Autumn marks a change – shorter days, cooler temperatures, falling leaves … and falling home prices. This is the season when buyers can take advantage of homeowners wishing to sell before the holidays and who show a willingness to budge on price or make other concessions.

We are starting to see all those signs following the release of September housing data from the Northwest Multiple Listing Service (MLS). Unfortunately for buyers, a combination of the typical seasonal trend and higher borrowing costs has shifted housing market activity to an excruciatingly slow pace – and there are concerning signs ahead.

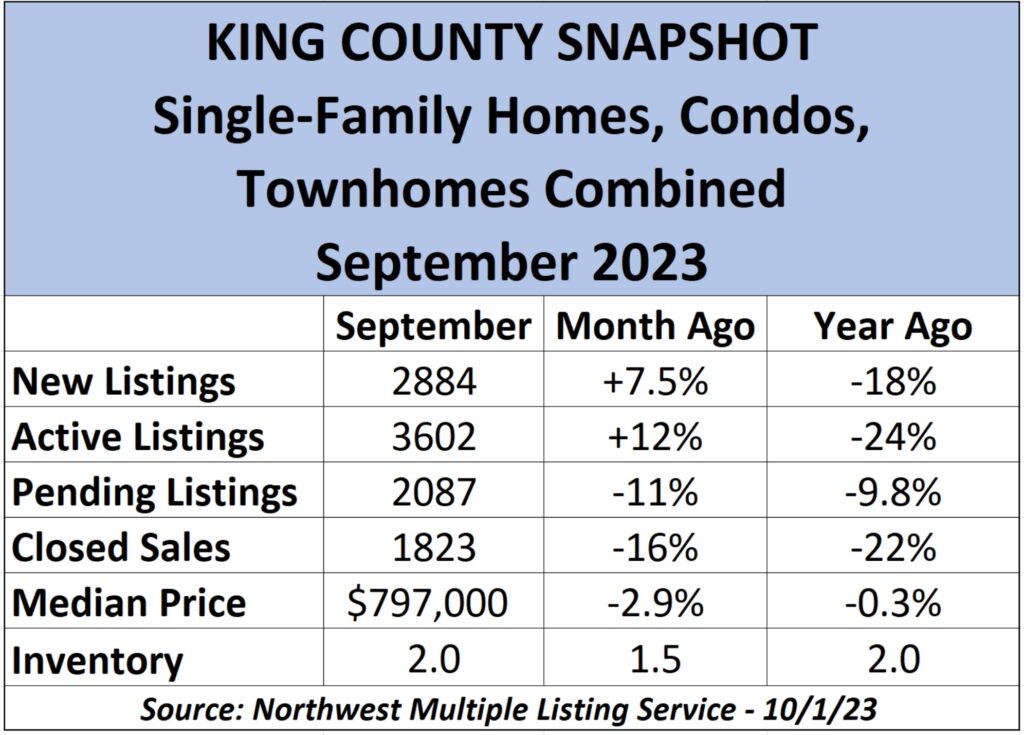

First a look at September’s numbers: A wave of last-chance listings for the year hit the market after Labor Day. That increased new listings by 7.5% (2884) and available homes on the market by 12% (3602) between Sept. 1 and Oct. 1 for all home types in King County. Seattle alone saw a 29% (1213) monthly increase in new listings. Even with the increasing numbers, the total available homes for sale in King are the fewest for any September since at least 1993 when records were first archived online.

At the same time, the number of homes going under contract (Pending sales) fell 11% (2087) for the month and 9.8% for the year. Total sales dropped 16% (1823) since August and 22% year-on-year (YoY) for the entire county – the fewest sales for a September since 2010 (1488). Seattle home sales also fell 16% (616) in the past month and are down 20% YoY.

The figures were similar in the single-family-home category for King. There were 6.4% (2176) more listings on the market from August to September, including a whopping 38% (836) added in Seattle. The number of homes for sale on Oct. 1 was 9.6% (2533) higher than 30 days earlier, while Pending sales were down 8.0% (1595) and closed sales dropped 17% (1380) in just the past month. Comparing this year to last, Pendings were off 12% and final sales declined 24%.

The median price of a typical home (single-family, townhome, condo combined) across King County fell 2.9% in the past month and a minuscule 0.3% YoY to $797,000, the lowest since April ($790,244). Prices were down for the month in most locales – off 2.1% ($1.27M) on the Eastside and 1.8% ($795,000) in Seattle – but they rose in North King (Richmond Beach, Shoreline, Lake Forest Park) by 5.3% ($842,000).

Median prices for single-family homes were mostly lower. They fell 1.0% ($900,000) across the county and were down 1.8% ($1.42M) on the Eastside. However, Seattle bucked the trend, with single-family home prices rising 3.0% since August to $926,250. Year on year, median prices were up 2.9% for King, up 5.7% on the Eastside and 2.9% in Seattle. Notably, prices tumbled 22% ($1.07M) YoY in the area comprised of Magnolia and Queen Anne based on 43 sales in September.

Condo prices were down across the county. They were off 1.9% ($515,000) in September, including 4.3% ($550,000) in Seattle, but rose 3.3% ($620,000) on the Eastside. Total sales fell 12% (443) from August to September for King and are off 17% YoY.

Despite the growing number of homes available to choose from, this is not to say that buying a place right now is a walk in the park. The housing market “is going to be difficult and challenging,” says Robert Dietz, chief economist of the National Association of Home Builders, speaking about the current environment.

The combination of rising mortgage rates through the year and increasing home prices this spring and summer helped to push the typical portion of average wages nationwide required for major homeownership expenses up to 35%, according to a Q3 report. The latest number is considered unaffordable by common lending standards, which call for a 28% debt-to-income ratio and it marks the highest level since 2007. Consumer confidence dropped to a 4-month low in September, as Americans continued to feel the pressure of inflation.

“With basic homeownership now soaking up more than a third of average pay, the stage is set for some potential buyers to be priced out, which would reduce demand and the upward pressure on prices,” said Rob Barber, CEO of ATTOM Data Solutions, publisher of the report. First-time buyers are especially burdened by today’s housing environment while Baby Boomers and others can at least leverage their existing home equity to soften the blow when making their next purchase.

Research conducted by realtor.com for August (latest data available) showed that Seattle had a nearly $2K difference between the median monthly rent ($2168) and median home-purchase costs ($4156). Preliminary data for Seattle shows rental prices in September for all newly leased units were down 4.6% YoY.

Buying a home has always been difficult in the nation’s priciest housing markets like Seattle. But as rental prices have simultaneously dropped this past month, the scales may tilt toward renters putting off homeownership for longer.

The good news for buyers: Experts from the American Enterprise Institute believe prices will inch lower – down about 1.3% between now and November nationwide – as sellers look to negotiate rather than hold onto their homes into the chillier housing season of December-February. This appears to be the case in King County, though lower prices in one month do not make a trend.

Homes are sitting on the market for a median of 10 days, up from seven only a month ago and for the highest rate since February. The average number of days is 22 for all homes sold last month in King.

The increase in homes on the market also tells us overall inventory is rising. There are 2.0 months of inventory available today across our county, up from 1.5 a month ago. (It would take 8 weeks for all existing homes for sale to be extinguished if no other listings hit the market – the same number as this time last year.) Seattle features a high 2.6 months’ inventory, a figure not seen since January (also 2.6). Single-family inventory is 1.8 months in King, up from 1.4 in August and the highest since January (2.1), and 2.2 months in Seattle, a jump from 1.5 in August.

In addition to King County’s 2.9% median price month-to-month decrease on all home types, to $797,000, Pierce County saw prices drop 1.7% ($530,000) from August to September and they were down 0.3% ($557,000) in Kitsap. Snohomish went the other direction and saw a 2.1% ($715,000) price increase for the month. Single-family home prices in King dropped 1.0% ($900,000) in a month, and that was surpassed by a 2.7% ($535,000) decline in Pierce and a 1.0% ($559,995) fall in Kitsap. Snohomish single-family prices added 2.6% ($749,900). Year-to-year, single-family median prices were mostly higher, led by a 3.7% rise in Kitsap, a 2.9% climb in King and a jump of 2.0% in Snohomish. Prices fell for the year in Pierce, however, by a modest 0.6%.

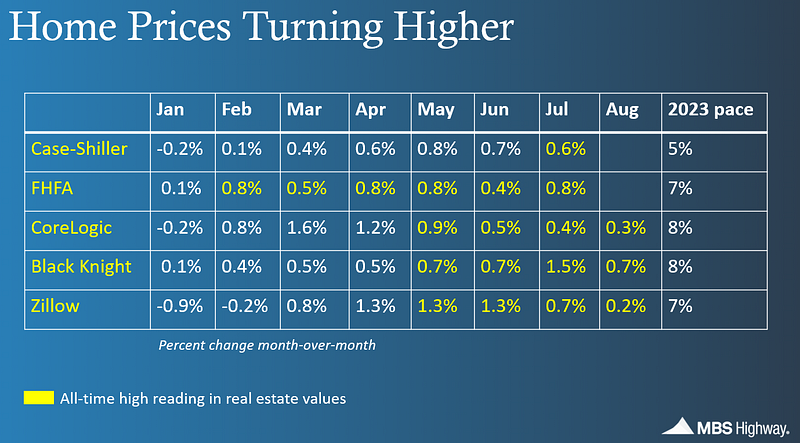

Prices across our nation are trending higher – which was also the case in Seattle metro through the reporting period in the chart below. If prices continued in this direction, they could be between 5% and 8% higher over the 12 months ending Dec. 31.

Rising consumer prices amid higher inflation and soaring interest rates for everything from homes to auto loans defies most logic – but we are not in a “logical” time in the economic cycle. To be sure, we are primed for a housing sales snapback but need a little help through lower costs to pay for things like those homes and cars.

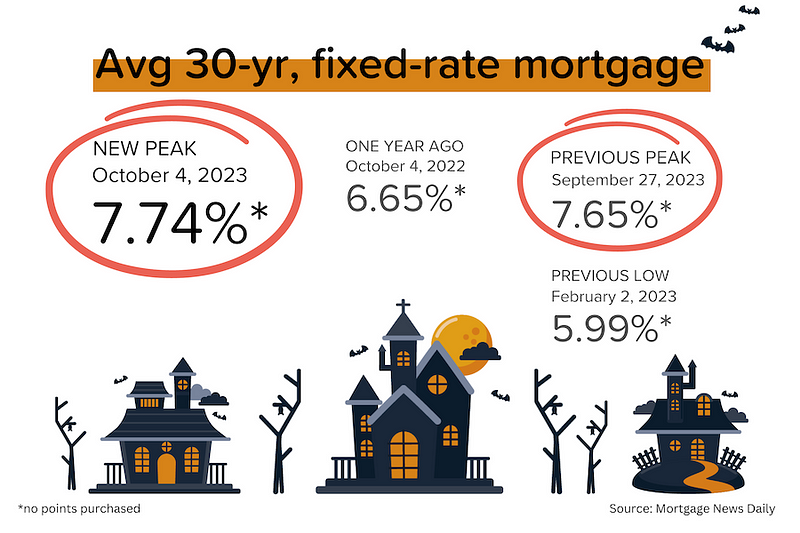

Mortgage rates are at eye-watering levels not seen since December 2000 and applications for mortgages are 22% lower YoY to a rate last registered in 1996. As I noted in last month’s market update, this is a spooky situation, with rates climbing closer to 8.0% than 7.0%.

If rates reach the 8% threshold, residential real estate activity would turn into a “market of necessity,” suggested Lisa Sturtevant, chief economist for Bright MLS, based in the mid-Atlantic states.

“The rapid rise in rates pushed an increasing number of potential homebuyers out of the market,” the Mortgage Bankers Association recently noted. Not surprisingly, interest in adjustable-rate mortgages is rising as buyers look for any opportunity to get their mortgage rate down.

“We do expect mortgage rates to come down, but pinpointing when is tough,” says Danielle Hale, realtor.com’s chief economist. “It might be later on this year or even next year.”

Marci Rossell is a noted economist with a focus on the U.S. housing market and she believes rates will start to come down in the second half of next year. “Then you can expect that to really boost housing activity … [but] it’s going to be a difficult slog between now and then.”

The best interest rates are being offered by home builders and their preferred lenders. Most are offering promotions with interest rates in the 6s.

Some builders are also lowering their list prices and contributing to buyers’ closing costs. Townhome developer Ashworth Homes, based in Shoreline, has reportedly dropped prices by about 10% from a year ago.

Even with promotions the rate of new home sales is falling – down 8.7% from July to August (most recent data) to an annual pace of 675,000 units across the U.S. That’s the lowest figure since March.

After 11 collective rate hikes in the last 18 months, the Federal Reserve paused its aggressive stance in September but signaled more increases to the short-term Fed funds rate may happen as soon as early November. Adding to that thinking, Neel Kashkari, the Fed president for Minneapolis, in late September said interest rates may need to go “meaningfully higher” to fully quell inflation.

The Fed said it would raise rates until inflation fell to about 2.0% and it is sitting at 3.7% today with the next report to be released on Thursday (Oct. 12). When reports say inflation is going down, the Fed is not saying that prices are going down but that the rate at which prices are going up is slowing. Nobody expects that prices are going to return to where they were before the pandemic.

As if that were not enough, the U.S. economy has added an average of 266,000 jobs a month in the past 3 months – far more than anticipated. The sustained strength of the labor market makes it likelier that the Fed will raise rates soon as it continues its drive to tame inflation by calming job creation. Economic data that exceeds expectations is bad for bond prices and mortgage rates.

“The minute those interest rates come down, all hell’s going to break loose and the prices are going to go through the roof,” predicted Barbara Corcoran, New York real estate broker and entrepreneur, in a late September interview with Fox Business. “[Sellers] are staying put but they’re not going to stay put if interest rates go down by two points.

“It’s going to be a signal for everybody to come back out and buy like crazy, and the house prices [will likely] go up by 20%,” she said.