The question of whether one should buy or rent is always challenging for real estate brokers (and many other industry professionals) to help answer. I don’t like to write the following words for my response, but here goes: It depends!

There are many components to develop an answer. It often depends on your circumstances: Are you settled in to your career and feel you will be doing similar work in the same region for at least another five years? Living in an at-will state, such as Washington, can make that question more difficult to answer since you really never know if you will be in the same employment situation from year to year.

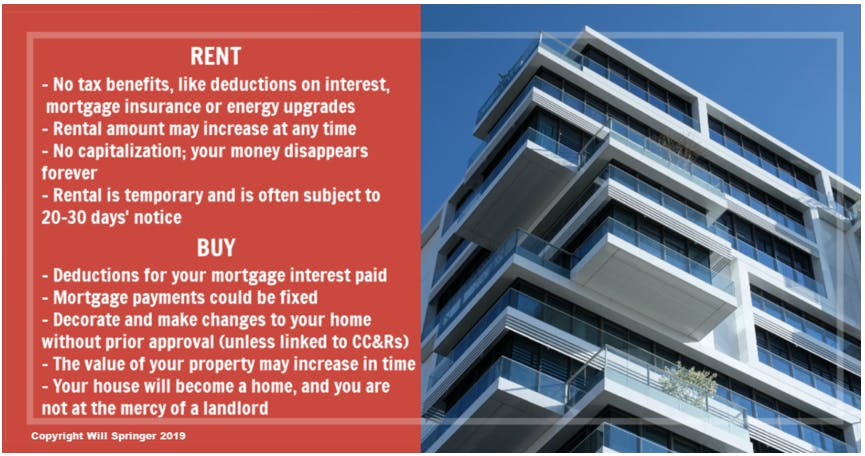

At the same time, if you don’t get on the property ladder to build equity and treat your home as an investment, then what? Do you resign yourself to renting a place (some would say throwing money away) and skip homeownership altogether? Likely not, but that is an option too.

“With interest rates fairly low and the standard deduction being much higher (than in the past), the question about buying or renting is much tougher to answer now,” acknowledged Stephen Fickenscher, a local tax and insurance expert. “With high rents in Seattle, buying may still be better even without being able to deduct interest and taxes as before.”

Let’s pause here and ask you to complete a Rent vs. Buy calculator. To be sure, a calculator can only do so much. It might tell you the better long-term decision on paper, but that still doesn’t mean it’s the best move for you now.

Unknowns are your greatest barrier to the truth. In other words, intangibles are difficult to quantify and, yet, become crucial in determining what’s best for you. For example:

- How long you’ll live in the home: The longer you’re in a home, the better, because your costs are spread out over time.

- The cost of housing: People typically rent because buying a house is too expensive for them, but it all depends (there’s that word again!) on your hyperlocal market. If renting is extremely costly in your area, buying a home could be more affordable (mortgage payments lower than monthly rent).

- Opportunity costs of your taxes and insurance: What kind of a return could you get if you invested the routine costs to homeownership instead in the stock market, a certificate of deposit or even an interest-bearing savings account?

- The opportunity cost of your down payment: How much of a return could you get if you invested that lump sum instead?

On the other side of the rent vs. buy fence, there are tax benefits to owning a home:

- The upside to a mortgage: Homeowners can deduct interest expenses from their income taxes up to $750,000 of mortgage debt, though when itemizing, homeowners forgo the new (for tax year 2018), more-generous standard deduction ($12,000 for individuals, $18,000 for head of household and $24,000 for married filing jointly).

- Appreciation: While the home typically increases in value during ownership, these gains are not taxed at the federal level. Homeowners can exclude up to $250,000 (single individuals) or $500,000 (married, filing jointly) in home appreciation when figuring their capital gains.

- Property tax break: A mixed bag here: Filers will be limited to a $10,000 deduction on all taxes (property, income, sales – although Washington state doesn’t have an income tax). Previously there was no deduction limit.

- Making points count: If you paid points to your lender when acquiring a mortgage, you can take advantage of a tax deduction as long as you (not your seller) paid for those points.

- Potential insurance deduction: Private Mortgage Insurance (PMI) is a fee you pay each month when owing 80% or more on the loan. Current law allows for a PMI deduction if your adjusted gross income is $100,000 or less (married, filing jointly) or $50,000 or less (single filers). [Many people still assume a 20% down payment is custom but first-time buyers put only 6% down on average. Renting until you have 20% down can take years to accomplish at a median income, all while home prices (and sometimes mortgage interest rates) typically rise.]

- Savings 2X: U.S. tax law permits credits for making energy-saving upgrades to your home, including electric and water-heating equipment. Between 2017 and 2019, 30% of your upgrades are eligible for the credit and the figure will drop in tax year 2020 to 26%.

There are other aspects to discuss with your financial advisor, including the property’s long-term investment prospects, the benefits provided exclusively to members of the military and veterans, historically low mortgage rates (as of this publication, at least) and first-time, home-buyer credits.

Recent tax changes may actually blur the distinction between homeownership and renting. Ask your advisor to provide a comparison of rent vs. buyer costs over several years. For some people, renting will be better now and for the next couple of years but buying would ultimately make more sense.

The goal of helping answer this question is to turn data into information and information into insights. Take some time before making your next move (pun intended).

Yes, it really does depend.

Disclaimer: I am not a personal finance expert (by any means!) nor should you rely exclusively on the internet for advice. Hire a financial planner, qualified accountant and/or tax attorney to sort through the variables and make an informed decision. Stephen Fickenscher, who is quoted for this story, is a tax specialist I have hired for personal tax assistance.