Good news! The national economy is growing. Unemployment remains low. Corporate revenues are up.

For housing and mortgage professionals, however, these apparent highlights are persistent nuisances. They signal that the economy is still running hot – or at least more than lukewarm – and inflation may need more cold water from the Federal Reserve to cool it off.

“Cold water” comes from the central bank’s intent to maintain high financing costs for banks that borrow from other financial institutions. In turn, consumers experience the trickle-down effect in the form of costlier lending rates when holding credit card debt or financing cars and homes. (More on this in a moment.)

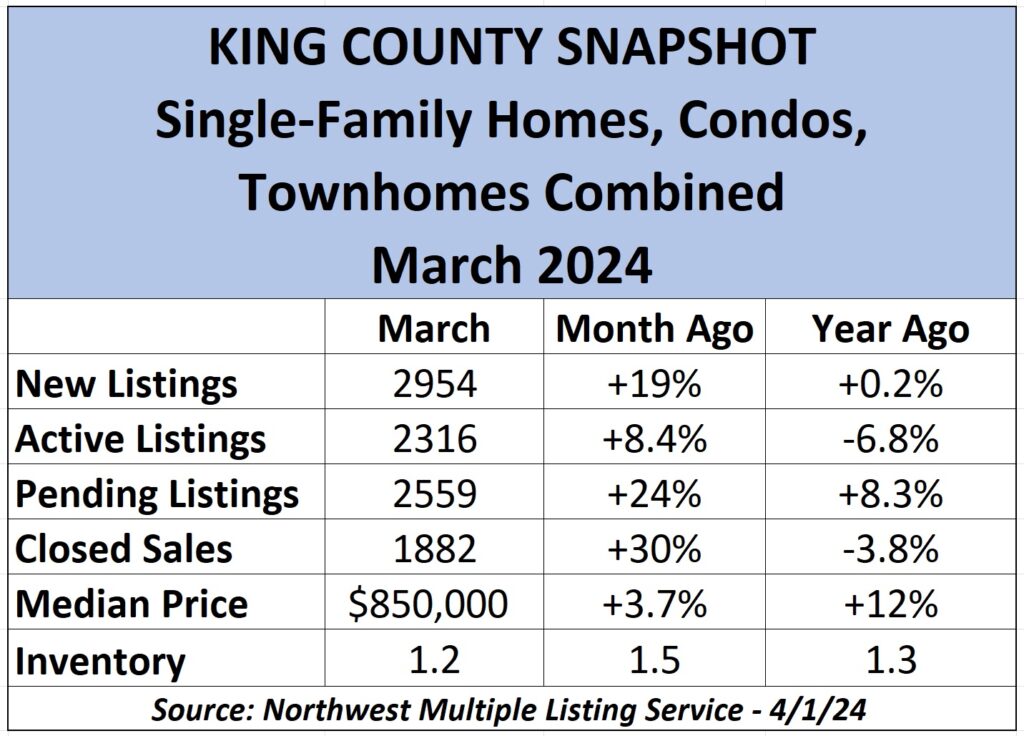

Despite a challenging economic environment, the Seattle/King County housing market is moving forward. That was highlighted by a 30% month-to-month gain in total home sales (single-family, townhome and condos combined) across the county in March and unseasonably low supply for buyers. It was particularly true on the Eastside, where sales surged 52% from February to March and 9% year-on-year (YoY) and inventory narrowed to under a month (29 days) before all homes for sale would theoretically be under contract if no others hit the market.

Sales activity in the single-family category was strong across all corners of King County – up 34% (1435 units) month-to-month but down 5.9% YoY. New listings (+17%), available homes at the start of April (+5.0%) and listings going under contract – also known as Pending sales – (+24%) were solidly higher when comparing month to month. And that is to be expected as the market wakes out of its early year hibernation into the spring buying and selling season.

However, we are missing the typical boost of sellers. The 2166 single-family new listings in King are the lowest of any March since records were archived online in 1991. The second lowest March was last year (2268 listings), according to the Northwest Multiple Listing Service. In addition, the number of single-family active listings on April 1 (1483) was 17% lower than a year ago.

Also remarkable was the robust activity on the Eastside, where new single-family home listings jumped 25% (687) between February and March, Pendings gained 34% (598) and closed sales skyrocketed 67% (430). Certain buyers nabbed what was hitting the market almost as fast as it became available, affirmed by a 14% month-to-month price increase ($1.68M), which is a whopping 19% higher YoY. In other words, the competition is heating up in at least this part of the county.

The sharpest Eastside price increase hit Juanita and Woodinville. That’s where home prices jumped 26% YoY to $1.38M and left this submarket with only 0.64 months (20 days) of available inventory. North King County, including Shoreline and Lake Forest Park, had the smallest inventory as of April 1 – 0.5 months.

The county saw median prices for single-family homes jump 3.4% for the month ($945,500), which is 13% higher YoY. Seattle prices fell a minuscule 0.3% ($925K) and are up 6.3% YoY. Elsewhere, median prices surged 23% ($690K) in Dash Point and Federal Way, while they fell about 5% in Enumclaw ($655K), Auburn ($589K) and Bellevue east of I-405 ($1.68M).

The swift pace of single-family sales activity is noticeable in the data, with only 0.9 months of inventory on the Eastside and 1.0 months for the entire county. Inventory stood at 1.3 in Seattle, virtually unchanged from last month. April 1 inventory was at or below one month in 18 of the county’s 29 submarkets (this excludes downtown Seattle, where there are no single-family homes).

Besides inventory, sales intensity can be measured by the median number of days the home is on the market – 5 for King County single-family homes, down from 6 in February and 22 in January. In addition, county sales are roughly 1% above the list price, the highest percentage since May 2022, when it was 3.9% above the list price. Nationally, home listings in February sold after a median 38 days on the market (latest data).

Condo activity continued to improve, with 22% (788) more new listings month to month in King, including a 41% climb (288) on the Eastside. This type of home is going under contract 25% (632) more frequently in March compared with February, and prices across the county inched 1.8% ($540K) lower month to month while the median price is up 6.5% YoY. The typical Seattle condo is selling for $587,500, up 5.3% since February and 9.8% YoY. There are 1.8 months’ condo inventory in King, 2.5 months in Seattle and 1.2 on the Eastside, where median prices fell a surprising 8.3% for the month ($610K).

In addition to King County’s 3.7% median price month-to-month increase on all home types, to $850,000, Kitsap County saw a solid 3.1% rise from February to March ($535,000). Snohomish added 2.1% to its median price since February ($730,000) while Pierce prices inched 0.4% lower ($535,000). Single-family home prices were mostly higher. They jumped 3.4% for the month in King ($945,500), followed by Kitsap (up 3.1% to $535,350) and Snohomish (up 1.2% to $760,000), with Pierce unchanged ($550,000) from February. Year-to-year, single-family median prices have soared 13% in King, followed by gains of 5.0% in Snohomish, 4.6% in Pierce and 3.5% in Kitsap.

Sellers are wisely taking advantage of a market with limited competition, as many households sit on low-interest mortgages from the thick of the pandemic. Unofficially, about 45% of single-family homes were selling in March above the list price in King County.

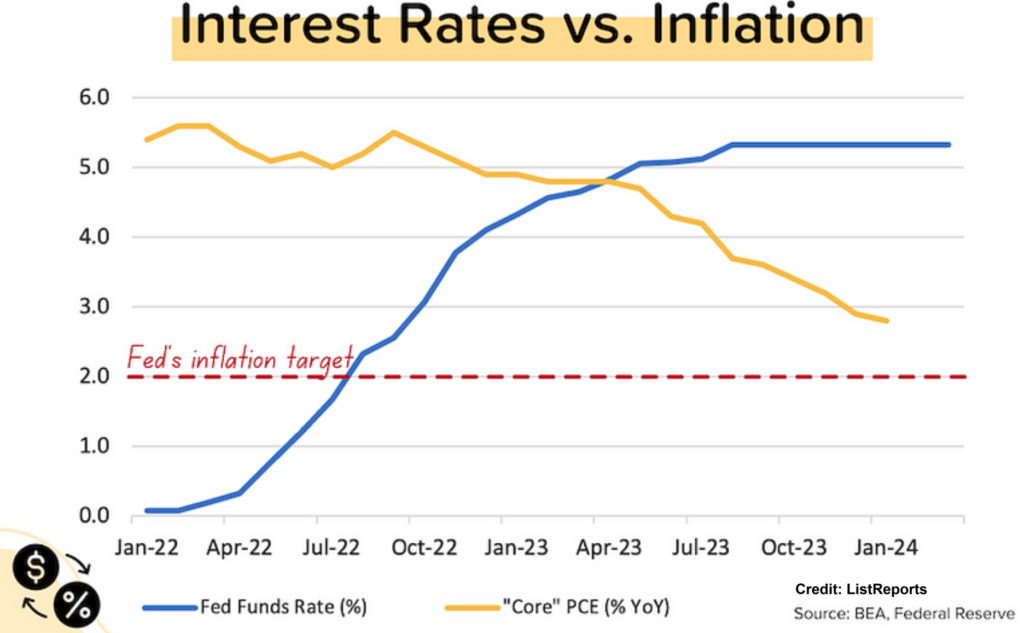

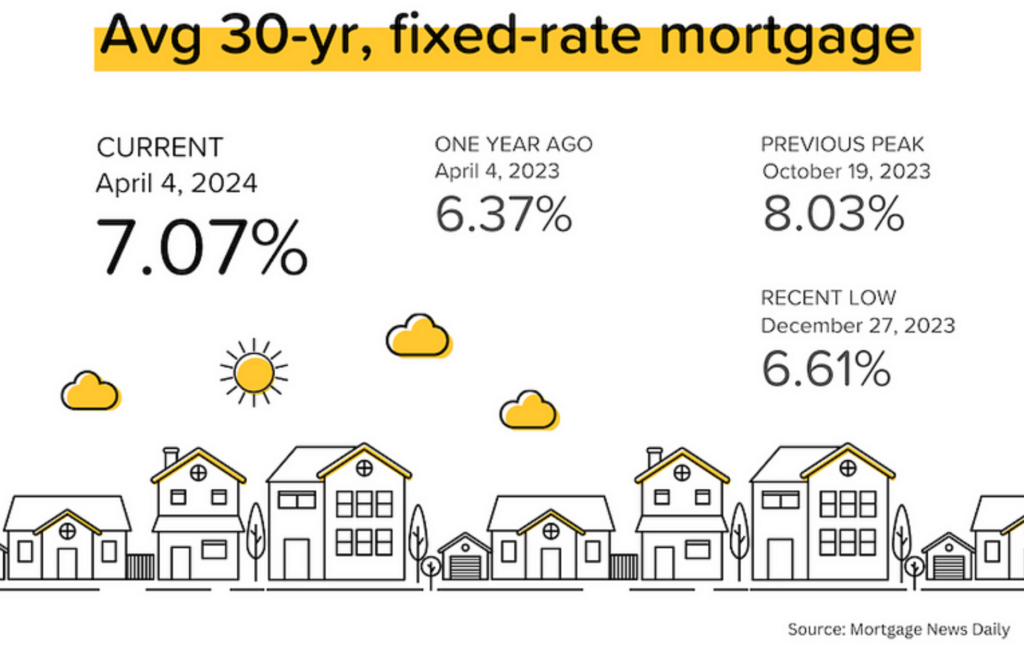

Mortgage rates continue to be the focus of both sellers and buyers, waiting for something to give. The Federal Reserve Board has kept its short-term interest rate steady – in a range of 5.25%-5.50% – for five consecutive meetings. The last time the central bank changed the policy rate was July 2023.

What was once a hopeful year for lower mortgage rates has so far been a letdown as the Fed waits, in the board members’ words from last month, “until it has gained greater confidence that inflation is moving sustainably toward 2%.” The median forecast for Personal Consumption Expenditures (PCE) inflation, the Fed’s preferred gauge, is 2.4% for this year and it’s currently running at 2.8%. (The chart below has not been updated since the latest PCE update – yellow line – in late March.)

This higher-for-longer mindset by the Fed has caused a rethink among top economists. In mid-March, Fannie Mae revised its forecast for mortgage rates and now expects them to stay in the “6s” for much longer.

Fannie Mae started the year with an optimistic view, forecasting rates to crack below the 6.0% level by Q4 of this year (to 5.8%) and continue a slow downward path through 2025 when rates would be at about 5.5%. However, the large federal guarantor of mortgage loans now believes we will end 2024 with an average 30-year mortgage rate of 6.4% and end next year at about 6.0%.

“The housing market is likely to continue to face the dual affordability constraints of high home prices and elevated interest rates in 2024,” said Doug Duncan, Fannie Mae’s chief economist.

The result will likely include two key developments:

- Higher rates will make buying a home less affordable, thus impacting demand.

- Market activity should continue, especially for those experiencing life-changing moments, but more slowly than in typical years.

Economists with Wells Fargo also issued a revised forecast a few weeks back. They now believe 30-year rates will end the year at 6.15% and 5.75% by the conclusion of 2025. Those same forecasters started 2024 believing rates would end this year and next at 6.05% and 5.70%, respectively.

“The longer rates stay higher, [then] the more inventory grows and we normalize back to previous years,” theorizes Mike Simonsen, president of Altos Research, a national real estate data consultancy. “So, multiple years of rates staying higher will get us slowly back to 2019 levels.

“If rates are at or below 6.5% by June, we’ll watch this inventory growth recede and we’ll actually watch buyers come back – more buyers than sellers – so lower rates will spur demand more than supply,” he adds.

“What those buyers [who] are waiting may not realize is how much competition is waiting with them,” Simonsen says. “If rates fall, it’s much easier to buy a home. If rates fall appreciatively in the next few months, you’ll see demand spurred, more transactions, inventory tightening and more competition from buyers – especially in those markets that aren’t weak now.”

Are you listening, King County?

“Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices,” says Lawrence Yun, chief economist for the National Association of Realtors®. “Job gains are clearly increasing demand along with more inventory.”

U.S. unemployment was 3.8% through March, down a tick from February. About 276,000 jobs were created each month this year, above forecast estimates. Unemployment in King County is 4.2% (down from 4.4% the month before) and 4.7% across King and Pierce combined (unchanged).

Recent layoffs in the local tech sector, however, are fueling hesitancy among some buyers. The question looming over their heads is: If laid off, could they still afford to pay a mortgage and other bills?

For now, high interest rates are preventing a growing pool of consumers from selling their homes and many more people from making offers. The robust spring season may be a disappointment for many, but we are in a slightly better place than last year when mortgage rates peaked at 7.79% in late October (Freddie Mac). Affordability undoubtedly remains top of mind.

Rosy economic news is unlikely to push Fed decision-makers to lower rates when they meet next in late April/early May. That is likely the reason for a decline in mortgage applications – down about 10% – compared with this time last year.