The Seattle/King County housing market appears to have come through the worst of times with a slightly stronger showing in January than in previous months. The number of newly listed homes more than doubled from December and increased moderately compared with the same time last year, according to data from the Northwest Multiple Listing Service (MLS). Total inventory remains low, however, keeping prices higher on an annual basis.

The final months of 2023 were among the quietest periods in recent memory for residential real estate amid a slow year overall. Annual sales across King County totaled 21,515 homes – down an incredible 24% from the year before and the fewest since 2010 (20,761). The market is now in the process of thawing after a lengthy cool down, as buyers begin anew to seek change in their home dynamics.

It’s too soon in the year to determine how supply and demand will shake out. There is plenty of pent-up demand from prospective buyers who have watched for months from the sidelines as financing costs remained untenable. The true barometer will be measured by the number of homeowners who enter the market this year – depending on lending rates and personal factors.

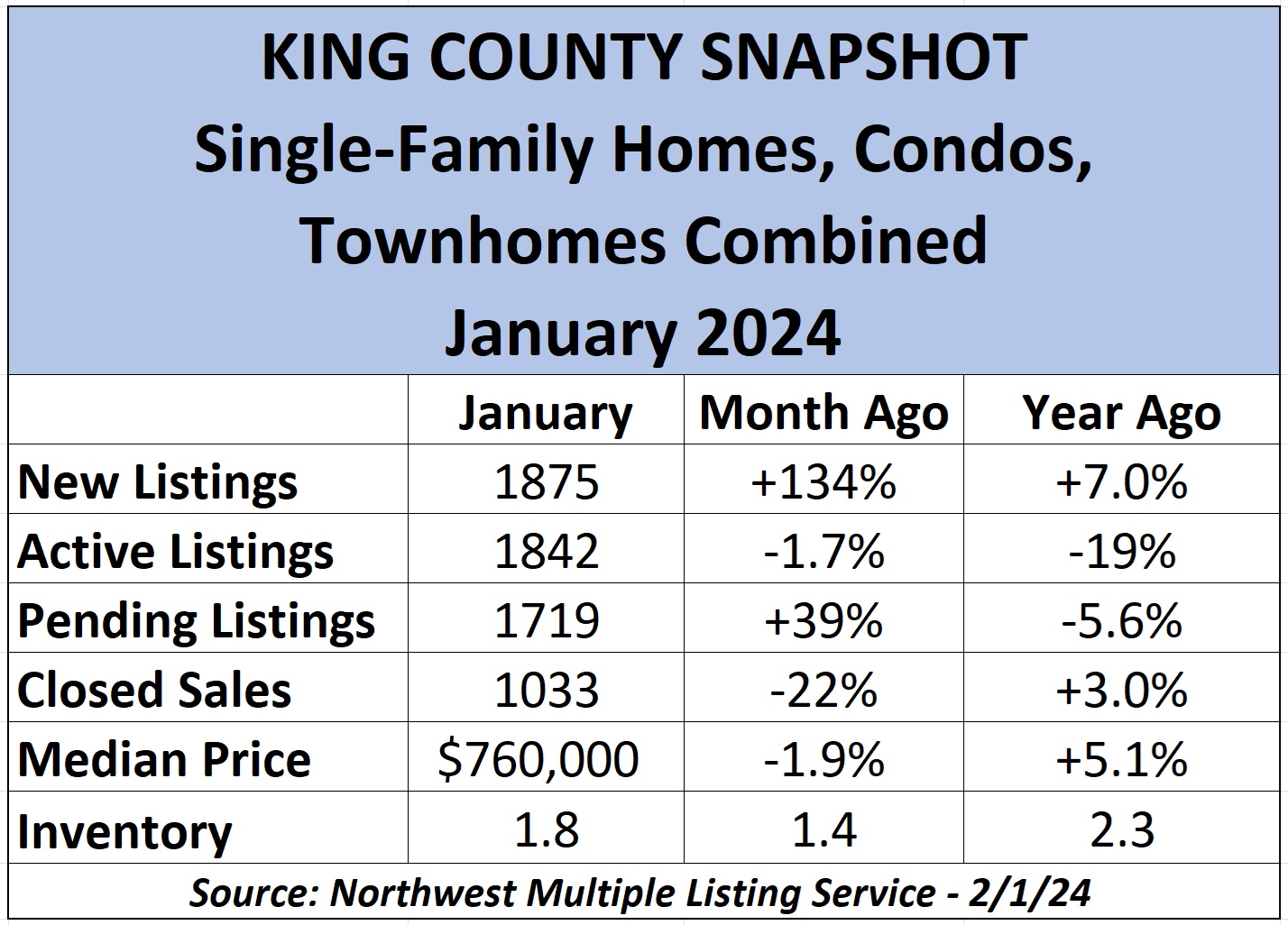

January offered a glimmer of hope as owners put 1875 of their King County homes on the market (single-family, townhome, condo combined). That’s a whopping 134% more than December and a solid 7.0% higher than January 2023.

We know buyers are eager to purchase properties, as 39% more homes went under contract in January (1719 units) compared with the previous – admittedly quiet – month. And, despite the rise in new listings, the number of homes still on the market on Feb. 1 was 1.7% fewer (1842) than on Jan. 1.

The figures were promising from the single-family-home category as well, with new listings jumping 129% (1335) from December in King and up a negligible 0.5% from a year ago. Seattle led the way with a 156% increase in new listings (517) month-to-month and 4.0% more versus January 2023. Pending sales for King rose 38% (1245) from December – including 59% higher (460) in Seattle – but were still 11% lower across the county versus last year at this time.

This indicates there may be higher turnover for homes hitting the market amid a growing number of buyers. People are seeking to move on as they experience life-changing moments – if they can afford what sellers are seeking.

The median price of all King County home sales fell 1.9% from December to January to $760,000, or 5.1% higher than in January 2023. The price of a single-family home sold in January for a median of $849,850, statistically unchanged from December and 8.8% stronger year-on-year (YoY).

Single-family prices rose 11% YoY in Bellevue ($1.46M), 15% in North King (Shoreline, Lake Forest Park) ($842,890), and 8.1% in both Southeast King (Auburn, Enumclaw) and Seattle. Southeast King enjoyed the sharpest monthly price rise, 9.3%, to $732,500, while Southwest King (Federal Way, Des Moines) experienced a decline of 6.6% ($605,000) since December but a rise of 5.2% YoY.

The number of available homes at the start of the month – known as Active listings – remains soft. Only 1183 single-family homes were on the market in the county on Feb. 1; that’s 2.8% fewer listings than December and 28% below January 2023 figures.

Active listings typically fall when mortgage interest rates fall and rise when interest rates rise. Why? Home buyers rush into the market when rates are more favorable and tend to return to the sidelines when lending costs rise to unaffordable levels. (More on the rate environment in a moment.)

The county market for condo homes – traditionally more affordable places to live – experienced one of its better months with solid increases in new listings, at 540 (up 145% from December and 27% YoY), Pending sales, with 474 (up 42% month-to-month and 12% YoY) and final sales of 277 (up 27% YoY).

Condos in our area can be units in high-rises or accessory dwelling units (ADUs) – essentially small single-family homes – sold as condos under city zoning rules. This will skew figures, particularly in Seattle where more ADUs are under construction than traditional single-family residences.

Bellevue saw a 68% increase in condos going under contract – or Pending sales – (163) in the past month for a 17% YoY boost. Seattle had a 12% YoY increase in Pendings (193). Median prices were 10% higher YoY in both King ($495,000) and Seattle ($537,500), and gained 5.0% in Bellevue ($570,000).

There was more supply across the county for all home types compared with December. King had 1.8 months’ inventory, up from 1.4 months in December. (That means it would take 1.8 months – or 54 days – to exhaust all homes for sale if no others came on the market.) Seattle enjoyed 2.5 months’ inventory (2.0 in December) and Bellevue had 1.6 months (1.1). Single-family inventory rose to 1.6 in King (1.2 in December), led by Seattle with 2.1 months (1.6) and Bellevue with 1.4 (1.0).

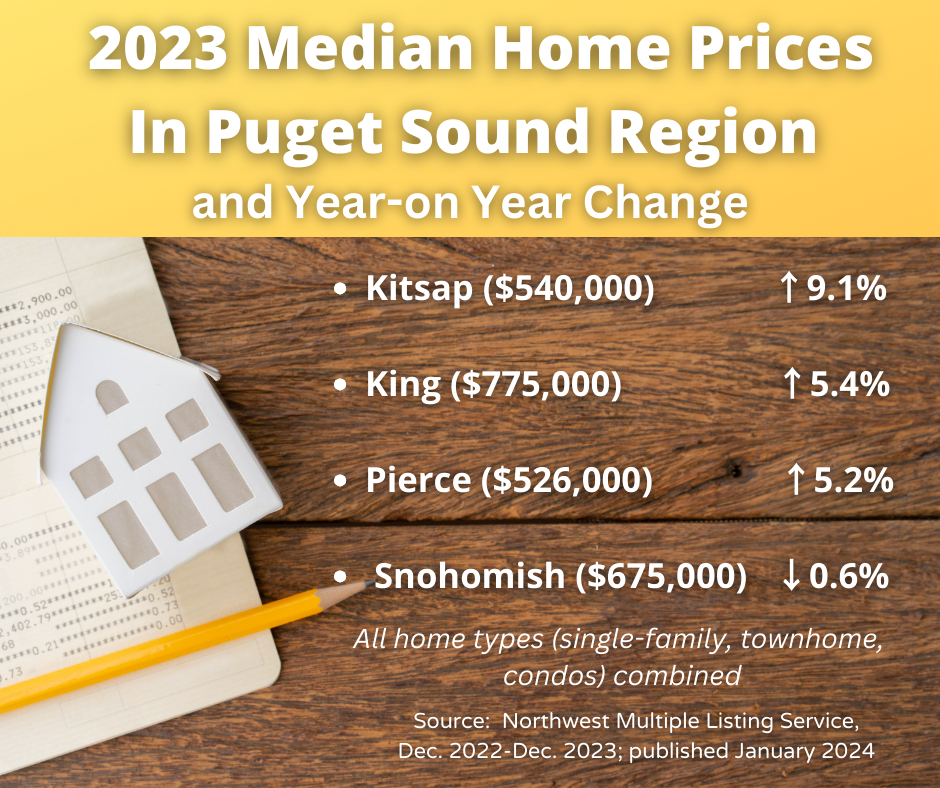

In addition to the four-county 2023 figures above for all home types, median prices for single-family homes jumped 6.6% in Snohomish from December to January ($729,990), followed by Kitsap up 0.9% for the month ($549,995) and Pierce up 0.7% ($539,975). King was statistically unchanged from December ($849,850). Year-to-year, single-family prices were higher across our region, led by a 12% increase in Kitsap, 8.8% in King, and up 4.4% in both Snohomish and Pierce.

Meantime, home sales across the U.S. were “only” down 19% YoY to 4.09M units in 2023 – not as harsh as the 24% decline in King County. The National Association of Realtors® (NAR) reported last year was the weakest for U.S. sales since 1995. The slump echoes the nearly 18% sales decline in 2022, when mortgage rates began rising, eventually more than doubling by the end of the year.

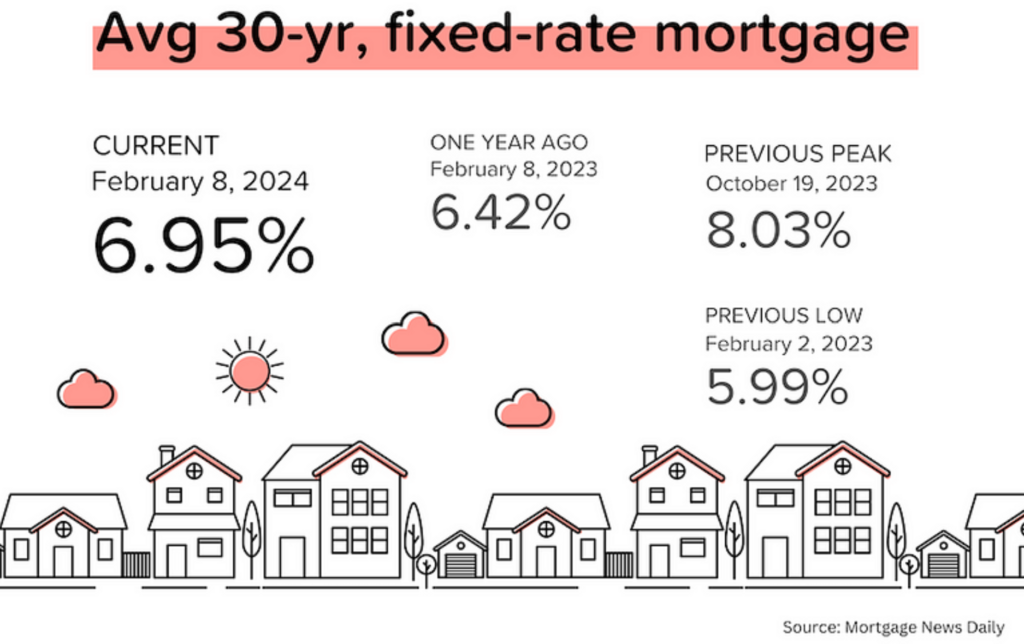

Lawrence Yun, NAR’s chief economist, said December’s sales “look to be the bottom before inevitably turning higher.” He cited “meaningfully lower” mortgage rates when compared with two months earlier. After moving sideways for all of January, mortgage rates jumped last week following a strong jobs report.

Rates climbed just above 7.0% on Feb. 5, the first full business day after the January employment report showed 353,000 jobs were added when economists had forecast about half that amount. The Federal Reserve sees this as potentially bad news for inflation as more consumers are added to payrolls and potentially increase spending, further heating inflation (or so the theory goes).

The jobs report came less than two days after the Fed upheld its short-term interest rate – known as the Federal funds rate, often used to lend between banks – to the same level (5.25%-5.5%). The last time the Fed funds rate increased was in July as the central bank was in the midst of easing inflation, which, as of this writing, stood at 3.4%. (The federal government updated inflation numbers on Feb. 13, the day this story was published.)

“We want to see more evidence that inflation is moving sustainably down to 2%,” Fed Chairman Jerome Powell said on Feb. 1. “Our confidence is rising [but] we just want some more confidence before we take that very important step of beginning to cut interest rates.” Powell’s comments aired Feb. 4 on CBS’s “60 Minutes”.

“This is a good economy. There’s every reason to think that it [will] continue to get better, provided that there aren’t events around the world which disrupt that,” Powell added.

“We don’t have a perfect crystal ball about the future, and things could happen. But I do think the economy is in a good place, and there’s every reason to think it can get better.”

The next Fed rate decision is on March 20.

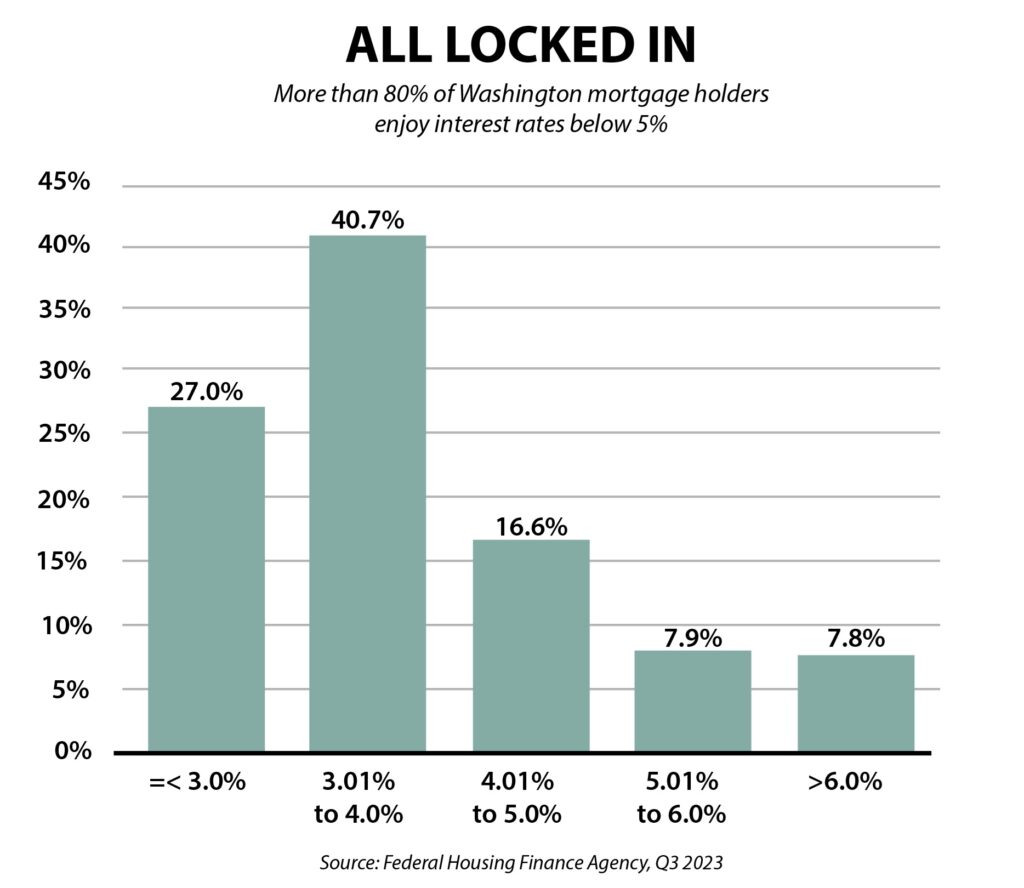

To be sure, consumers are more sensitive to changes in mortgage rates than to the absolute levels of home sales activity. Households with historically low lending rates are mostly staying put until the cost of financing becomes more tolerable – hence the oft-used term “rate-lock effect” in residential real estate.

The average rate for a 30-year mortgage today is still more affordable than the 2023 peak of 7.79% in October (Freddie Mac) but well above the rates many people locked in over the past decade.

This lock-in effect, combined with a slower-than-expected pace of seniors moving, is limiting the supply of resale homes.

“Seller reluctance has led to a continued decline in year-over-year inventory levels,” notes Mason Virant, associate director of the Washington Center for Real Estate Research at the University of Washington. The lack of supply combined with strong buyer demand will push home prices up further.

It was a bit of a surprise to see one of the authorities on interest rates, Fannie Mae, already issue a revised interest rate forecast this year – and it’s good news. The government-sponsored enterprise believes rates for 30-year mortgages will likely fall below 6.0% by the fourth quarter. Here are some of the revised quarterly averages:

6.4% in Q1 2024 (previous forecast: 7.0%)

6.2% in Q2 2024 (previous: 6.8%)

6.0% in Q3 2024 (6.6%)

5.8% in Q4 2024 (6.5%)

5.7% in Q1 2025 (6.3%)

5.6% in Q2 2025 (6.2%)

5.6% in Q3 2025 (6.2%)

5.5% in Q4 2025 (6.1%)

In addition, Fannie Mae believes the number of mortgage applications – in raw dollars – will jump 52% in Q2 of this year from Q1 to roughly $4B for home purchases. Another $1.1B will be directed to refinancing products, a 76% increase in just one quarter.

“In 2024, we expect home sales and mortgage origination activity to begin a gradual recovery in the presence of a slow-growing economy,” Doug Duncan, Fannie Mae’s chief economist, said on Jan. 18. “Inflation’s decline and the resultant Fed pivot to signaling future rate cuts rates lead us to believe that home sales and mortgage originations likely bottomed out in the second half of 2023 and that a gradual improvement is now underway.”

Of course, one real estate group’s expertise does not a trend make, and forecasting mortgage rates has been a mostly fruitless undertaking in recent years. However, Fannie Mae’s forecast shows an acceleration of a rate decline – and that should bring relief soon to buyers.