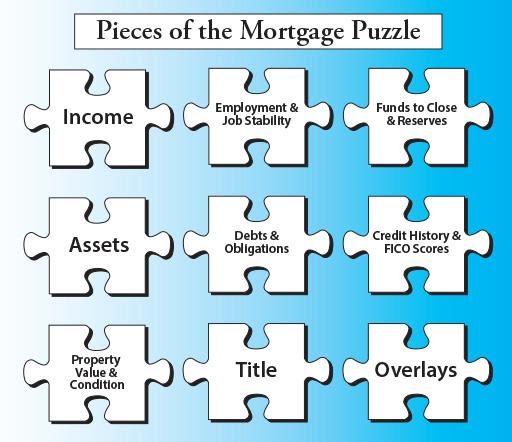

The lender collects information – or pieces of the underwriting puzzle – to determine whether applicants meet loan qualifications and the amount they can afford. While credit, income and assets are primary determinants, there are a host of characteristics (okay, puzzle pieces) to a mortgage application:

Income – This can come from a variety of sources: salary, disability or Social Security benefits, trust or retirement funds, gifts or gambling winnings.

Employment & Job Stability – Lenders typically look for 2 years of consistent hours and pay, with some exceptions such as an applicant working less to attend university and learn a subject that relates directly to the buyer’s career.

Funds to Close & Reserves – Tracking funds that will go toward the down payment is critical for lenders, as well as proving buyers will have steady income and cash reserves to adequately fund at least the first 12 months of mortgage payments.

Assets – Part of the financial equation includes what the buyer has on hand: cash, property, foreign and domestic investments.

Debts & Obligations – This includes the usual: credit card, car loan and leases, as well as child support commitments and student-loan debts (depending on the loan program).

Credit History & FICO Score – While each lending institution has different thresholds, most look for FICO scores at or above 620.

Property Value & Condition – Lenders will review the appraisal to determine the home’s market value and ensure there are no health or safety concerns with the property. They will also look at the financial standing of a Homeowners Association if the buyers are seeking a condo.

Title – A property should be “clean” in the mind of the title company. That means no unpaid taxes, probate issues or other encumbrances.

Overlays – Lenders often include other qualification requirements to ensure the loan is being awarded to a financially responsible applicant. For example, government-backed loans (Freddie Mac, Fannie Mae and Ginnie Mae) typically have a debt-to-income (DTI) ceiling of about 50% – assuming the applicant has an excellent financial profile – but some lenders may have an overlay of 40% DTI to reduce risk exposure for the loan servicer.

My point to this blog post is this (Yes, I took you on a scenic journey with this blog post rather than straight to the freeway!): Buyers often look at the basic pieces of the puzzle along with their lenders to determine both the person’s financial qualifications and the long-term viability of managing monthly finances with a potentially burdensome mortgage. Many use the PITI model – principle, interest, taxes, insurances – to weigh the primary costs to homeownership.

There is a bigger picture that buyers should consider: PITI ULM – which includes the above items along with utilities, location and maintenance. Every home has those additional expenses to ownership but are not often factored in when working with a lender. (Enter the rose-colored-glasses effect!)

Unless they’re working with a financial advisor before purchase, buyers are sometimes blind-sided by the real cost of ownership. What appears to be affordable on paper can easily become a money pit unless buyers/owners first factor their ULM:

Utilities – A savvy buyer will ask for monthly utility statements from sellers to paint a clearer picture of potential costs to live in the home. A house without trees and predominate southern exposure could jack up the air-conditioning portion of the electric bill at least one month every year in our part of the country, as an example.

Location – A buyer usually purchases a home because of its location to schools, work or other important conveniences. (We covered that in an earlier post.) Transportation expenditures are typically among the highest for households. Looking for a home within walking distance of a Link light rail station to use daily instead of a vehicle will help lower costs, such as when buying in a nice neighborhood like Mountlake Terrace (MLT), where a rail station is planned to open in 2024. The cost to drive from MLT to downtown Seattle could be twice as much today than in 5 years when switching to public transit.

Maintenance – Unless new construction, homes are imperfect when moving in. There are touch-ups, repairs or full remodels in most homeowners’ future. Buyers should factor in the cost of improving the home.

The traditional measure of housing affordability recommends that total costs should be no more than 30% of household income. That would place a little more than half of U.S. neighborhoods in the category of “affordable” for the typical household. In reality, few households enjoy this level of affordability.

The “real” in this real estate story is about the true cost of homeownership. It’s a “PITI” many buyers don’t factor in the full “ULM.”