From health-care and auto workers – even Hollywood actors – Americans have hit the picket lines in greater numbers in 2023. At least 453,000 workers participated in strikes in the first nine months of the year, according to one tracker. Beyond labor strife, America’s home buyers and sellers appear to be on strike as well.

Worsening affordability issues and lower-than-usual inventory have prompted many consumers to watch this housing market from the sidelines – without the picket lines. Compounding the financial squeeze, home prices have risen in many cities outside Seattle.

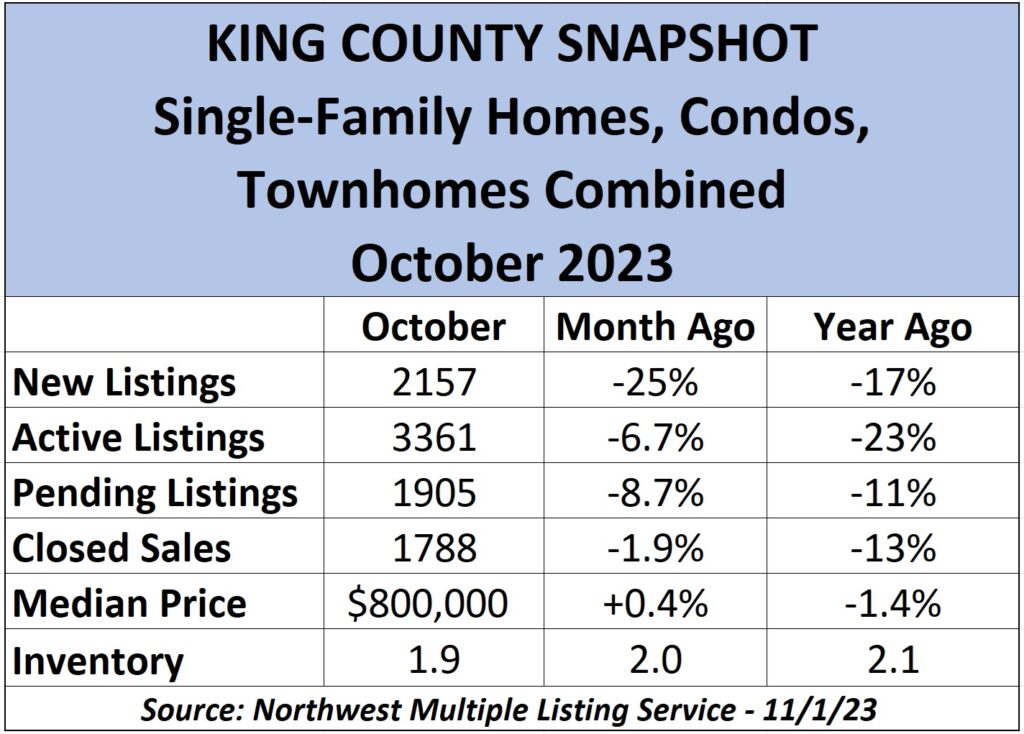

October figures from the Northwest Multiple Listing Service strongly suggest prospective buyers and sellers are taking a wait-and-see approach. Sales activity across the county is at historic lows; no October has experienced fewer listings in King County – not even close – since at least 1992 when records were first archived online.

New listings for all home types in King County stood at 2157, a whopping 25% drop from September to October. There is a seasonal slowdown and then there is a market shutdown.

Only 3361 homes were for sale (known as Active listings) on Nov. 1, a 6.7% decline in a month and off 23% year-on-year (YoY). In somewhat of a surprise, closed sales were only 1.9% lower (1788) than in September but they have maintained their double-digit declines over the 12 months, down 13%.

The single-family-home category was in similar territory. New listings in King were off 26% month-to-month (1583) and Active listings were down 9.4% (2296). Closed sales fell 0.9% since September and dropped 14% YoY.

The decline in Actives translates to less available supply. Overall, there are 1.9 months of inventory available in the county, down from 2.0 in September. Single-family inventory narrowed to 1.7 months (from 1.8) in King, including 2.0 months in Seattle and 1.6 on the Eastside.

Between October 2018 and last month, the number of single-family homes on the market in King has dropped 53%. That compares to an approximate 60% decline nationwide over those five years. Only one in five homes on the market in the Pacific Northwest included multiple offers to buy the listed property in September, according to info from the National Association of Realtors® (NAR); that compares with one in three homes sold across the nation.

Among all U.S. sales in September, 29% of them were paid with cash (no mortgage), below the peak of 35% in 2011. All-cash deals were less than 20% in Seattle metro in September (latest data). At the same time, the percentage of first-time buyers in the U.S. declined to 27% amid affordability challenges.

Near the top of the purchase funnel, the number of mortgage applications is down 27% YoY to a low not seen since 1995. Mortgage volume will likely continue to decline until at least early next year.

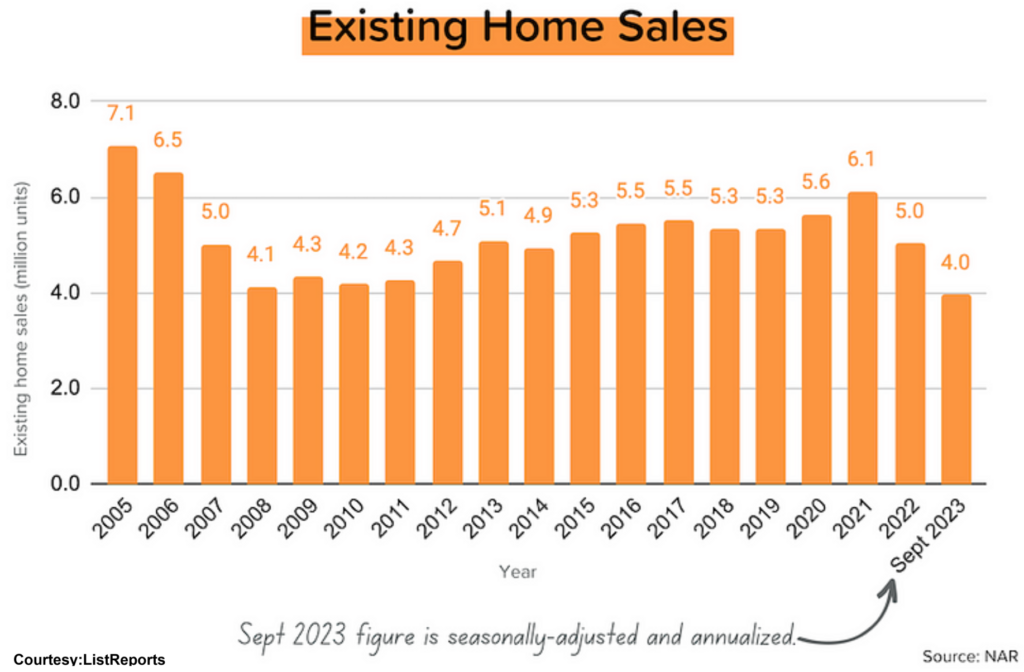

Meantime, the number of single-family home sales nationwide – 3.96M (or 4.0 when rounded up) on an annual basis – is the lowest since October 2010. Sales could slip further – to about 3.90M – by the end of this year, as owners hold on to their existing mortgages with low financing costs.

Early estimates call for a modest increase in U.S. sales volumes – to a forecast 4.1M in 2024 and 4.5M in 2025, according to economists.

Except for some pockets, King County median prices were little changed across all home types (single-family, townhome and condo combined), up 0.4% ($800,000) in the past month. North King (Shoreline, Kenmore) was one of those exceptions, with prices jumping 6.9% ($850,000) for the month and 15% YoY. Seattle prices rose 0.9% ($802,500) in October but were down 5.6% YoY. Eastside prices declined 5.1% ($1.21M) for the month but were up a slight 0.8% YoY.

Looking more closely at single-family homes – the largest segment of the market – King County median prices were down 1.9% ($882,997) for the month and 2.2% for the year. Seattle experienced a 2.8% ($900,000) price drop in October and a significant (ie, rare) 5.3% fall YoY. Eastside prices lost a marginal 0.5% ($1.42M) over the last month but are 5.2% higher YoY.

Two areas on the Eastside incurred the sharpest price shifts in the past 12 months for single-family homes. Kirkland prices jumped 18% to a median of $2.01M, while the area west of I-405 that includes Bellevue, Clyde Hill and Medina saw prices fall a sobering 21% ($3.21M) YoY.

Condo prices were higher across the board, including a 4.9% monthly gain ($540,000) in all of King and up a healthy 9.1% YoY. Median prices on the Eastside added 6.0% ($657,000) in October and were 8.2% higher YoY. Seattle condo prices added 4.3% ($573,750) for the month and jumped 9.8% YoY. Inventory of county condos rose to 2.5 months from 2.4 in September. The area comprising Belltown and downtown Seattle, where median prices are $630,000, has 6.7 months’ inventory – up from 5.2 in September – a true buyer’s market.

In addition to King County’s modest 0.4% median price month-to-month increase on all home types, to $800,000, Snohomish County saw the sharpest change – a drop of 2.1% from September to October ($700,322). Pierce prices fell 1.9% ($520,000) while Kitsap dropped 1.3% ($549,995). Single-family home prices fell in all four counties, led by a 2.7% decline in Snohomish ($729,950), followed by 1.9% lower in King ($882,997), 0.9% softer in Pierce ($530,000) and off 0.7% in Kitsap ($556,000). Year-to-year, single-family median prices remain mixed, led by an 8.3% gain in Kitsap and declines of 2.2% in King, 0.9% in Pierce and 0.01% – or statistically unchanged – in Snohomish.

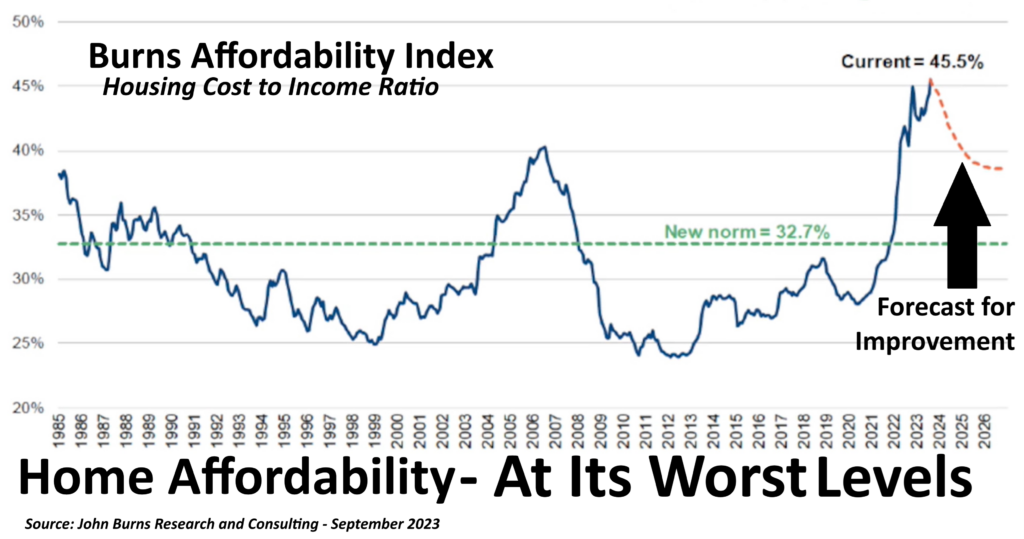

Financial Squeeze

Home affordability has never been worse, according to John Burns Research and Consulting, whose U.S. housing affordability index – the ratio of household income required to cover typical housing costs – is 45.5%. Most experts believe a rate of about 33% or less is considered affordable. For context, the worst of the housing crisis around 2008 was at about 40%. The good news: John Burns forecasts improvement over the next few years (orange dotted line, below).

Breaking it down by city, Seattle has an affordability index of 58%, placing it among the worst in the nation. Portland is around the national average of 46% and Tacoma is at 45%. (Indianapolis is at the bottom, at 29%, as the most affordable major city.)

About eight in 10 Americans say their household debt is higher or about the same as it was a year ago, according to a recent poll, and consumer confidence is weakening. Many households find themselves house-rich – thanks to soaring price appreciation over the last decade – and cash-poor. This has led to significantly fewer foreclosures, as owners typically dig out of financial difficulties by selling.

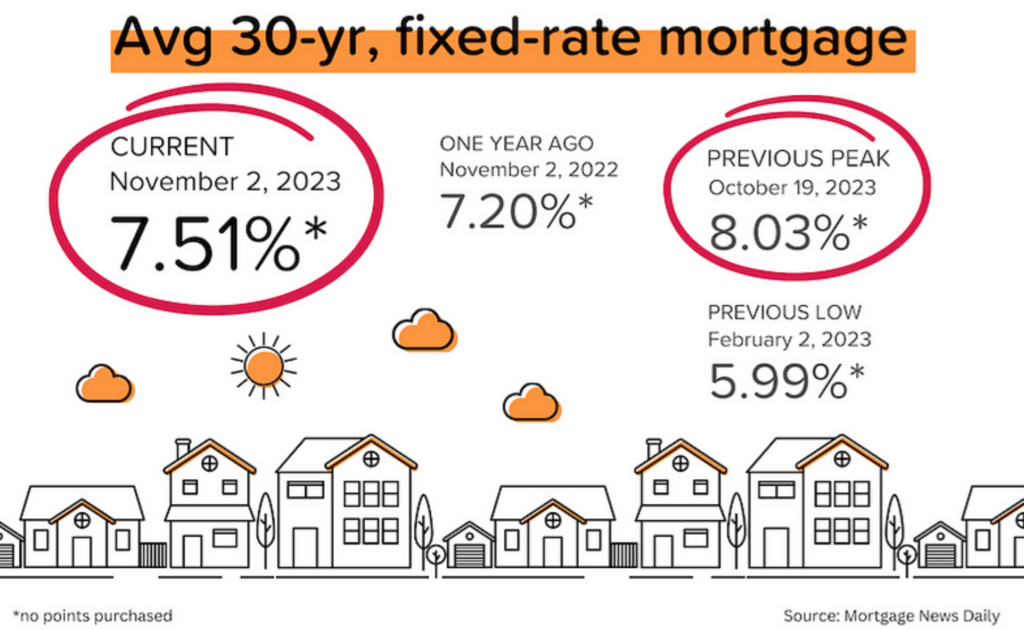

The Federal Reserve guides interest rates that banks charge each other, known as the Fed funds rate. The central bank has increased those lending rates 11 times over the past 19 months to a high of 5.5% as it attempts to calm an overheated economy and high inflation. It has held firm on rates for the past two months. (Banks tend to pass those higher rates onto consumers.)

Inflation and the labor market are of keen interest to the Fed. The September Consumer Price Index stood at 4.1%, somewhat improving but well above the Fed’s goal of 2.0%. (The October report was scheduled to be released on Nov. 14.) Businesses continue to seek more workers, with about 1.5 job openings per every unemployed person in the U.S., but there are signs of a slowing economy with rising unemployment (3.9%, near a 2-year high) and easing wage growth (4.0% a year).

Since the release of the weaker jobs report about two weeks ago, the bond market has reacted as if the Fed has stopped its planned rate increases and will begin to cut them in 2024. The key benchmark 10-year Treasury yield slid to as low as 4.56% on the news, falling within a few days from a high of 4.99%. According to Lawrence Yun, chief economist for NAR, that means mortgage rates will be coming down, likely in the 7% range by year’s end and into the 6s by next spring.

“The good news is that the Federal Reserve is probably done with its aggressive interest rate hiking cycle,” said Desmond Lachman, senior fellow at the American Enterprise Institute. “That means we can expect considerable mortgage and auto-loan interest rate relief and less competition from high interests to stock market valuations.”

While they may not acknowledge this, many lenders have apparently been padding their interest rates as a hedge against consumers who plan to refinance their mortgage when rates fall. That helps to explain, in part, why rates rose so quickly – by more than 4.5 percentage points in the past two years.

The expectation is that, while mortgage rates rose exponentially, they should also fall at a fast pace once Treasury rates begin to slip. This interest rate phenomenon will undoubtedly trigger a new wave of home buying, many experts believe.

2024 Outlook

Freddie Mac is one of a few government-backed agencies that purchases mortgage loans from lenders. It has a finger on the pulse of the lending market and offers a pessimistic view of the 2024 economy.

“We expect U.S. economic growth to slow at the end of this year and remain muted in 2024,” Freddie Mac offered in late October. “Inflation will continue to moderate, but the reduction will be gradual so policymakers will hold rates higher for longer. In this environment, mortgage rates will remain elevated,

New Construction

Buyers are shopping for more newly built homes as developers offer eye-popping financing options to help keep sales moving forward. About a third of builders surveyed in September by John Burns were offering mortgage rates in a 4.5%-5.5% range through the length of the loan. Unheard of!

This has boosted new home sales to a 28% share of the U.S. market when it typically runs around 13%. Seattle and Portland are seeing a rate of about 13% of new home sales. (Houston leads the nation with about 30% of sales coming from new homes.)

Sales of U.S. new homes increased in September to an annual rate of 759,000 units, according to the Census Bureau. That’s the biggest number since February 2022, as builders partner with lenders to offer interest rate buydowns. Incentives are a costly proposition to maintain and it will be worth watching how long builders can continue their offers.