You unwrap that new Samsung Galaxy phone and can’t wait to start migrating your contacts, apps and files before sleuthing out how to use the functions and customize everything to your liking. There’s a rush after you have programmed the device just the way you want.

But that’s a phone – a tool that often hand-holds you through the set-up process.

There are other aspects of consumer living that require a helping hand. Buying a custom-fitted suit, purchasing a piece of luxury jewelry and planning a wedding all have better outcomes when a specialist helps you through the process.

The same can be said when buying a home for the first time. No one truly enjoys trying to figure out something as complicated as purchasing a single-family home, townhouse or condo without the help of an expert or experts.

Take it from me, I see many first-time buyers who look like a deer in headlights (no offense intended!) when attempting to navigate the home-purchase process. And, you know what, that’s okay! There is just so much to understand. Here are my 10 tips for first-time buyers:

1. SAVE NOW OR FOREVER HOLD YOUR PEACE

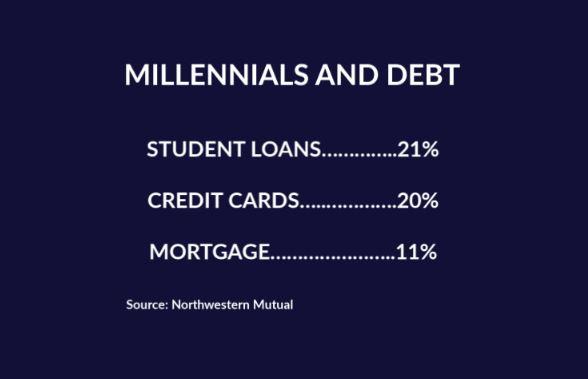

Buying your first home doesn’t start with a real estate search app. It should actually begin months before when examining your personal situation – budget, net income, credit reports – to ensure your financial house is in order. Many first-time buyers are Millennials who are saddled with student debt. According to the Federal Reserve, a $1,000 increase in student loan debt causes a one to two percentage point drop in the home ownership rate for student loan borrowers during their late 20s and early 30s. Lesson? Whether you are weighed down by debt or in good financial standing, save as much as possible every paycheck and begin to estimate how much you will have set aside for your earnest money deposit and down payment at closing (with the rest of the home price covered by your mortgage). Dabble with financial calculators to see where you land now and where you want to be when the time comes to make an offer on a home.

Buying your first home doesn’t start with a real estate search app. It should actually begin months before when examining your personal situation – budget, net income, credit reports – to ensure your financial house is in order. Many first-time buyers are Millennials who are saddled with student debt. According to the Federal Reserve, a $1,000 increase in student loan debt causes a one to two percentage point drop in the home ownership rate for student loan borrowers during their late 20s and early 30s. Lesson? Whether you are weighed down by debt or in good financial standing, save as much as possible every paycheck and begin to estimate how much you will have set aside for your earnest money deposit and down payment at closing (with the rest of the home price covered by your mortgage). Dabble with financial calculators to see where you land now and where you want to be when the time comes to make an offer on a home.

2. KNOW YOUR FINANCING OPTIONS

Interview at least two mortgage lenders to see how they differ – both in their style of doing business with you as well as the types of lending options offered. In addition to a conventional mortgage (at terms of between 15 and 30 years), buyers may qualify for other loans from government programs. In addition, there are dozens of state and local assistance programs that can help defray the down payment or mortgage costs. Ask your lender about all options to better understand how much home you can afford – and, more importantly, how much of a monthly payment you wish to make without stretching yourself too thin.

3. MORTGAGE APPROVAL

One of the most important pieces of paper you will ever receive is a preapproval letter from your lender. Buyers will need to produce this letter to their broker as a piece of leverage when submitting an offer on a home. To make the offer even stronger, ask that your lender provide a “fully underwritten letter,” which is the financial institution’s full assurance of your ability to get financing NOW – not in a few weeks after more of your finances are verified. Timing is everything when it comes to making an offer and receiving mutual acceptance.

4. HIRE THE RIGHT REAL ESTATE PROFESSIONAL

You can only get so far along the home-buying journey before you will recognize a need for a “special agent.” Buyer brokers can not only help with your search, but they should be able to dive deeper with seller agents to better understand their clients’ circumstances. Ask the brokers you interview if they are certified negotiation experts. Only about 3.5% of the nation’s real estate agents are skilled negotiators – like me.

5. RESEARCH NEIGHBORHOODS

Many buyers look for homes in a certain price range and then try to determine if the neighborhood suits their wants and needs. Looking for a particular house of worship? Want to ensure your child is in a particular day care or school? Need to be within a half-hour of the office? Drive and walk the neighborhoods that may meet your expectations. Ask your friends and real estate agent about their impressions, too. Take these factors into account first and then begin your home search within those areas. A time-saver.

6. WATCH YOUR BOTTOM LINE

You and your lender agreed to a certain ceiling that you can afford on your first home. You basically cannot go over that number. But what happens if you move in and find a few months later the roof has a leak or that beautiful tree on your property has root rot and needs to come down? You haven’t budgeted for those surprises, have you? Well, now that you’ve read this blog post you know what to do: Look for homes about 3% less than your price ceiling, lowering your monthly mortgage slightly and, in theory, allowing you to create an emergency fund by saving a few dollars every month and cover those surprises.

7. OPEN HOUSES ARE YOUR BEST FRIEND

I encourage all buyers to start visiting homes months before planning to make an offer. Why so soon? You want to know the neighborhood (see above), the different types of homes, the types of gadgets (think smart technology), the amenities, and types of repairs that you feel comfortable making (such as electrical outlet replacement) instead of asking a seller to take on that responsibility. When visiting homes, look for issues in plain sight: cracks in the ceiling, walls and pavement. Use your nose too to anticipate odd smells. Ask questions of the open house agent or your broker. Learn about different flooring and cabinetry. Before you know it, you’ll be a home-pricing expert and more confident when making an offer.

8. SAVE UNTIL IT HURTS

Your lender will give you general guidance on saving for your earnest money deposit and down payment. That’s great. But, with some closings and signings of contracts, there can be an expense that may catch you off guard. You should anticipate closing costs of about 3% of your sales price. Then add another 0.5% for good measure – for any surprises (for example, costs associated with a rescheduled moving date or for a 1-2 night’s stay in a hotel for a smoother transition from one home to the next). Also, the lender is watching your credit score and buying habits right up until the day your financing is delivered to escrow to pay for the home. If you jolt your credit score by purchasing a new car a week before moving in, well, you may have to come up with more money for that home or even delay closing to allow the lender more time to justify the loan under these new circumstances. Yes, it has happened!

9. TAKE ADVANTAGE OF THE HOME INSPECTION

You will likely hire a qualified inspector to check on the stability of the home – from foundation to roof, walls, plumbing, wiring and everything in between. Attend the inspection and listen to what the expert has to say. Learn about the home and its quirks (if there are any). The inspector’s report will include a list of any issues and items worth having a look. Leverage this report by requesting some of the repairs be made by the seller or ask for a credit on the sales price to cover the expense of making those repairs after move-in. In Seattle/King County, we are no longer in a frenzied, multi-offer housing market (circa 2017-2018) in which buyers were waiving the housing inspection (gasp!). Address major issues with the seller’s agent as part of the negotiation or risk having those items come back to bite you later.

10. PROTECT YOUR NEW HOME

I personally believe home warranties are an excellent addition at the time of purchase. Whether it’s the garage door or refrigerator door, when it breaks you want assurances the item will be fixed – and it won’t put a dent in your budget. Insist your seller stand behind the quality of his/her home – including appliances – by purchasing a top-notch home warranty to protect your assets. Failing that, purchase one yourself; the $350-$450 expense is the best insurance policy against issues in your home.

BONUS TIP: SHOP FOR HOMEOWNERS INSURANCE

Your lender will require you to buy homeowners insurance. Remember to get at least three quotes from different insurers – national and local companies – and compare for both price and coverage levels. Not all policies are created equal. Some may start as the best option because of price but turn out to eat a hole in your wallet when filing a high-deductible claim.

Yes, you may have seen a pattern in this blog post. Research. Ask questions. Save – and save even more. Get protection on your home through service contracts (warranties) and safety nets (insurance).

Then, rest easier.