The Seattle/King County housing market inched forward – and a little sideways – as the number of new and unsold listings continued to expand in June while fresh signs of a slowdown approached. Home prices continued to confound buyers by climbing toward record highs as summer began.

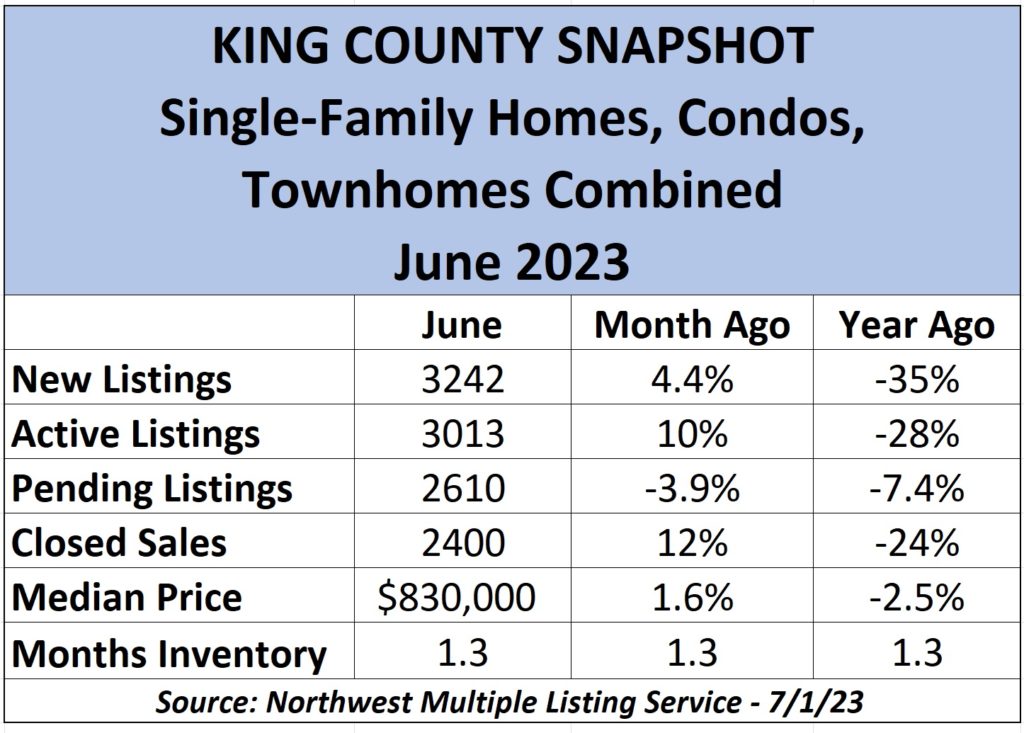

The county saw the combined number of single-family, townhome and condo listings increase in June by 4.4% from May to 3242 units – the highest monthly figure since last September. While that percentage may appear strong, it’s nothing compared to the April-to-May rise of 18%, signaling a probable cooling of new listings in the future. Meantime, unsold listings rose a solid 12% for the month to 3013, including 11% (1344) higher in Seattle and 10% (815) stronger on the Eastside.

New single-family-home listings rose 3.8% month-to-month (2491) – a much slower rate increase than the 19% monthly surge in May – and climbed 13% for units unsold at the end of June (2181). Seattle (12%) and the Eastside (11%) drove the increase in single-family units sitting on the market as of July 1.+

The number of Pending listings fell 3.9% for all home types in King County (2610) and declined 5.7% among single-family homes (1999) compared to May. The slippage in listings under contract – which is currently at the third-slowest annual pace this century (after 2008 and 2009) – is a barometer for future sales. For example, May’s Pending sales were 12% higher than April for all listed homes in King and June’s final sales were – not surprisingly – 12% higher than May, as home contracts pass through the sales funnel to completion.

It does not take an economist to predict that next month’s direction of completed sales will decline and possibly continue to slip through the year. The May-to-June drop in Pending sales is the first monthly slowdown this year. This comes as Pendings across the country have declined for three consecutive months through May (latest data).

While the boost in available inventory in King County is welcome, it’s important to note that the number of new listings is 26% lower than in June 2019 when the housing market was red hot. The number of unsold (Active) listings in King is 49% fewer today than on July 1, 2019.

We are not alone in witnessing a welcome rise in available homes on the market. There were 614K unsold (Active) listings through June in the U.S., up 5% from May. However, that’s only up 7% year-on-year (YoY) and is half the level from June 2019.

When we see King County home sales rise 12% month to month, as noted for May to June, it draws a simplified conclusion that buyers are still purchasing homes despite the potential for challenges. Just think what the housing market would be like if financing a home purchase was more affordable.

Even while the intensity of the market has cooled in recent years, some data suggests consumer demand for homes remains. For example, the average number of days a home sits on the market has steadily declined in King – from 48 days in January to 17 in June. It’s now 14 days for single-family homes. This time last year when activity was more busy, the figure was 9 days for all homes on the market as well as single-family units.

Housing experts believe the spring market proved further that we have a severe inventory shortage, intensified by the pandemic’s remote work boom and a desire for more detached homes. This is nothing new. Federal Reserve Chairman Jerome Powell in November said: “There’s a longer-run housing shortage” and blamed it on a number of issues – from restrictive local zoning laws to shortages of skilled builders and financial constraints.

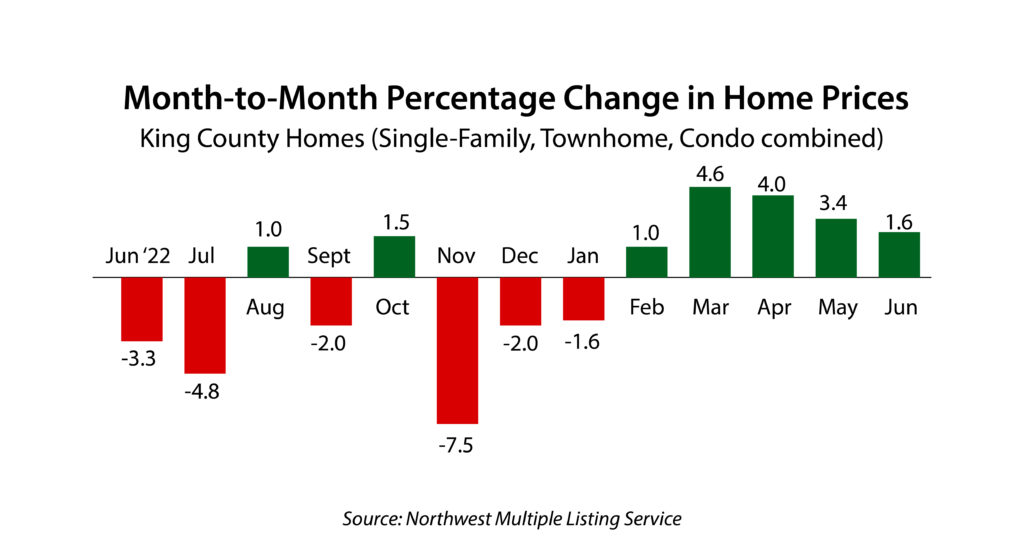

And then there is price appreciation. U.S. home prices have climbed for at least three consecutive months as tracked by Case-Shiller, which said year-to-date (YtD) prices have gained 2.3% (through April). Case-Shiller reported Seattle metro – which includes Bellevue and Tacoma – saw prices fall 12% YoY for the steepest decline of any major U.S. market. (Case-Shiller issues monthly reports two months behind data from the Northwest Multiple Listing Service).

The local MLS reported prices across King County rose 1.6% from May to June and 15% YtD to $830,000 for all home types. That’s a 2.5% YoY decline. The median price of all single-family sales in the county added 2.7% month to month to $935,000. Prices on all home types combined were little changed in the big cities – statistically unchanged in Seattle ($828K) and up 1.2% on the Eastside ($1.268M) in June. Compared to this time last year, Eastside prices have slipped 2.4% and Seattle is down 6.7% – including off a whopping 18% in Magnolia/Queen Anne, the sharpest decline of any reporting area in the county.

The median price of all homes sold in King has risen for five consecutive months (chart), including a stunning 20% for single-family homes. In fact, the median price of a single-family home ($935K) is now only 6.4% below the all-time high ($998.8K) set in May 2022.

In addition to King County’s 1.6% median price month-to-month increase on all home types, to $830,000, Snohomish County saw the sharpest jump – a rise of 4.2% from May to June ($749,950). Pierce prices fell 1.0% ($531K) while Kitsap was statistically unchanged ($550,666). Single-family home prices in King added 2.7% in a month ($935K), the only county to see market appreciation. Single-family prices fell 1.3% ($550K) in Kitsap, dropped 1.0% in Snohomish ($774,975) and were flat ($545K) in Pierce. Year-to-year, single-family median prices remain in negative territory, led by an 8.3% drop in Kitsap, down 4.1% in Pierce, 3.1% lower in Snohomish and off 0.3% in King.

Keep I mind that a 1% month-to-month price change is significant – 12% growth on an annualized basis. “It will be interesting to see if this trend can continue given the stubbornly high mortgage rates,” said Matthew Garner, a real estate economist, quoted by Puget Sound Business Journal.

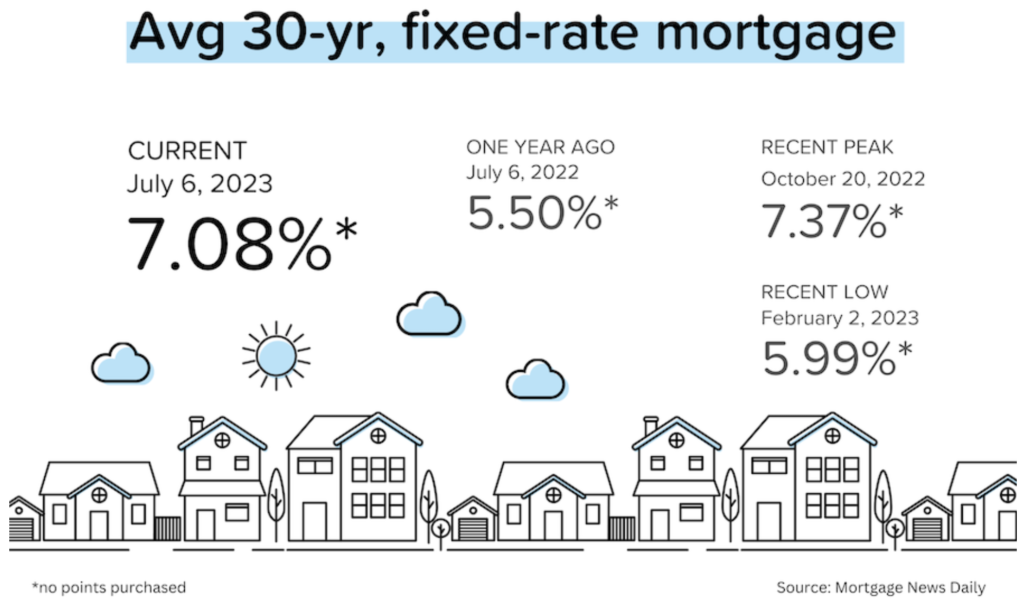

The Federal Reserve last month ended a cycle of 10 consecutive interest rate increases on its short-term loan called the Federal funds. The news fueled hopes that borrowing costs for consumers could ease in the coming weeks. But the Fed has a different mindset, which includes the possibility of two additional rate increases by year’s end.

America’s central bank wishes to see additional data before it decides on further increases even though the key measuring stick – inflation – continues to decline. Inflation is now at 4.0% annually, the lowest level in two years but still double the Fed’s target of 2.0%. (The June inflation report is to be released on July 13.)

May and June marked the first time in two years that wage growth outpaced consumer price inflation, therefore improving the average standard of living. The Fed’s stance in June was curious in that it believes inflation is heading in the right direction yet more rate increases may be necessary. For one, the central bank is concerned that consumers will spend more rather than less with their now 4.4% annualized wage growth and businesses will continue to hire people to feed America’s appetite for spending.

Mortgage rates do not directly correlate to the Fed funds rate but the central bank’s actions impact the overall direction and mood of the financing markets – from car loans to home loans.

The Fed’s decision to hold off on a rate increase in June “will ensure that mortgage rates are likely to keep moving sideways for the next couple of months,” predicts George Ratiu, chief economist at Keeping Current Matters.

Mortgage rates higher than in recent years exacerbate the lock-in effect in the resale housing market. Approximately three out of every five mortgage holders are enjoying interest rates locked in at 4% or lower and about a quarter of those householders have a rate below 3%.

“We’ve been in a sort of housing market deep freeze for a year,” said noted economist Marci Rossell.

While the largest chunk of real estate activity – resales – is moving more slowly, new construction is taking over a larger percentage of the action. First, there are housing starts – when developers break ground on a project; they jumped 22% from April to May to an annualized rate of 1.63M homes, the highest figure since April 2022.

The construction industry is on pace to complete more than 1.51M units this year, which would be the highest total since 2007.

Builders are now officially bullish. Why? Low inventory of existing homes for sale is pushing buyers toward new homes and the price of key building materials has started to ease. Completed sales of new U.S. single-family homes surged in May to a seasonally adjusted annual rate of 763K, the highest level since February 2022. Meantime, existing home sales in the U.S. were basically flat from April to May at an annualized pace of 4.3M units.

The Fed is also monitoring the U.S. labor market. Job losses are a sad consequence of higher interest rates as businesses typically cut output and staff. The national data shows low unemployment (3.6%) as well as weekly jobless claims (248K) which are about half of what typically occurs during a recession. Seattle/Tacoma reported a net loss – 1400 jobs – in May, the first monthly decline since May 2022.

“What’s flying in the face of everyone’s forecast is the strong [U.S.] labor market,” Sean Dobson, founder and CEO of real estate investment firm Amherst, told Fortune. “Consumers were already well funded because of the big [pandemic-era] stimulus. And now, the ‘voluntary quits’ number remains high because people are so confident they can get another job that pays more, they’ll leave their current position without another one lined up.”

Is a recession still on the horizon? It depends on who you ask and what day you pose the question. In mid-June, Darrell Cronk, president of Wells Fargo Investment Institute, was quoted as saying “recession is at our doorstep,” and Justyna Zabinska-LaMonica, a senior manager at The Conference Board, said the data signals “a worsening economic outlook.”

A week later, Treasury Secretary Janet Yellen said the risk for the U.S. of falling into recession was diminishing: “My odds of it, if anything, have gone down because look at the resilience of the labor market and inflation is coming down.”

Rossell, one of my go-to economist experts, said in late June: “We need to see weaker consumer spending and job losses before a recession … [and] I don’t see the data yet that’s telling me a recession is around the corner.”

The next Fed meeting is on July 26. Thanks to the still-active U.S. employment market, Fed watchers say there is an excellent chance of a 0.25-percentage-point increase in the Fed funds rate to a 5.25%-5.5% range. Then, mortgage rates may follow higher.