Recent news that the National Association of Realtors® (NAR) wishes to settle a series of lawsuits from home sellers has sent ripples through the real estate industry. Allegations of collusion to inflate compensation paid to both buyer and seller agents in transactions prompted this landmark settlement, estimated at a staggering $418M.

While the NAR denies any wrongdoing, the proposed settlement promises significant changes in how business is conducted in the real estate market. Many owners who sold a home between Oct. 31, 2019 and Feb. 1, 2024, could be eligible for a payment, so long as the property was listed on a Multiple Listing Service (MLS) and compensation to a real estate agent/broker was made. Sellers should receive notification if they’re entitled to a payment.

One of the most notable changes expected, particularly in our region, is the likelihood that the Northwest MLS will discontinue publishing compensation details within listing information. This move, while aiming to “decouple” buyer and seller compensation, may inadvertently reduce transparency for consumers when reviewing home-sale listings.

One of the most notable changes expected, particularly in our region, is the likelihood that the Northwest MLS will discontinue publishing compensation details within listing information. This move, while aiming to “decouple” buyer and seller compensation, may inadvertently reduce transparency for consumers when reviewing home-sale listings.

It’s essential to note that cooperative compensation offers between sellers and brokers will still be addressed in purchase and sale agreements. Sellers will retain the option to compensate buyer brokers for their services, whether in part or in full, acknowledging the crucial role they play in finding financially sound consumers to purchase their homes.

Another requirement of the settlement mandates that buyers must enter into a written services agreement with a broker before touring homes – or “as soon as reasonably practical,” according to current Washington law. This agreement, similar to those long established between sellers and listing agents, includes provisions for managing the compensation component with their broker and ensures clarity in negotiations.

While these changes may initially appear daunting, consumers must understand their implications. Here are some key points to consider:

- Re-evaluation of real estate services: Sellers may opt to offer reduced compensation to both listing and buyer agents in response to the settlement. Negotiating compensation terms with agents will become increasingly common and may vary from one transaction to another. At the same time, few – if any – sellers would willingly lower the home price because of lower transaction costs – particularly in today’s seller-favorable market.

- Buyer cost pressures: Buyers, who have historically paid little or nothing for representation through the purchase process, may now be expected to contribute financially. This could add additional costs, potentially ranging from 1% to 2% of the agreed price, to their bottom line (unless they buy a less expensive home than planned).

- Deeper negotiations: Buyers will need to engage in frank conversations with their brokers, not only on price and contingencies but also on compensation terms. Any shortfall in compensation covered by the seller will ultimately come out of the buyer’s budget.

- Under-representation: To mitigate costs, some buyers may consider forgoing exclusive representation and work directly with listing agents. However, this poses its own risks, as listing agents are legally obligated to prioritize their contractual relationship with the seller while potentially opening the door to conflicts of interest.

Veterans using the VA home loan benefit are currently prohibited from directly compensating their real estate broker. If the settlement moves forward unchanged, buyers using a VA loan would be at a significant disadvantage when offers of compensation are not provide by a seller – unless the Veterans Administration rushes through a revision.

Now we wait for reviews by the court, Department of Justice, and perhaps, other federal or state agencies. The settlement can only be approved, however, by the judge assigned to the case and could also be rejected or amended. (A federal appeals court, in a separate – but related – legal case, on April 5 granted the DoJ the right to reopen an investigation into NAR policies even after the government ended the probe in 2020.)

While these changes may pose challenges for both buyers and sellers, it’s essential to remember that Realtors® like me remain committed to guiding consumers through the real estate process. By staying informed and advocating for themselves, consumers can navigate these changes with confidence.

As always, I am here to answer your questions on this or any other residential real estate question.

URGENT CLIMATE ACTION

The climate crisis is no longer a distant threat but a pressing reality affecting communities worldwide. In Seattle/King County, the impact of climate change is already evident, with rising greenhouse gas emissions exacerbating climate hazards and threatening the resilience of our housing stock.

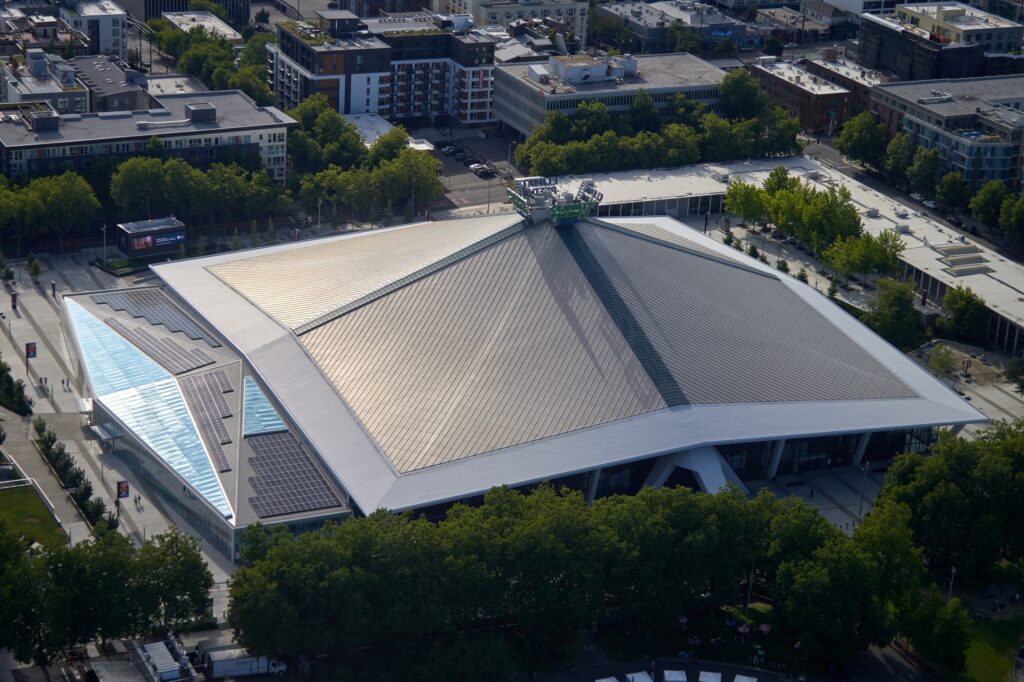

Climate-resilient housing, which is designed and constructed to withstand and adapt to the impacts of climate change, is increasingly recognized as a critical priority for our region. (Climate Pledge Arena, pictured atop the newsletter, features solar panels on its iconic roof and is a great example of a climate-resilient building, recently becoming the largest structure in the world to achieve a Zero Carbon Certification from a prestigious international organization.)

Climate-resilient housing, which is designed and constructed to withstand and adapt to the impacts of climate change, is increasingly recognized as a critical priority for our region. (Climate Pledge Arena, pictured atop the newsletter, features solar panels on its iconic roof and is a great example of a climate-resilient building, recently becoming the largest structure in the world to achieve a Zero Carbon Certification from a prestigious international organization.)

Despite growing awareness, progress toward climate resilience in housing has been hindered by fragmented efforts and competing priorities. Affordable housing initiatives focus not on the climate but on increasing inventory to meet demand, while climate-focused efforts lack integration with housing resilience goals.

As we mark Earth Month, stakeholders should remember to adopt a holistic approach to advancing climate-resilient housing. This includes leveraging federal legislation like the Inflation Reduction Act and the Infrastructure Investment and Jobs Act to invest in sustainable and resilient housing infrastructure. Additionally, stakeholders should prioritize collaboration and coordination to ensure that climate initiatives are integrated into housing policy and planning processes.

Our region will play a crucial role in leading climate action efforts, with ambitious targets to reduce carbon emissions and build sustainable communities. By prioritizing investments in renewable energy, energy efficiency and sustainable building practices, we can create a more resilient housing stock that withstands the challenges of climate change. It’s time for decisive action, so future generations can enjoy a more sustainable future.

For more news on this topic, please visit my Living the Dream blog for an ongoing series to celebrate Earth Month.

INSURANCE FOLLOW-UP

The top item in last month’s newsletter struck a chord with readers. One, who may have a connection to a federal mortgage guarantor named here, enlightened me about some data: The average homeowners insurance premium for a single-family home using a Freddie Mac-backed mortgage paid 41% more in 2022 than in 2018 ($1522 vs. $1081).

Insurance companies may argue, however, that the costs are simply increasing along with home values. The average mortgage holder paid $4.90 in homeowners insurance premiums for every $1000 of their home’s value in 2022. That’s only 20 cents more than in 2018.

A new report from Freddie Mac notes insurance rates are increasing modestly in Washington ($2.30 per $1000 of home value) but soaring elsewhere. Oklahoma, where tiny earthquakes rumble underneath homes regularly, pays $9.80 for every $1000 of a home’s value, and Texas, with its extreme weather events, pays $6.70. Mississippi, walloped nearly every year by a major hurricane, pays the most – $10.60 per $1000 of value.

BY THE NUMBERS

>> Compensation received by a buyer broker affiliated with our local MLS fell an average of four-tenths of a percent each year between 2000 and 2019. However, since the MLS introduced full disclosure of a seller’s offer of compensation to buyer brokers in listings in October 2019 the average has fallen at a rate of 1.5% per year through 2023 (from about 2.75% compensation to 2.55% in roughly the last 4 years), according to a recent legal brief and reported by Inman.

>> Washington ranked 43rd in the nation for best places to retire, according to a 2024 report from WalletHub, which compared states across 46 indicators of retirement-friendliness. Our highest ranking, 17th, was for quality of life. Oregon came in 37th overall, with Florida and Colorado at the top.

>> King County residents love to work from home. Bellevue, at 39% of its employment force, works remotely, the third-highest rate of any U.S. city. Seattle ranks fifth at 36% of all workers, according to a report from SmartAsset. Cary, N.C., has the largest percentage of stay-at-home workers at 41%, with Frisco, Texas, second (40%).

>> This may surprise you but Seattle was recently ranked No. 1 in the U.S. for the most Meetup groups, according to research from Remitly. The international money-transfer company said the Emerald City has 1774 Meetup groups, ranging from art & culture to health & well-being. Boston was ranked 2nd (1051 groups). Seattle is also No. 1 in the world for groups when based on a per-capita basis (24.5 per every 10,000 people) while London was the global leader with 2618 groups, but only 2.9 per 10,000 people.

>> King County residents have a life expectancy of 81.6 years, according to a University of Wisconsin report issued in March and based on data from 2019-2021. That’s the second highest in Washington behind San Juan County (86.3 years). King ranked No. 1 in the state for fewest smokers (9%) and lowest obesity rate (23%).

APRIL HOUSING UPDATE

Good news! The national economy is growing. Unemployment remains low. Corporate revenues are up.

For housing and mortgage professionals, however, these apparent highlights are persistent nuisances. They signal that the economy is still running hot – or at least more than lukewarm – and inflation may need more cold water from the Federal Reserve to cool it off.

“Cold water” comes from the central bank’s intent to maintain high financing costs for banks that borrow from other financial institutions. In turn, consumers experience the trickle-down effect in the form of costlier lending rates when holding credit card debt or financing cars and homes.

Despite a challenging economic environment, the Seattle/King County housing market is moving forward. That was highlighted by a 30% month-to-month gain in total home sales (single-family, townhome and condos combined) across the county in March and unseasonably low supply for buyers. It was particularly true on the Eastside, where sales surged 52% from February to March and 9% year-on-year (YoY) and inventory narrowed to under a month (29 days before all homes for sale would theoretically be under contract if no others hit the market).

Read a detailed assessment of our housing market in my most recent blog post: Eastside Residential Market Sees Big Gains in Sales, Prices

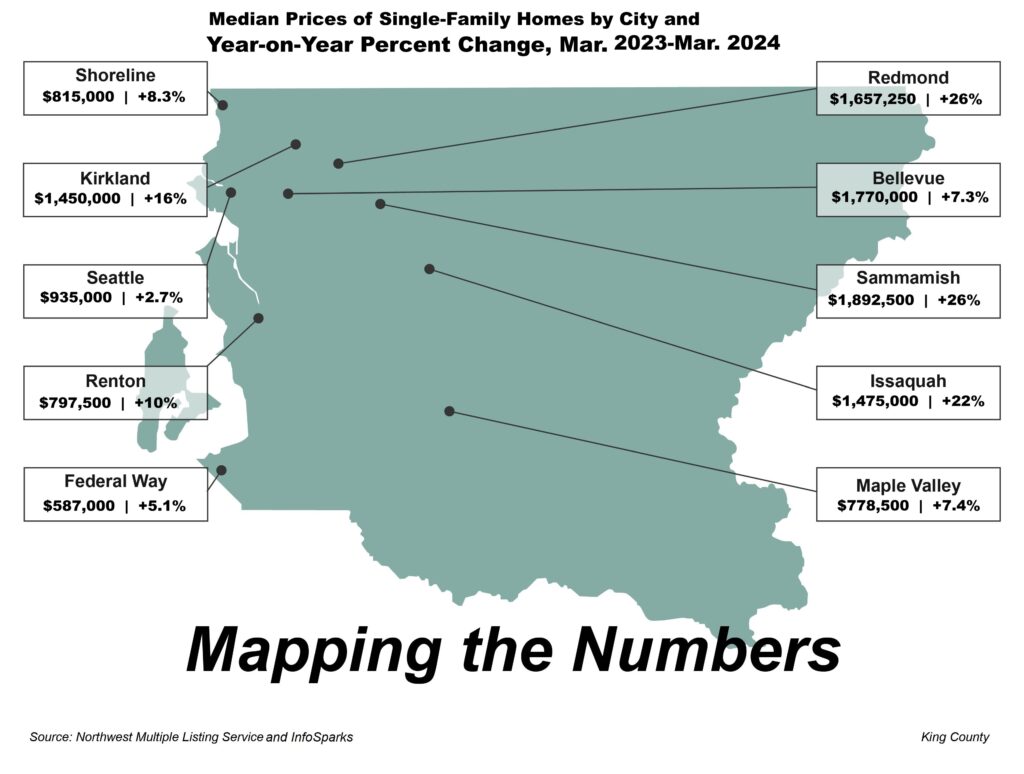

Housing prices continue to rise at a rate that makes home affordability a greater challenge for many. The Eastside continues to run hotter than the rest of the county, with median prices on a single-family home up as high as 26% YoY, as this monthly chart shows.

CONDO NEWS

Spire is, well, inspiring by the way buyers have embraced this standout luxury new condo project. This 41-story, 343-unit structure where Denny Triangle meets Uptown meets Belltown has been running two years of strong sales since opening in 2021. The high-rise has hit a high mark of more than 75% sold inventory – impressive when you consider urban condos have lagged behind the rush for homes post-pandemic.

There must be something about Spire. Oh, yes! Maybe it’s the top-floor amenities with fitness, lounging, and dining areas. Or that its location guarantees unobstructed views of the Space Needle. Check out my tour of the community as well as a special video feature on the building’s unique auto-park valet system.

Interested in seeing a home or two? Contact me to schedule a visit.

———-

One half of the great luxury condo community Avenue Bellevue has been open for a few months and the final touches on part deux move forward – but reportedly without a couple of Michelin star chefs.

December’s newsletter touted the forthcoming opening of three top-notch restaurants, however two have them have been 86’d, according to Puget Sound Business Journal. Masaharu Morimoto of “Iron Chef” fame and Robbie Felice have decided not to open their restaurants MM by Morimoto and pastaRAMEN, respectively. PSBJ quoted Montclair Hospitality Group, the planned operators of the restaurants, for its story last month.

The hotel and ground-floor retail area is still expected to feature Joshua Skenes and his Angler restaurant and other high-end shops. Skenes is the first and only American chef to garner three Michelin stars cooking entirely over open flame.

The Residences building – with its 224 homes within 25 stories – opened in the fall, while the ultra-luxe Estates 26-story, 141-unit tower with 208-room InterContinental Hotel plans to open soon after a bit of a delay.

About half of all homes within the twin-tower community have buyers under contract. Interested in learning more? Contact me to provide additional insights or to schedule a visit, just north of Bellevue Square.

LUXURY LIVING

Let’s start our tour at the top, the top of a hill that is. This one stands above the rest: a 5-bedroom, 6.25-bath mansion with outdoor pool and fountain atop Clyde Hill (380 ft. above sea level to be precise). Built in 2018, this place has everything – theater, fitness room, vaulted ceilings, two kitchens and a Nana Wall that only acts as a barrier between indoors and out when you want. A warm, welcoming space in search of new owners. List: $9.75M ($1496/sq. ft.).

Just a little to the West, this newly constructed home in Medina features everything a buyer would want. It starts with the numbers: 5-beds, 5.25-baths, 6040 sq. ft. on a nearly half-acre. The 2-story home features natural wood, limestone walls and floating staircase. Did I mention the wet bar and wine cellar? Great views. List: $14.89M ($2467/sq. ft.).

Or how about something new in Seattle? Try this 6-bed, 5.25-bath, 5278 sq. ft. statement home in Washington Park. Completed this year, the residence comes with hardwood floors, marble tile, vaulted ceilings, a 10 ft.-plus quartzite kitchen island and many tasteful accents throughout. Rooms focus on wood elements – very Scandinavian – with contemporary lighting and picture windows that add a sense of openness, while the rear terrace seamlessly blends the indoor space with the outdoors. Top-notch mountain views! List: $6.19M ($1175/sq. ft.), a recent price drop from $6.54M.

I love Craftsman homes, so much so that I published a blog post about the beginnings of this architectural style in Seattle. Few Craftsmans remain and fewer look like this one, the Polson House, a 6-bed, 5-bath, 7840 sq. ft., 2-story manse with basement in Queen Anne. Check out the rich wood craftsmanship and tile work. This video shows us how the past blends well with the present. And, the south-facing views of the Space Needle and Elliott Bay are captivating. The owners are reportedly former finance execs who put almost $2M into updating the home, including a state-of-the-art kitchen. List price: $6.95M ($886/sq. ft.)

What else is happening in and around your Seattle?

Meeting of the (AI) Minds, Apr. 18

Attend an evening of thought-provoking discussion about the vision for artificial intelligence at the Innovation Exchange. The shared knowledge takes place at MOHAI (860 Terry Ave. N.) Register to attend this free event. 6-9pm.

Tea Party, Apr. 20

A cozy event – Cascadia Spring Tea Festival – features a few local vendors, tastings (bring a cup!) and teaware for sale. It takes place at Brightwater Environmental Education and Community Center (22505 SR-9 SE) in Woodinville. Entry: pay what you want. 11am-6pm. (Bonus: Check out my blog post on Seattle’s favorite tea purveyors.)

Vegetarian Variety, Apr. 20-21

A two-day conference on all things vegan? It’s true! Planted Expo Seattle will host about 200 vegan edible and lifestyle businesses for a weekend of information sharing and inspiration. All are welcome at the Seattle Convention Center (705 Pike St.). Kids under 12 are free. 10am-5pm.

Marking Earth Day, Apr. 20-22

Our region will celebrate Earth Day (officially April 22) with a variety of events. They include, on Apr. 20: Earth Day Run (Magnuson Park, Seattle) at 10am; a virtual Earth-a-Thon tech project (9am-5pm); Volunteering at the Washington Park Arboretum (2300 Arboretum Drive E., Seattle) starting at 9am; and, Sammamish Earth Day at Beaver Lake Lodge (25101 SE 24th St., Sammamish), 11am-2pm. Also, national parks are free on Apr. 20 while access to state parks is complimentary on April 22, the same day Seattle U. will hold Earth Talks (12-1:45pm).

Home Sweet Home, Apr. 26-28

The Evergreen Home Show promises 200 booths of “specialized local businesses ready to help you customize, update, or even design the home you have always wanted” at Evergreen State Fairgrounds (14405 179th Ave. SE) in Monroe. Fri., 12-6pm; Sat., 10am-6pm; Sun., 10am-5pm. Ticket info, including a coupon! Separately, on Apr. 27, register online now for a self-guided Northwest Green Home Tour to see a selection of sustainably focused homes in and around Seattle. Tour map. Free. 11am-5pm.

Cinco de Mayo Celebration, May 4

Something tells me that all of early May will be a fun time for bars and restaurants to mark the Mexican holiday (May 5). For something more authentic, check out a celebration of food, music, crafts and more at Plaza Roberto Maestas (1660 S. Roberto Maestas Festival St.) in the Beacon Hill neighborhood of Seattle. Free to attend. 12-5pm.

Boating Season, May 4

Seattle marks the start of boating season with a parade and rowing competition. The fun can best be seen along the Montlake Cut near UW. Get there early. Then, cheer crew teams as they row through the cut in the Windermere Cup. Free. (Try to avoid driving in the area! Montlake Bridge will be closed to traffic, 9:20am-3pm.)

Seattle Film Fest, May 9-19

Enjoy what is one of the largest film events in the country – the Seattle International Film Festival (better known as SIFF) – which is celebrating its 50th year. Come for the films, of course, as well as hear from some of the directors, actors and critics who attend festival premieres and screenings. Tickets are available for a single screening, an entire event pass or for just the parties! Plus, there are options to watch many of the films online (May 20-27). A full schedule will be released in a couple of days but here’s a sneak peek.

Storm’s Approaching, May 14

The WNBA Storm hit the hardwood for a new campaign with high hopes following a challenging 2023 without their two pillars – Sue Bird (retired) and Brianna Stewart (free agency). Seattle grabbed the offseason headlines by signing two outstanding playmakers – Skylar Diggins-Smith and Nneka Ogwumike – to join superstar Jewel Loyd. The Storm host Minnesota in the May 14 home opener and follow that with games at Climate Pledge Arena (334 1st Ave. N.) against Indiana (likely with Caitlin Clark after her stunning collegiate career at Iowa) on May 22 and Washington on May 25. Tickets.

Events are subject to change. Please check with venues to confirm times and health-safety recommendations.

In case you missed it….

Every Tuesday (unless it’s a holiday), I publish a new story on my Living the Dream blog. I research and write pretty much all of the articles – many of them focus on local residential real estate, naturally.

However, there are times when I like to stray outside of that wide-ranging topic for something a little more adventurous. For example, check out my video blog (vlog?) on cherry blossoms in our area. That was fun!

On more serious topics, I explain the difference between MIP and PMI in home financing and share a deep look at this year’s housing-related legislation following the short session in the Washington Legislature.

==============

CORRECTION: In last month’s newsletter, we incorrectly stated at least 48 pieces of housing-related legislation passed either the state’s House or Senate. The correct figure was 23. There were at least 48 pieces of housing-related legislation considered but some proposals did not pass either chamber of the Legislature in Olympia.

Thanks for reading and see you here next month!