The Federal Reserve played the role of Santa Claus and delivered an unexpected present just before Christmas in the form of a forecast for lower interest rates in 2024. Ho, ho, ho … and oh my!

This should have sparked the fading embers of an otherwise chilly housing market in Seattle/King County in the final days of 2023. Perhaps too late in the year to make a difference to many, at least the Fed’s upbeat forecast offers renewed hope for the pent-up pool of prospective buyers – possibly sellers, too – to seek out a new home in the coming 12 months.

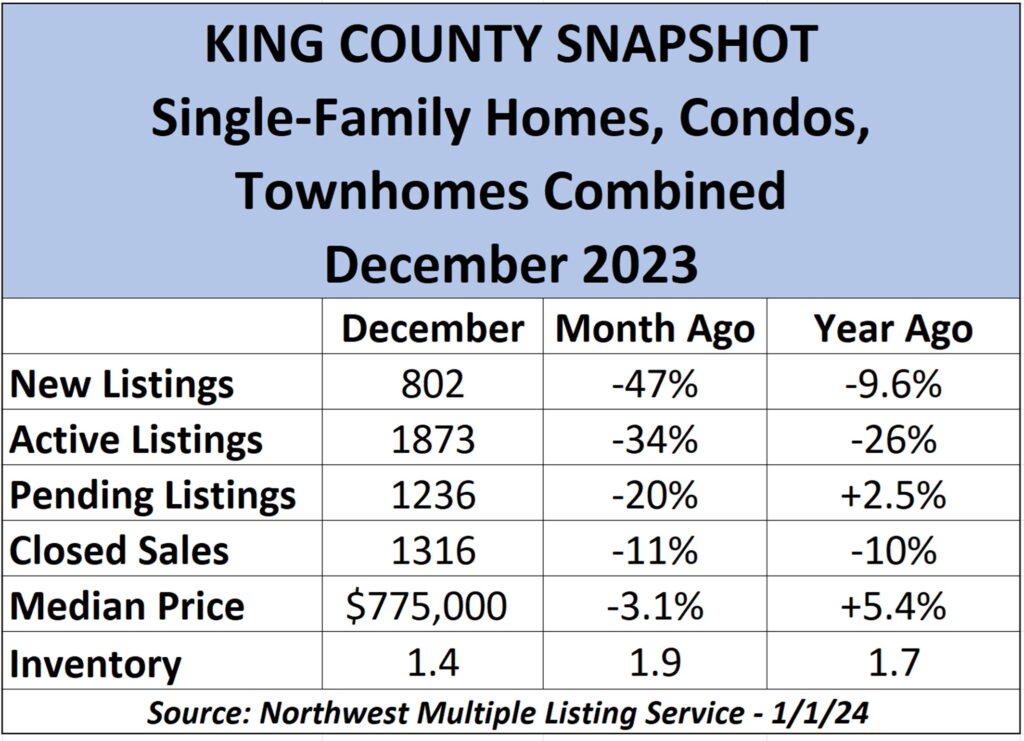

Before we look ahead, let’s take a quick glimpse at the final numbers from 2023, courtesy of the Northwest Multiple Listing Service. December’s housing activity in King County was marked by shriveling supply amid fewer listings hitting the market in what is traditionally a low point of the real estate year. Prices mostly fell from the previous month but were higher year-on-year (YoY).

The 802 new listings in December were a low not seen since records were archived online from 1990. The second-closest monthly total for all home types (single-family, townhome, condo combined) was 887 in December 2022. No other month has fallen below 1000 new listings in more than three decades of record keeping.

In other words, the housing market was in deep hibernation and the conditions should only improve from here. But by how much? There is little doubt the inventory shortage will continue through 2024 – as mortgage rates remain too high for many consumers – and that means great pressure to push prices higher.

Median home prices are enjoying what will likely be a brief respite as many homeowners who wanted to sell by year’s end did so with price cuts. They fell 3.1% across King County ($775,000) since November for all homes sold and are up a moderate 5.4% YoY, as sellers accepted prices at an average of 96.6% of the original amount – the lowest rate since January 2023 (94.1%). Prices for the single-family category dropped 4.0% ($849,950) over the past month and are up a modest 3.0% YoY, with sellers accepting 96.7% of the original price on average.

Notably, median prices were down a full 10% month-to-month in Seattle for both the total home spectrum ($765,000) and single-family segment ($850,000), and they are down about 3% YoY. The Eastside market remains more buoyant with prices up 1.7% for the month and a sharp 14% YoY ($1.25M) for all home types and up 2.9% since November and 11% YoY for single-family homes ($1.44M).

Condo sales remain in a different orbit, with prices up 11% in one month across King ($537,000) and a strong 15% YoY. Condo prices inched up 0.4% in Seattle since November and 14% YoY ($585,000), while the high-end section of the city – including downtown and Belltown – saw a 61% price rise month-to-month and 56% higher YoY ($867,000) as buyers/investors likely anticipated signs of a rejuvenated city and grabbed luxury homes before real estate values climb further.

Inventory fell in terms of months of supply across the county. Overall, only 1.4 months’ inventory was available as of Jan. 1, or about 43 days of supply before it would be extinguished if no other homes hit the market. The figure is down from 1.9 in November. Inventory stood at 2.0 months in Seattle and 1.1 on the Eastside for all home types combined. The figures are lower for the single-family category – 1.2 months for King, 1.6 in Seattle and only 1.0 on the Eastside. Condo inventory was 2.2 months in King.

In addition to King County’s 3.1% median price month-to-month decrease on all home types, to $775,000, Snohomish County saw the sharpest drop – down 4.1% from November to December ($675,000). Kitsap lost 1.4% since November ($540,000) while Pierce was down only 0.7% ($526,000). Single-family home prices in Snohomish tumbled 5.5% in a month ($684,995), followed by King down 4.0% ($849,950), Kitsap off 0.9% ($545,000) and Pierce 0.7% ($536,000). Year-to-year, single-family median prices were mixed, led by Kitsap’s 9.5% rise and a 6.2% gain in Pierce; they were up 3.0% in King but down 2.1% in Snohomish.

The character of the 2023 housing market was also shaped by a sharp increase in new home sales. As the National Association of Home Builders notes: “Despite mortgage rates that are at a 23-year-high, new home sales posted a double-digit percentage gain in September because of a lack of inventory in the resale market.”

Is there anything in the cards to suggest that inventories will significantly increase this year? One option developing in Washington is the reshaping of zoning laws to allow more housing on parcels of land once zoned for one home. The result will be more Accessory Development Units – better known as ADUs, the small, independent living spaces placed on underused lots or within existing homes – as well as the creation of more multiplexes such as townhomes.

Mortgage Rates

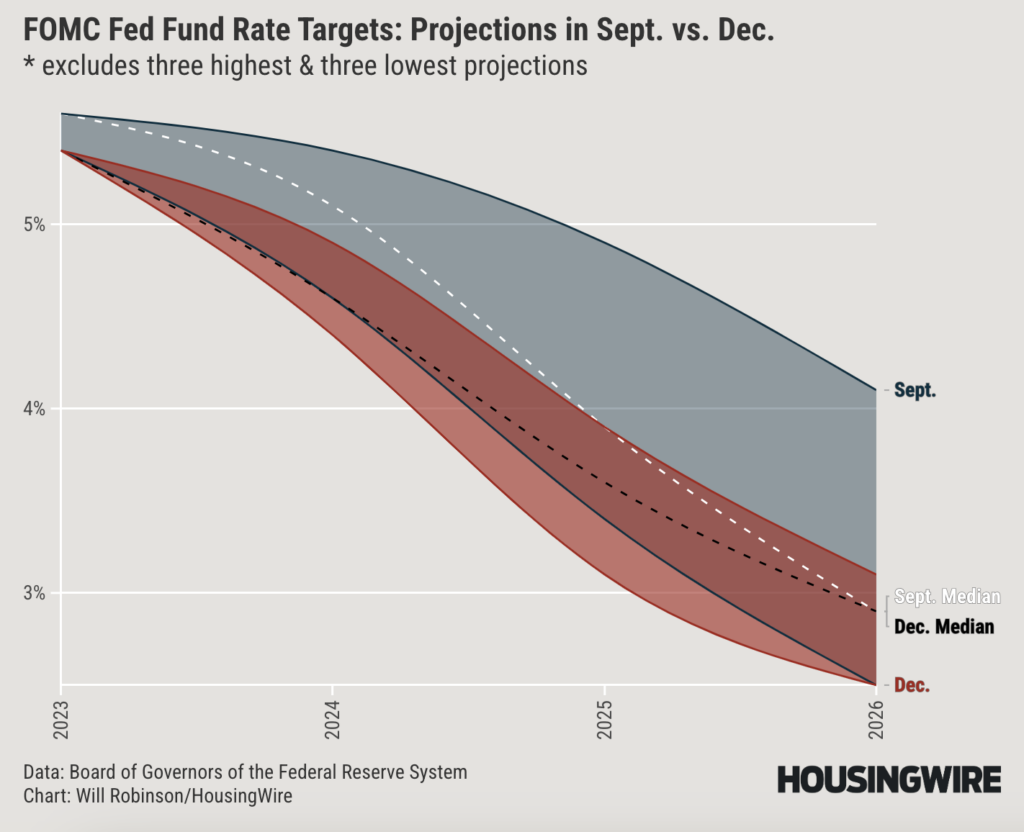

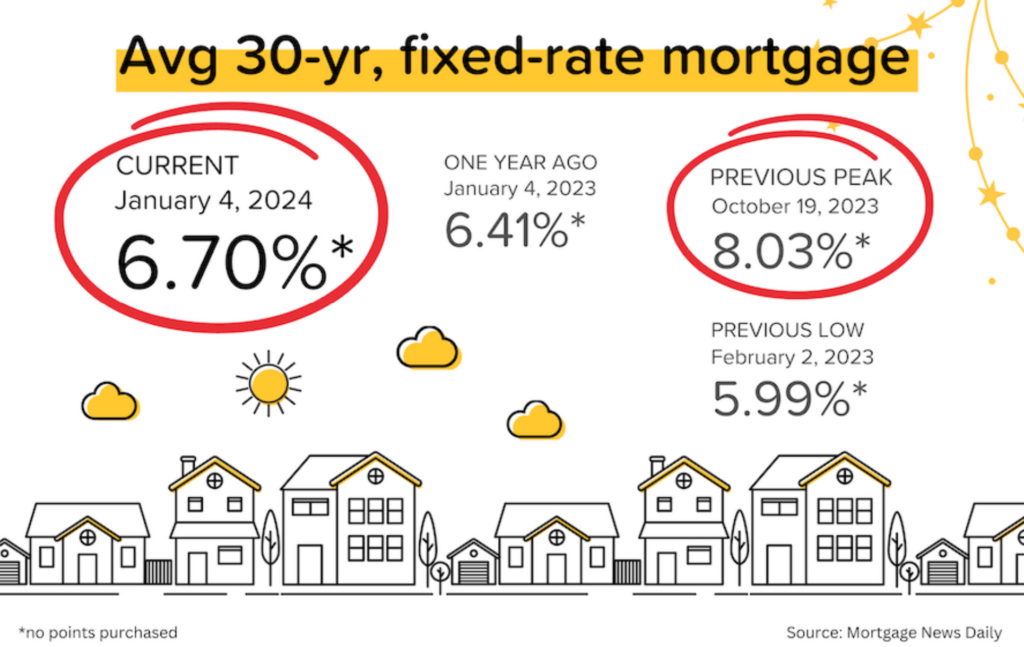

That holiday present from the Federal Reserve? Well, members of the Fed board shared an upbeat forecast about where they believe short-term lending rates are headed. Fifteen of the 19 members expect rate cuts of between 50 and 100 basis points (0.5%-1.0%) this year from the current range of 5.0%-5.5% and a median forecast drop of 75 points (0.75%) in 2024.

That should translate into lower financing rates – and monthly outlays – on things like credit card interest, car loan costs and mortgage payments. The graph (below) from Housingwire shows where the Fed sees rates shifting.

The central bank’s projections are highly based on expectations that inflation will improve more quickly than previously anticipated, possibly reaching the Fed’s target of 2.0% in 2026. Inflation currently stands at 3.1%. (The next update is scheduled for release on Jan. 11.)

The top left of the chart shows the Fed’s aggressive stance in September 2023 of 5.5% interest on its interbank – or Federal funds – lending rate. That translated into mortgage rates then of about 7.75%.

Using the same spread of 2.25 percentage points as a guide, the Fed funds rate should land at around 3.75% by year’s end (black dotted line). Speculating further, that could put mortgage rates at roughly 6.0% by that time – a nice improvement from only a month ago when national economists were projecting mortgage rates of about 6.5% by the end of 2024.

This is the clearest picture yet that we are on the road to improving Americans’ lending costs for the foreseeable future.

“High mortgage rates are the main reason for the low level of sales. Higher interest rates make it more expensive to purchase a home and more difficult to qualify for a mortgage,” says Cristian deRitis, deputy chief economist at Moody’s Analytics. “The sharp increase in the mortgage rate from its lowest level on record in 2021 to a 23-year high has caused the vast majority of homeowners to become ‘locked in’ to their existing mortgages.”

Lending rates for home buyers are determined by demand for mortgage-backed securities and investors typically act in anticipation of Fed actions. You may be able to access lower rates before the Fed makes a move.

The Fed raised rates for 11 of the last 15 meetings, with pauses in June, September, November and December of last year.

The next Fed rate decision will be on Jan. 31. Will we see a rate hike or cut? The Fed funds futures market is currently pricing in a 93% probability that the central bank will hold rates as-is.

Housing affordability has not been this bad since 1981 when mortgage rates pole-vaulted to a peak of 18.6%. As we just witnessed in 2023, higher rates can quickly take the air out of a market’s sales intensity.

In addition, owners have had little incentive to sell. Sixty percent of mortgaged homeowners have lending rates below 4.0% and nearly 90% enjoy rates below 6.0%. This represents about 75M homeowners, according to Harvard research, out of a total of 85M households nationwide.

A select group of consumers earned a lift in 2023 from rising stock prices, which could help ease affordability challenges for those looking to buy. Many tech workers in our area should benefit from increasing values in their stock holdings.

Gains were largely driven by seven stocks – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla. Dubbed the Magnificent 7, they accounted for about two-thirds of the gains in the S&P 500 in 2023. Nvidia led the group with a gain of about 239%, driven by the impact surrounding artificial intelligence. The S&P index finished 2023 up 24% YoY after it declined 19% in 2022.