Home prices and mortgage rates. These are the two most frequently discussed items by both the people working in residential real estate and the customers and clients they serve. It’s the bacon and eggs of the housing market – two staples that are often linked to one another.

And the May report for Puget Sound residential sales is no different. Unfortunately for buyers, both figures – prices and rates – are climbing, raising the hurdle to homeownership even higher for many.

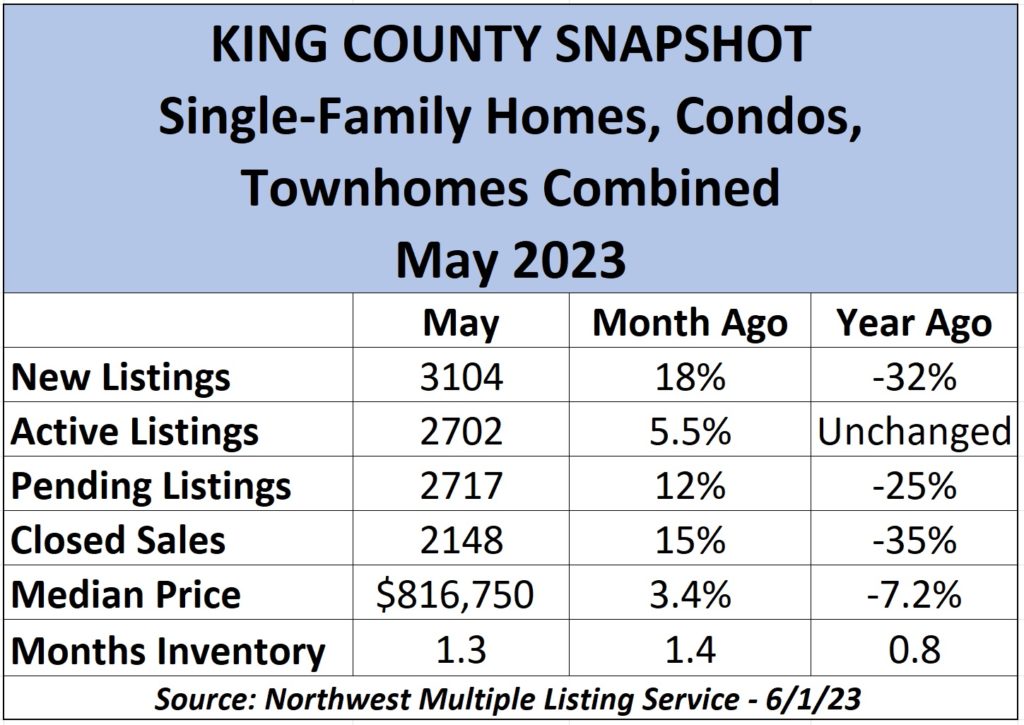

Median home prices for King County on all home types added 3.4% from April and 13% since the start of the year to $816,750. Prices were up 5.1% ($830K) in Seattle for the month and 4.5% ($1,253,550) on the Eastisde.

Price appreciation is more extreme for single-family homes across our county. It jumped 4.0% in the past month and a whopping 17% Year to Date (YtD) to $910K. Median prices were up 2.2% ($905,125) between April and May and 13% YtD in Seattle and unchanged ($1.45M) in May on the Eastside but up 9.8% over the first five months of the year.

Median prices in King County peaked exactly a year ago (though the Eastside hit its high mark a month earlier in April) before falling through the rest of the calendar. Since January, however, county prices have climbed every month (though some areas such as the Eastside experienced its low mark in February). This means the negative YoY price decline – which is in a range of minus 7%-11%, depending on the submarket – will slowly return to positive territory, likely by early 2024.

Today’s YoY declines underscore just how far the market has shifted from 2021 and 2022. County single-family-home prices hit a high of $998,888 just 12 months ago; they soared to $1.72M for a typical Eastside single-family home and $1.025M for the same in Seattle. Prices for all home types combined (single-family, townhome, condo) in May 2022 were up 14% YoY across King, 27% on the Eastside and up a “modest” 7.9% in Seattle.

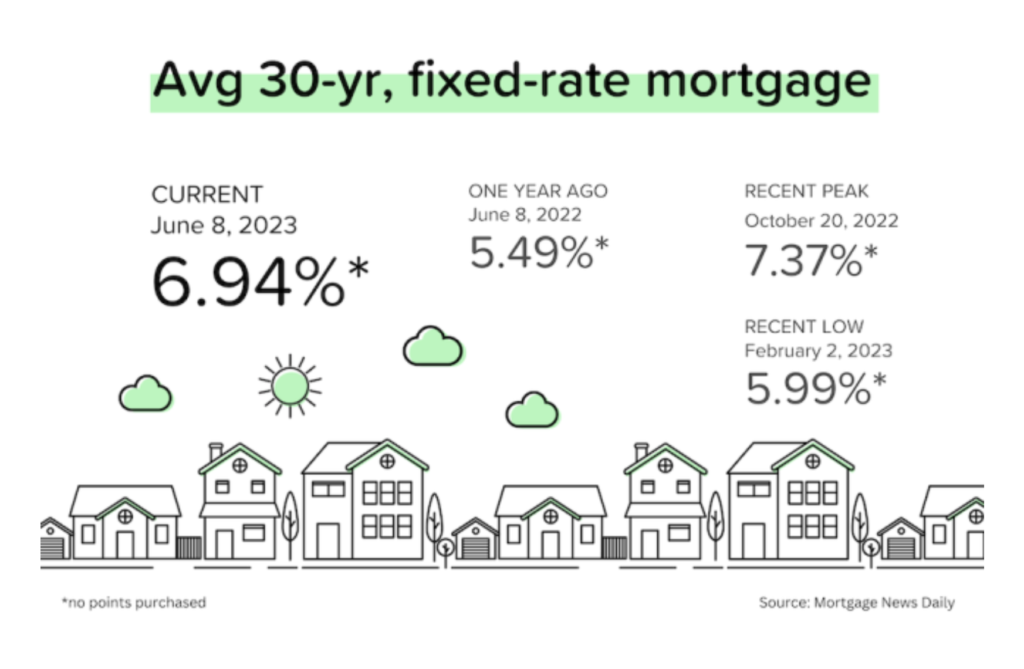

The pandemic housing market was super-charged by historically low interest rates and buyers seeking more spacious properties amid global health fears. That changed in March 2022 when mortgage rates started their steady climb into the 4s, then into the 5s in May and 6s by September. Rates peaked in early November at 7.08%, according to Freddie Mac, and they have been stubbornly high pretty much ever since.

Higher mortgage rates make monthly financing payments more expensive – not to mention more frustrating – and can often push homeownership further out of reach for younger buyers.

Economics 101: Home prices are determined by two things – supply and demand. Yes, there are few buyers in an inflation-heavy economy with high interest rates, but for home prices to go down there needs to be fewer buyers than sellers – and that is just not within the realm of possibility today.

There is a lot of pent-up demand for housing and as affordability improves, we are going to see more people move forward with their homebuying plans. There are no economists (to my knowledge) predicting a reversal of the rising home-price trend and as rates drop buyers will be out in droves again grabbing whatever is available – likely for more than the list price.

Which begs the question to potential buyers: Why exactly are you waiting for interest rates to fall when you know prices and competition will only heat up further?

“It’s a good time to buy because the minute interest rates go down, everybody’s waiting for them to go down even by a point, and when they do, they’re going to come rushing back in the market,” predicts Barbara Corcoran, TV personality and founder of New York City real estate firm The Corcoran Group. “Prices are going to explode, and you’re going to be paying more for the same house. And you can always refinance, remember, when and if interest rates come down.”

Even now, we are hearing of multiple-offer situations and prices well above the asking figure on homes in desirable King County locales. Despite high interest rates, some hungry buyers are competing over limited inventory.

It’s true, there is a welcome increase in new listings from month to month – up 18% across all home types in King from April and 19% higher for the single-family-home category – but isn’t that what you would expect in the typically busiest periods of the housing season? The number of Active listings as of June 1 for all homes in the county (2702) were six fewer(!) than last year’s figure at this time.

The conveyor belt of home listings and sales is moving at a more civilized pace – averaging 24 days on the market, which is double from this time last year. Let’s call this a calm before the next round of frantic activity. Today’s pace is more measured, with monthly sales off 35% YoY in King.

Supply of resale housing (as opposed to new construction) is shrinking across our region. There are 1.3 months’ total inventory in the county, down from 1.4 a month ago. Eastside inventories are at 1.2 months and Seattle stands at 1.5 for all home types. The figures are down a smidge further in the single-family category.

Interestingly, a higher proportion of home sales are now coming from new construction. In March, 33% of homes listed for sale in the U.S. were in various stages of construction. That share from 2000–2019 was an average of 13%. With limited available inventory, new construction will continue to be a significant part of prospective buyers’ search for years ahead.

And, like a new car, new homes can cost a pretty penny, which has often kept buyers focused on resale listings. A big difference now, however, is that builders don’t want to sit on inventory; they have bills to pay, including massive financing costs from lenders. They want their money and move to the next project, so it’s not uncommon to see price discounts and other incentives at new construction developments. The share of U.S. builders offering incentives in May was 54%.

Meantime, condo inventory stands at 1.6 months across the county, ranging from 1.0 month on the Eastside and 2.4 in Seattle. Median condo prices, at $505K, are 1.0% higher than in April and up 12% YtD. Seattle prices stand at $550K, up 2.0% for the month, while they fell 6.1% ($582K) on the Eastside since April. It’s noteworthy that while condo inventories are shrinking, downtown Seattle is an exception by climbing from 3.9 months in April to 4.8 – likely an indication of affordability concerns and continuing questions about living in the urban core.

In addition to King County’s 3.4% median price month-to-month increase on all home types, to $816,750, Kitsap County saw the sharpest jump – a rise of 7.8% from April to May ($549,900). Pierce added 3.9% ($535K) to its median price since April while Snohomish added 2.3% ($720K). Single-family home prices in King jumped 4.0% in a month ($910K), but that was surpassed by a 7.2% climb ($557,450) in Kitsap, followed by Pierce (up 3.8% to $544,990) and Snohomish (up 1.6% to $780K). Year-to-year, single-family median prices remain in negative territory, led by an 8.9% drop in King, down 6.4% in Pierce, 4.3% lower in Snohomish and off 1.0% in Kitsap.

Prices haven’t fallen nearly enough to offset dramatic price hikes earlier in the pandemic: King County’s median single-family-home price is 30% higher than it was in May 2019, according to data from the Northwest Multiple Listing Service. Prices are up 56% in Snohomish, 47% in Pierce and 45% in Kitsap – yes, in just four years.

Mortgage rates are generally established by investors who buy them in bulk as securities. And while the Federal Reserve does not directly drive interest rates in the mortgage world, the central bank certainly influences it.

That’s why many real estate insiders are watching carefully the outcome of Wednesday’s (June 14) Fed announcement on the direction of the short-term Fed funds rate. There is a good chance there will be no change in the rate, which will be a sign that policymakers believe inflation is coming down off its highs and the economy is slowly improving.

“Skipping a rate hike … would allow the (Fed) to see more data before making decisions about the extent of additional policy firming,” Philip Jefferson, a Fed governor, said about two weeks ago. “A decision to hold our policy rate constant … should not be interpreted to mean that we have reached the peak rate for this cycle.”

So, yes, we’re saying there is a chance of a quarter-point rate increase this week, which could impact the financing of many purchases – from cars to homes – in the coming weeks.

Mortgage rates are far higher than we have been used to seeing over the past decade but, from an historic perspective, they are about average. Since 1971, Freddie Mac has conducted more than 2700 weekly surveys of mortgage lenders and 63% of the time rates were at least as high as they are now.

The goal of the Fed’s actions is to avoid sinking the economy into a recession, which is effectively two consecutive quarters of economic contraction. The Fed always cuts rates aggressively in response to a recession, which in turn would likely send mortgage rates lower. And lower mortgage rates should also “unlock” would-be sellers who have been compelled to retain their lower financing costs.

So, yes, a recession comes amid a mix of bad news (job losses, manufacturing cuts) and good (lower financing costs to stimulate spending). Most economists believe a recession is still likely but, like a soft landing of a massive jetliner, this one would be only mildly felt by many.