By Catherine Mesick

You’ve found the perfect home – sunny kitchen, the right number of bathrooms, and a big, beautiful yard. And then someone mentions a case of flooding in the area – far from any major body of water. You start wondering, could my dream home be at risk for flood damage?

The fact is home buyers need to pay attention to their flood risk and the need for flood control. All home buyers. As the Federal Emergency Management Agency (FEMA) fact sheet says, “Anywhere it can rain, it can flood.”

Unexpected flooding caused major problems for Mabél Guzmán, a real estate broker in Chicago: “I moved into a townhouse that was not even near a flood zone and didn’t require flood insurance,” she says. “I lived there for over five years and had no flooding issues until a storm caused so much flooding that we had to replace the furnace. Moreover, FEMA had to help, and each homeowner impacted received $2,000.”

Property owners outside of high-risk flood areas file more than 20% of all claims with the National Flood Insurance Program. Plus, they receive one-third of all federal disaster assistance for flooding.

But your real estate professional and other resources can help you contact flood risk experts. We can assess the flood risk on a particular property and sharpen the view of how much risk you can tolerate.

How to Assess a Home’s Flood Zone and Flood Risk

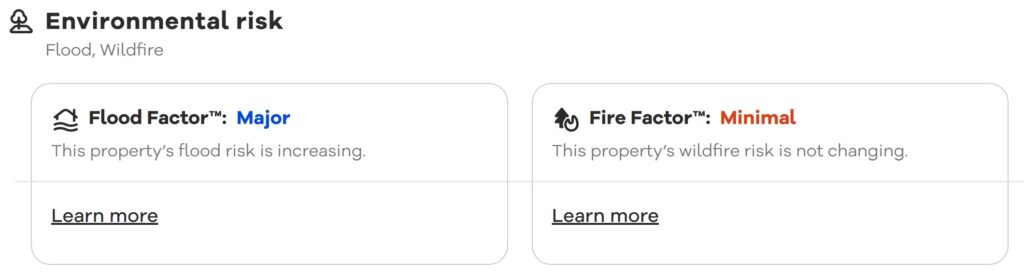

If you start your home search on realtor.com, you’ll find flood risk information baked into some of the listings. Specifically, you might see a section on the listing page that looks like this:

On home listings with a flood risk, the left tile will link to ratings from Flood Factor and FEMA:

FEMA produces flood map ratings and uses letters to indicate risk levels:

- An A or a V — high-risk flood area

- B, C, or X — moderate-to-low-risk area

- D — area that hasn’t been mapped, so the risk is unknown

If you’re intrepid, you can visit FEMA’s flood map service center for more information. But FEMA info isn’t available everywhere and is updated only every 5 to 30 years. In addition, it doesn’t factor in rainfall for areas away from major water bodies. In fact, the best person to translate FEMA data is your city or town’s floodplain manager. (More on this below.)

The Flood Factor rating system, developed by the nonprofit First Street Foundation, works on a 1-10 scale:

- 1 — minimal risk

- 2 — minor risk

- 3 to 4 — moderate risk

- 5 to 6 — major risk

- 7 to 8 — severe risk

- 9+ — extreme risk

The consumer-friendly Flood Factor site, recently renamed to Risk Factor, lets you search by property address. You can see an aerial image of the property and a summary explaining overall flood risk (as well as fire, heat and wind risks). You can also read about flooding sources like rainfall and historical information. The site is said to be updated quarterly.

Your Broker Can Help Provide Flood Information

While not flood map experts, real estate brokers like me can be knowledgeable partners. We can provide relevant market and inventory information. Buyers should be upfront about how much flood risk they are comfortable with and whether they need contacts for flood professionals. Then, together, the buyer and broker can look for that dream home with confidence.

How Your Local Floodplain Manager Can Help

Once you have a sense of the flood risk associated with a property you’re interested in, the next step may be to consult your local floodplain manager. They are trained to decipher FEMA flood maps for consumers and answer flood risk-related questions, and those services are free, says Chad Berginnis, executive director of the Association of State Floodplain Management. (Contact details for floodplain assistance are further below for King, Snohomish and Pierce counties, and Washington state.)

This step is an especially good idea if the FEMA flood maps and Flood Factor both show your flood risk is high and flood control is an issue. But even if one shows moderate risk, a floodplain manager will probably advise you to talk to a reputable insurance agent. Flood insurance is cheap outside of high-risk areas. The peace of mind may be well worth the price.

Local floodplain managers can also provide resources that may not be included on FEMA maps. Resources include historical reports and local information about known flood hazards. And, Berginnis says, they can even answer some basic insurance-related questions. One might be whether your prospective home falls into a special flood hazard area (SFHA).

FEMA defines an SFHA as a location with special flood hazards. If you’re interested in a house in one of these areas, you’ll likely be required by federal law to buy flood insurance.

For homes in an SFHA, the floodplain manager may also have an elevation certificate on file. You will likely need this certificate if you’re required to purchase flood insurance. The certificate documents the elevation above sea level of the home and lets the floodplain manager compare the building’s elevation with the estimated height of floodwaters during a major flood.

FEMA recommends hiring a licensed land surveyor from the National Society of Professional Surveyors to create the certificate. A floodplain manager will provide the certificate free, but a licensed land surveyor will charge a fee. The cost can range from an average of $600 up to $2,000+ depending on the size of the parcel and other factors.

Consult Your Insurance Agent About Flood Risk

You’ll likely want to check in with your insurance agent about flood risk to the property. That’s especially true if you’re looking to buy a home in a high-risk area. Even in a moderate- or low-risk area, mortgage lenders may require you to buy flood insurance, says a spokesperson for the Insurance Information Institute.

Your standard homeowner’s policy won’t provide flood insurance, the spokesperson adds. “Coverage is available in a separate policy from the National Flood Insurance Program (NFIP) and a few private insurers” that partner with them.

Flood insurance costs, on average, $700 per year nationally. But premiums could run much higher depending on your risk zone. Private market insurance options in addition to the NFIP are also available. Both will offer policies to cover damage to the structure of the house. You can also buy coverage for your personal property.

The Insurance Information Institute spokesperson recommends sharing your FEMA flood maps and elevation certificate with your insurance agent. You can also ask the current homeowners to request the claims history of the property directly from the NFIP. The NFIP insurance provider locator can help find a nearby provider.

Your Home Inspector Can Provide Clues About Flood Risk

When you’re ready for a home inspection, you’ll want to work with an experienced inspector. Pay close attention to clues. Ask if the inspector uses a moisture meter or has experience with flooding. Water lines in a basement or crawl space or a musty smell from behind the walls may signal flooding in a home, says Bruce Barker, a home inspector and past president of the American Society of Home Inspectors.

However, a home inspection may not tell the whole story, Barker says. “If the area has been repaired, flood damage may be hidden behind the walls. The damage would then be ‘out of scope.’ It would not be accessible to the home inspector, who only does a visual inspection.”

Check the Seller’s Disclosure for Flood Risk

Once you get serious about a home, you’ll have another chance to learn more about its potential flood risk. Sellers are required to disclose knowledge of previous flood damage to a home unless it’s an estate sale when a personal representative did not live on-site or in other circumstances.

Real estate pros are a good resource for disclosure forms and follow-up questions. For instance, you could ask whether you should consult a flood professional for a property-specific risk assessment or inspection.

Just as a blood pressure test can’t definitively predict a particular ailment, flood sources can’t make spot-on flood warnings about a home. But if you do some research and consult with your real estate broker for flood risk contacts if flooding is a question, you’re more likely to make an informed decision.

Reprinted from HouseLogic.com with permission of the NATIONAL ASSOCIATION OF REALTORS®.

Local Resources

King County River and Floodplain Management Section – 206-477-4812

Snohomish County Flood Hazard Management Planning – 425-388-3464

Pierce County Floodplains and Watershed Services – 253-798-2460

Washington Department of Ecology – 503-385-3076

Related Stories

Quakes, Climate Change and the Risk of Floods to Our Homes

Climate Change and the Impact on Our Homes

Is Your Home Fully Insured Against Loss or Damage?

Leaky Basements – What Sellers and Buyers Need to Know