This marks the introduction of a new feature. Each month, this blog will publish a fresh assessment of the King County area housing market. The article will include the latest monthly data from the Northwest Multiple Listing Service, analysis from national and local experts and a glimpse ahead at what to expect in the coming weeks. I hope you enjoy reading this monthly report. –Will Springer, Realtor®

======

December is typically the slowest time of year for local residential real estate sales, but the final few weeks capped what turned into the slowest year in a decade for the purchase and sale of homes across King County.

A patch of foul weather and persistent economic challenges chilled an already cold housing market. The Northwest MLS monthly housing report described it best: “December ends with a ‘whimper’.”

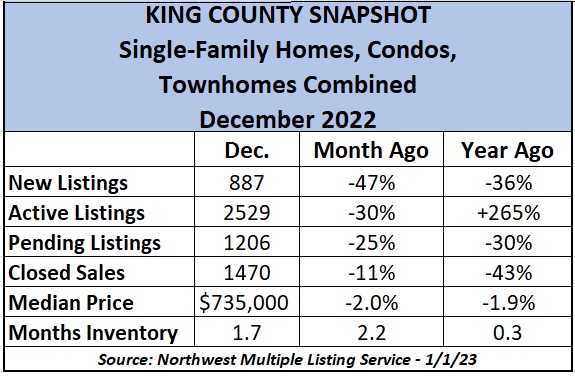

The number of new listings for all home types – single-family, townhomes and condos combined – in King (887) fell 47% from November and declined 36% from December 2021. Homes going under contract (Pending sales) dropped 25% from the previous month and by 30% year-on-year (YoY) – staggering drop-offs. The number of Pendings (1206) has fallen for five consecutive months and is the lowest of any month since December 2008 (1167).

In fact, the numbers of new single-family (701) and condo listings (186) in the county were 44%+ lower than November figures. They reached lows never seen this century – not even close.

A bright spot for buyers: Active listings for all homes as of Jan. 1 in King (2529) were 265% above the total on the same date last year. Among the single-family-home category, it was 376% higher than a year ago (1881), including 830% higher on the Eastside (511).

The market traditionally slows in December to enjoy holiday parties, family gatherings and vacations, but this market chill is unprecedented. The bar is so low on listings and sales data that one might trip over it.

A total of 28,393 homes were sold in King County in 2022 (excluding new construction sales). That is the lowest annual figure since 2012 (27,601), according to MLS data.

Median home prices in King have fallen two consecutive months after a mostly consistent climb since the start of the pandemic. They finished December at $735K for all home types, down 1.9% for the year, the first YoY price decline in the county since May 2020 early in the pandemic.

Prices were broadly lower from month-to-month – down 4.3% in Seattle ($789,250) and off 4.4% on the Eastside ($1.1M). Bucking the trend was Southwest King (Federal Way, Des Moines), which saw a 1.7% monthly rise in median prices ($548K), which surprisingly is 3.9% lower YoY.

Single-family-home prices fell 2.8% in Seattle ($879,975) from November to December but are 4.9% higher YoY. Prices on the Eastside, while only 1.3% lower ($1.29M) over the month, are off a whopping 15% since this time last year. Leading the price decline was a 29% YoY drop in Kirkland/Bridle Trails ($1.45M), thanks partly to an unusually high median figure of $2.03M in December 2021. Median prices across the county were statistically unchanged from November ($825K) and up a modest 1.9% from the year before.

Exclusive Eastside communities topped 2022’s highest-priced home sales. Two of the top three most-expensive transactions were in Medina:

Condo prices in December moved in different directions depending on the area of the county. Overall, median prices stood at $465K, down 1.0% from November and up 1.1% YoY. While prices were 1.0% lower on the Eastside month-to-month ($565K), they were up 6.7% in Seattle ($512,500).

In addition to King County’s 2.0% month-to-month price decline on all home types, Pierce County saw the sharpest drop – down 3.4% ($500,000). Kitsap prices fell 2.1% month-to-month ($495,000) while Snohomish was statistically unchanged ($679,000).

Single-family home prices in King ($825,000) and Snohomish ($700,000) were unchanged in the past month. They were down 3.9% in Pierce ($504,500) and off 1.5% in Kitsap ($497,777) for the month. Year-to-year, single-family median prices were little changed – up 1.9% in King, unchanged in Snohomish, down 3.0% in Pierce and off 0.4% in Kitsap – a far cry from the double-digit, YoY price appreciation experienced right after the pandemic.

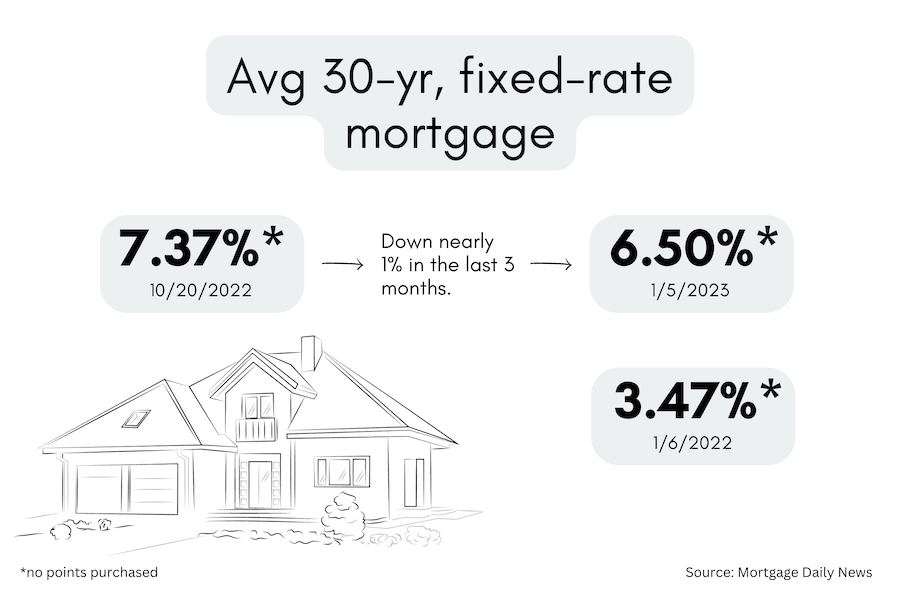

Prices are expected to inch lower month-to-month, at least through winter. Economists across the U.S. believe prices will fall year-to-year by about 5%, including about 7% in our region. Those experts also believe home sales (excluding new construction) should fall about 10% YoY in King County unless mortgage rates slide below 6% and job certainty solidifies – two factors that would help boost activity. Home sales fell a stunning 43% in King for the year ending December.

Prices in King have fallen 16% since their 2022 highs of $880,000 in May. The pace of the decline rivals the 2008 crisis but should in no way be interpreted as a housing crash as supply remains historically low and households have record levels of equity in their homes.

“Mortgage rates have more than doubled from last March, so it’s not surprising that housing prices in many markets are falling and flatlining across the country,” says real estate and finance professor Susan Wachter for The Wharton School of the University of Pennsylvania. “This is not a replay of the Great American Housing Bubble.”

The general softening of prices comes despite tight inventory, even when factoring out canceled and expired listings that typically take place in November and December. Across King, there were 1.7 months of inventory, down from 2.2 months in November. Inventory in both Seattle and on the Eastside was at 1.8 months, down from 2.5 and 2.2 months, respectively, from the previous MLS report.

How slow is the market? Homes are sitting in King County for a median of 25 days, up from 17 days in November and only 6 days a year ago. Eastside homes are on the market for a median of 26 days and 20 in Seattle.

What else can we expect in 2023? Economists look at several factors to forecast home sales. Two are excellent guideposts for home purchases: Mortgage applications and Pending sales. We have seen a 36% decline in applications from this time a year ago and Pending contracts for December were 30% lower than the same month in 2021 – signaling a sluggish start to the new year. (Pendings typically become final sales about 5 weeks after reaching mutual acceptance and should be reflected in the following month’s report.)

”We expect home sales to slow dramatically in 2023,” says realtor.com Chief Economist Danielle Hale. “It means fewer new first-time homeowners celebrating, and that’s sad.”

First-timers are “struggling with high consumer prices, property values and interest rates, which are pushing savings rates to very low levels and delaying their ability to gather a sufficient down payment,” notes George Ratiu, manager of economic research at realtor.com.

The monthly mortgage payment for a median-priced home in the U.S. is 64% higher than a year ago, according to Ratiu. Plus, current homeowners are delaying their plans to sell amid inflationary pressure and current interest rates that are about double what they are facing on their existing mortgages.

If there is promising news, it’s that winter housing statistics are usually stark amid a lack of activity and few new listings. There are also positive signs that the rate of inflation is easing. Whether the slightly favorable tone can help stave off a recession is another story.

“The economy caught its breath in the second half of 2022, but that doesn’t change our expectation that it will run out of air in early 2023 via a mild recession,” says Doug Duncan, the chief economist at Fannie Mae.

======

Before becoming a full-time licensed Realtor® in 2018, Will Springer spent his career working in the communications industry. Will spent 15 of his 25 years as a journalist with Dow Jones & Co., publishers of The Wall Street Journal, where he was an assistant managing editor of WSJ.com in New York. He also lived abroad, enjoying 5 years in different editorial roles with U.K. news publishers. Today, Will researches and writes all material you see on the Living the Dream blog and newsletter (free sign up). His goal is to help buyers and sellers navigate the challenges of the real estate process.