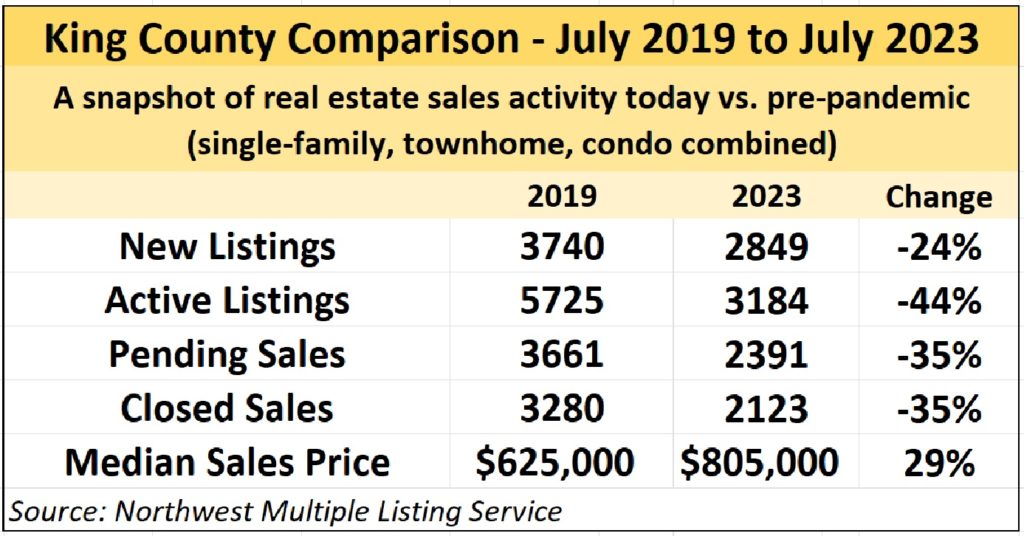

Ah, for the good old days of 2019 – when we could stomach home prices closer to the mid-million-dollar mark and housing options were somewhat plentiful amid a mildly competitive buyer environment.

The market has, ahem, evolved in the four years since. After a pandemic-induced free-for-all, where newly listed homes could be off the market in hours and prices soared into a stratosphere more recognizable by the Blue Angels, we are now “enjoying” a period of rest and re-evaluation in summer 2023. Variations between the two years are stark, to say the least:

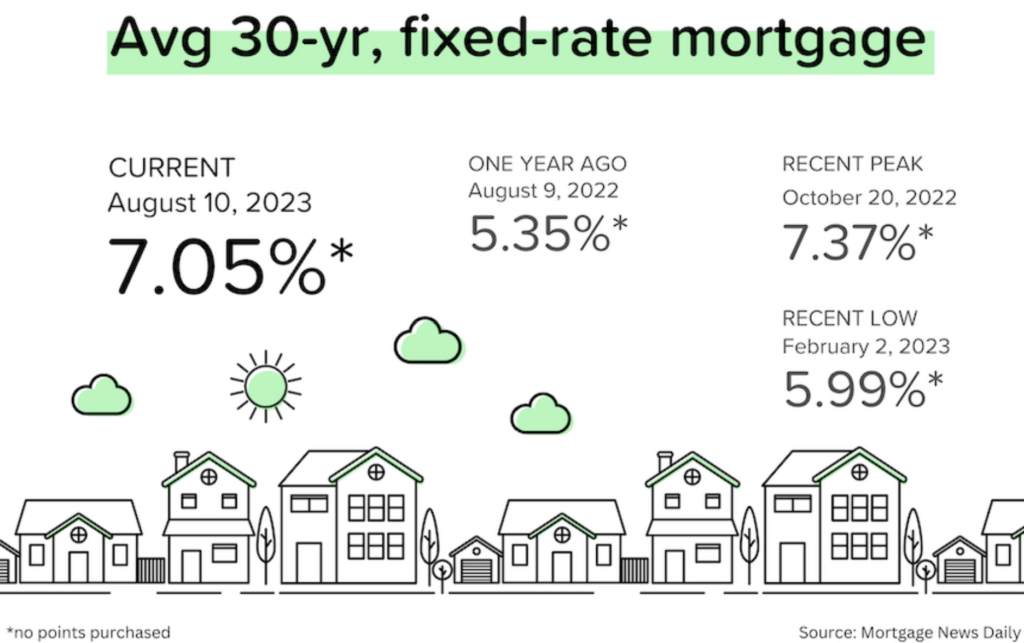

A “re-evaluation” for future buyers can be defined as consumers determining when to jump (or jump back) into the home-search pool as mortgage rates appear stuck around 7.0%. Sellers, too, are waiting for the easing of rates before looking for their next home, as estimates show 60% of today’s homeowners possess a mortgage with an interest rate of 4% or less.

The typical mortgage payment was 91% larger in June than in June 2019 and 9% greater than only June of last year, according to a Realtor.com analysis. The calculation uses national median home list prices and assumes a 20% down payment (a big assumption) on a 30-year mortgage while excluding taxes and other post-closing costs.

“The housing market’s going nowhere fast,” Mark Zandi, chief economist of Moody’s Analytics, told the media in July. “From a buyer’s perspective, it couldn’t be worse. Mortgage rates are high, home prices are high, there’s no inventory.”

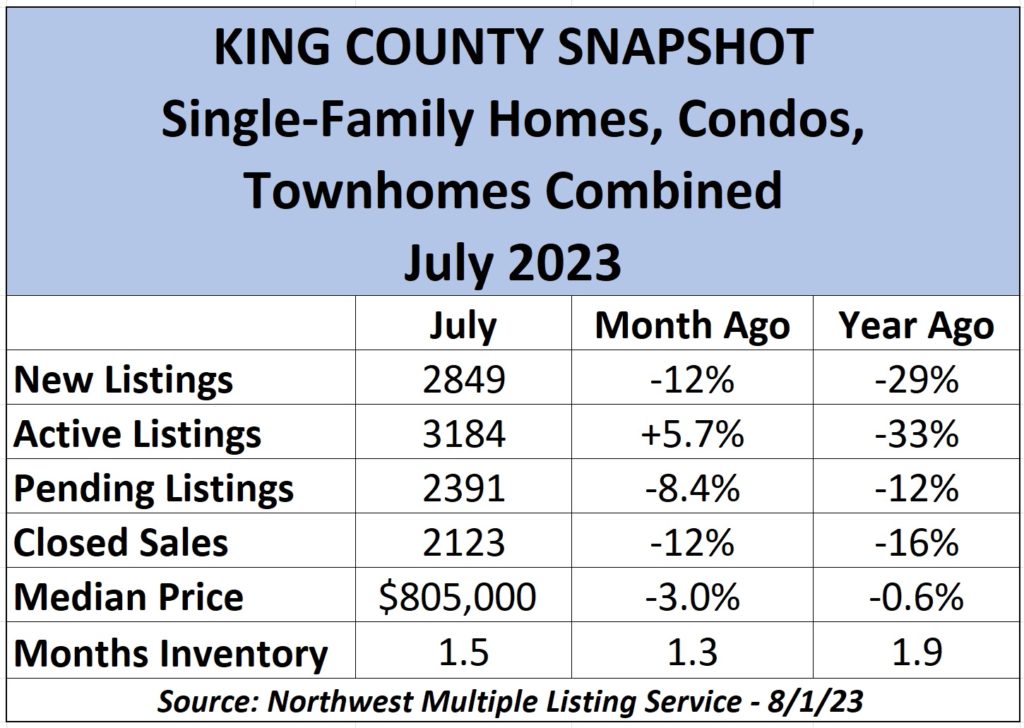

The local market appears to be sleep-walking through a year that will be best known for near-record-low activity and prices higher than at the start of the year. The season has been shaped by slumping new listings, a slowly climbing number of homes sitting on the market from previous months, fewer closed sales compared to last year and prices moving plus/minus five percentage points year-on-year (YoY).

Data from the Northwest Multiple Listing Service show a precipitous 19% drop-off of new listings in Seattle to 1013 units from June to July and a 24% slump YoY. The Eastside saw a 3.5% decline (915) while King County overall lost 12% from June for all home types (single-family, townhome and condo combined).

The number of homes for sale, as of Aug. 1., rose 5.7% from June to July across the county (3184) – the fifth consecutive monthly gain. The Eastside led the way in July, with an 8.7% increase in active listings (886). Seattle saw a modest 1.1% increase (1359) in the month but the figure was down 15% YoY.

At the same time, Pending sales were off 8.4% month-to-month in King (2391), including an 8.7% drop in Seattle (811). Closed sales fell 12% month-to-month countywide – just as it did from May to June – to 2123 homes sold in July. Sales on the Eastside fell 19% in the month (607) and 15% in Seattle (730). For the year, sales are off 16% countywide, down 18% in Seattle and 7.5% on the Eastside.

The single-family housing market is sluggish, as many prospective buyers and sellers have chosen to focus on enjoying the many weeks of beautiful weather. King County new listings fell 13% from June to July (2158), led by a 20% slide in Seattle (690). The county has not seen a July figure this low since records have been archived for brokers in the early 2000s; the previous low of 2512 single-family new listings in July occurred in 2012.

The county saw a 4.9% rise in single-family homes for sale, as of Aug. 1, to 2293 units, despite a 2.5% monthly decline in available Seattle listings (793). Overall, King had 38% fewer homes for sale at the start of August than a year ago, including 42% fewer on the Eastside and 19% fewer in Seattle.

The number of single-family homes going under contract (Pending sales) fell 8.7% for the month (1826), led by the Eastside’s 5.1% drop (542). Sales volumes fell 12% in the county (1640), with the Eastside experiencing a whopping 21% decline in closed transactions from June to July (455). Seattle sales dropped 16% for the month (513). Sales are down 16% YoY in King, including 20% lower in Seattle and 5.0% softer on the Eastside.

Eight percent fewer condo homes came on the market in July across King (691), led by a 30% drop-off in downtown Seattle/Belltown (67 new listings). Pending sales in the county declined 7.5% for the month (565) and are 6.9% lower YoY, while sales fell 11% in the last month to 483 units and by 17% over the past year. The median price of a King County condo is $510K, down 3.8% from June but up 4.1% YoY; Eastside condos sell for a median price of $600K, down 7.7% from June but up 4.4% YoY and Seattle prices are flat month to month at $550K, up 2.4% YoY.

Single-family home prices were mixed in July compared with June. They were off 4.0% across the county to $897,500 and down 3.2% in Seattle to $899,950, but prices rose 3.4% month-to-month on the Eastside to $1.5M. For the year, single-family prices are down only 0.8% across the county, 5.7% lower in Seattle but up 5.6% on the Eastside.

The neighborhood with the sharpest YoY single-family price drop is Capitol Hill/Central District, where median prices have tumbled 16% to $1.05M. On the other hand, 12-month price gains have been registered in Skyway (up 23% YoY to $750K); Redmond/Carnation (up 13% to $1.43M); Bellevue, west of I-405 (up 11% to $3.89M) and Kirkland (up 11% to $2.1M).

Homes across the county are selling right around their current list price, but those final figures are also about 98% of the original asking amount. Buyers may expect to see one – even possibly two – price drops, particularly on resale condo homes and where properties are in less-desirable neighborhoods.

The supply of homes inched higher across the county – to 1.5 months for all home types (from 1.3 in June), to 1.4 for single-family houses (from 1.2) and to 1.8 for condos (1.5). The average number of days all homes stay on the market before finding a buyer is 18 in King, up 39% from a year ago, and 17 days for single-family homes.

The dynamics of this year’s housing market are complex. Demand isn’t an issue here; 76% of all U.S. homes sold in June found a buyer in less than a month. The figure is around 60% for King County through early July. Availability and affordability, on the other hand, are making buying and selling inadvisable to many.

The pandemic is at the core of today’s rather dysfunctional market nationwide. The supply and demand imbalance is supercharged by the unorthodox response from buyers and sellers in 2021-2022 when people bought investment properties, second homes, and vacation hideaways and/or moved their primary residence by an unusually high 50 miles (the national average).

The U.S. is on track to sell only 4.16M homes this year, the fewest since the Great Recession and the June inventory figure is believed to be the lowest for the month on record. (July national data was not yet available.) The result: generally rising prices amid limited inventory.

In addition to King County’s 3.0% month-to-month median price decrease on all home types, to $805,000, Snohomish saw the sharpest drop – a loss of 4.3% from June to July ($717,691). Median prices in Kitsap fell 2.8% in the month ($535,225) and they were statistically unchanged in Pierce ($530K). Single-family home prices in King fell 4.0% in the past month ($897,500), followed by a 3.1% drop in Snohomish ($751,250), and they were 1.0% lower in both Pierce ($541K) and Kitsap ($544,975). Year-to-year, single-family median prices are mixed, including down 5.9% in Pierce and off 2.4% in Snohomish, but they are up 1.3% in Kitsap and 0.8% in King.

“With high mortgage rates keeping one in seven homeowners from selling, new listings have lagged far behind what we’ve seen in prior years, pushing buyers to continue to bring their best offers even as [U.S.] homes sales are 20% lower than this time last year,” said Danielle Hall, chief economist at realtor.com.

Many experts believe when mortgage rates show a steady and consistent decline – closer to 6.0% than to 7.0% – there will be a surge of buyers that could further limit inventory. The Federal Reserve has signaled all along that it will raise its Fed funds interest rate until the central bank’s inflation target of 2.0% is in reach. Inflation through July was at a 3.2% annualized rate, up slightly from 3.0% the previous month.

And while the Fed does not establish mortgage rates – bond investors do – it’s not surprising to see the home-financing market follow suit along with the rest of the borrowing sector. Adding to the interest-rate misery was investors’ negative reaction to the Aug. 1 downgrade of the U.S. government by Fitch Ratings, pointing to concerns over expanding national debt and woes with the budget deficit.

“Unfortunately, interest rates have settled in at a much higher rate,” said Len Kiefer, deputy chief economist at Freddie Mac. ”Absent some major shock, I wouldn’t expect rates to dip much lower.”

Not all economists agree. NAR’s forecast team believes 30-year, fixed-rate mortgages could reach 6.3% by Dec. 31, followed by 6.0% by the end of 2024.

The next meeting of the Fed board, Sept. 19-20, gives Chairman Jerome Powell and his fellow bankers two months’ of inflation and employment data since their last session. Will the central bank adjust rates further? It’s too soon to tell.

Meanwhile, the new home market has surpassed expectations this year. This rarely covered segment of the market typically supplies about 13% of all sales. However, builders are now delivering 28% of all homes available for sale in the country – or roughly 734K units sold annually (through June) – as buyers have been drawn to sales promotions such as mortgage-rate buydowns from developer-backed lenders or “free” upgrades.

A report for Q2 claims 32% of buyers in the West are “interested” in new construction, up five percentage points from the end of March, and, according to property tech company Zonda, Seattle metro has experienced an 85% increase in new-home sales in the 12 months through June. National builders D.R. Horton, Lennar and Toll Brothers (among others) are adding supply in our area, including this just-announced community called Canopy Cottages on the northwest fringes of Redmond.

New homes are usually pricier to start. For example, the offering of cottages by Toll will be priced from about $1.2M for approximately 1260 sq. ft. ($952/sq. ft.). Harvard researchers note higher prices in building supplies lifted the cost of residential construction by 35% in the past three years. Medium new home prices across the U.S. are $415K, though they tend to be at least double in King County.

Zonda indicates that new-home prices have averaged a 27% premium above resale prices dating back to 2010. That spread has narrowed to just 4% today.

Builders have fallen off their quick pace of construction from earlier this year. The number of projects that have started – registered when builders put a shovel into the ground – fell 8% in June, the biggest drop of the year, to an annualized rate of 1.4M units. June’s decline was followed by a 16% month-to-month burst in May starts. Meanwhile, building permits are on the rise, hitting a 12-month high mark and signaling more housing starts are around the corner. Get the shovels ready!