The first month of the year in residential real estate is typically one of resetting and preparing for the spring rush, which can start as early as February (despite the groundhog’s forecast of six more weeks of winter). The Seattle/King County housing year kicked off slowly with some promising signals.

From a macro perspective, the 2023 outlook for home buyers is the best it’s been for three years. Danielle Hale, chief economist for realtor.com, said: “There will be more homes for sale, homes will likely take longer to sell and buyers will not face the extreme competition that was commonplace over the past few years.”

Economists and real estate geeks like me look for any signs that may raise hope. Inflection points are important in finding those signals and since last month’s assessment of the market, we are beginning to see what appear to be important – possibly significant – upward inflection points in housing market data.

Mortgage Applications – The number of consumers seeking a mortgage, the earliest sign of home-buying intent in the purchasing funnel, is averaging 9% above the trough of Q4, though still down about 30% from a year ago.

Pending Sales – Another leading indicator, these are the homes that go under contract and typically complete the transaction within two months. The number in King County rose in January from month to month for the first time since August. (Read on to see by how much.)

Easing inflation – The rate of inflation has fallen for six straight months, with the latest figures released Feb. 14 showing an annual rate of 6.4%. This easing of everyday costs is a psychological boost to consumers even while the cost of living remains high.

Inflection points matter and they appear to show things are “getting less bad.” Or, as we optimists like to say, “getting better.”

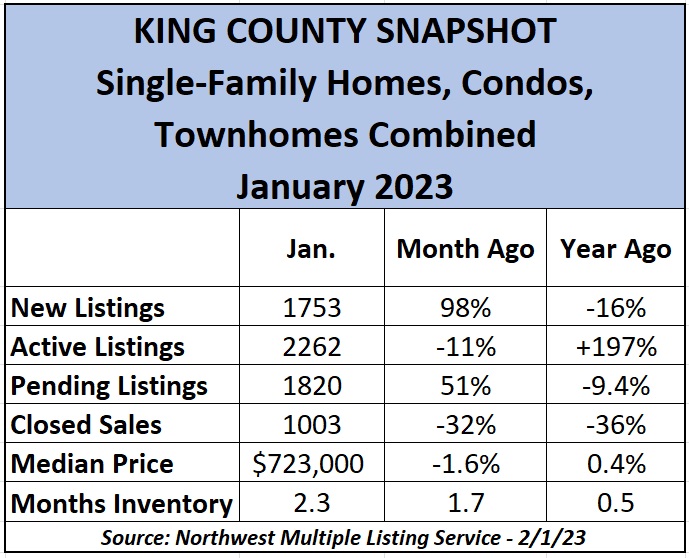

The number of Pending sales soared 51% since December for all home types in King County to 1820 listings under contract, including a 69% boost on the Eastside (480) and a 47% jump in Seattle (610). The figures were nearly identical for the single-family-home category, up 50% across the county (1397).

Another positive sign: The number of new listings surged from the previous month. They were up 129% for all home types in Seattle (696), 123% on the Eastside (506) and 98% for the entire county (1753). New single-family homes on the market jumped by a similar number – up 90% for King (1329). However, the figures are still below year-on-year (YoY) figures, down 16% in King County for newly listed homes and 11% lower for single-family listings.

One data set to watch for in February will be the number of homes still active on the market. It’s not uncommon to see those figures drop until late February or March before climbing again. They are down about 11% month to month across the county but up about 200% YoY. Limited active inventory – if it continues into spring – could force prices higher.

Median home prices in King have fallen three straight months – not surprising for this time of year – after a mostly consistent climb since the start of the pandemic. They finished January at $723,000 for all home types, up 0.4% for the year but down 1.6% since December. County home prices have sunk 18% since their high of $880,000 last May.

Prices of single-family homes in King stand at $781,098, down 5.3% from December but up a modest 0.8% YoY. Median prices were widely mixed in the big cities; they were down a significant 8.7% for the month but up 1.7% YoY in Seattle ($803,750) and up 1.6% for the month but down 13% YoY on the Eastside ($1.32M). In a see-saw moment, single-family prices on Mercer Island were off 40% YoY ($2.12M) in January after recording a 40% YoY increase a month earlier.

Inventory is improving but the region remains in a seller’s market at about 2 months’ available supply. There are 2.3 months’ inventory across all home types in King County and 2.1 months for single-family homes. The Eastside is showing 2.6 months’ inventory for single-family homes and Seattle has 2.1 months – far higher than a year ago when it was closer to 2 weeks.

The King County condo market remains sluggish with 2.8 months’ inventory on a median sales price of $450,000, down 3.2% since December and off 1.1% YoY. Eastside condos are selling at a median price of $543,000, which is 3.9% lower than the previous month and down a whopping 16% YoY. Seattle prices are down 4.9% since December to $487,500, which is 2.5% lower YoY. There are 4.0 months of condo inventory in Seattle and 2.5 on the Eastside.

In addition to King County’s 1.6% median price month-to-month decline on all home types, to $723,000, Snohomish County saw the sharpest drop – 5.0% from December to January to $645,000. Kitsap saw median prices fall 1.6% for the month ($487,500) while Pierce was the lone county in Puget Sound to experience a rise in prices, up 2.0% since December to $509,997. Single-family home prices in King declined 5.3% in a month ($781,098), followed by Kitsap, down 1.6% to $489,725. Median prices rose 2.6% in Pierce since December ($517,442) while Snohomish was statistically unchanged ($699,000). Year-to-year, single-family median prices were mostly lower, down 3.7% in Kitsap, off 2.2% in Snohomish and 1.4% in Pierce but they were up 0.8% in King.

We are not out of the economic woods yet. Overall inflation (6.4%) is still above the YoY rate increase of average hourly earnings (4.4%) and, therefore, a majority of Americans are falling behind in their standard of living. Have you seen the price of eggs – up about 60% in a year!

Yes, a recession is almost certain, but economists are calling for one that is shallow and short-lived – assuming inflection points continue to trend in the right direction.

“We’ve never had a period where home prices have declined and there has not been a recession,” noted Robert Dietz, chief economist for the National Association of Home Builders. That appears to be where we are headed.

We are likely in for challenging months. However, forecasts for a housing market turnaround having to wait until next year are fading.

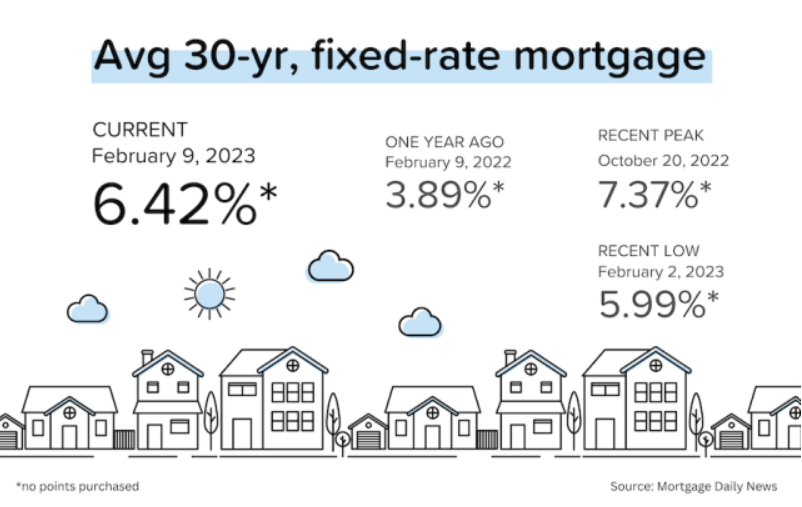

Predictions of mortgage interest rates in the “7s” have now all but been left in the dust. The next big step is a consistent rate for 30-year conventional mortgages in the “5s” – a real possibility as soon as the coming months, some economists and lenders speculate while offering a generally positive belief in the Federal Reserve’s actions to tame inflation.

“Mortgage rates continue to tick down and, as a result, home purchase demand is thawing from the months-long freeze that gripped the housing market,” Sam Khater, Freddie Mac’s chief economist, said in late January. “Potential homebuyers remain sensitive to changes in mortgage rates, but ample demand remains, fueled by first-time homebuyers.”

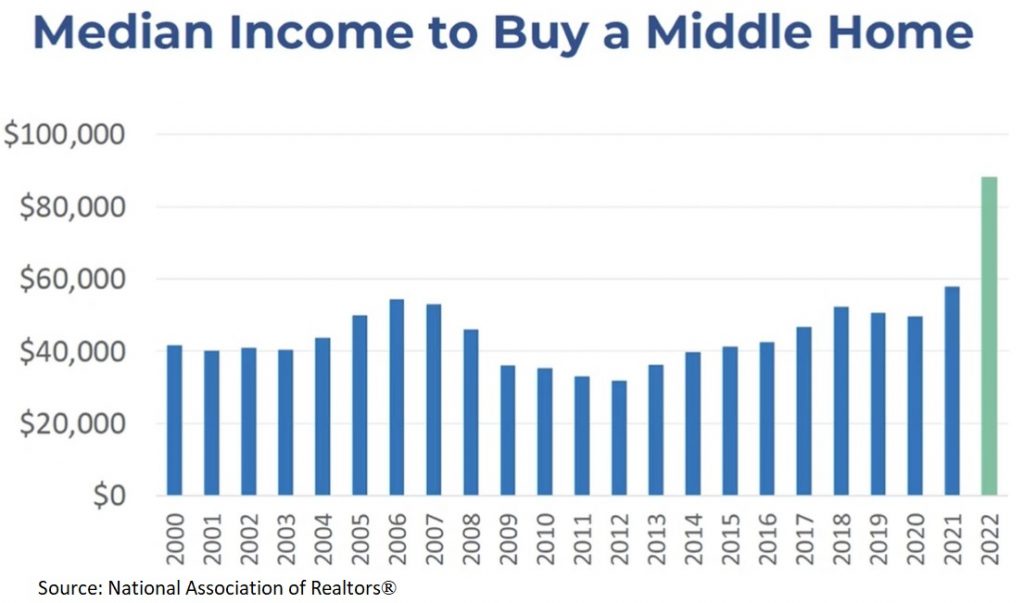

To be sure, housing affordability amid job insecurity in the tech sector is making home buying a low priority for some. The median income needed to buy a typical home in the U.S. has soared to $88,300 as of late 2022. That’s about $44,000 more than the same figure in 2019 before the pandemic.

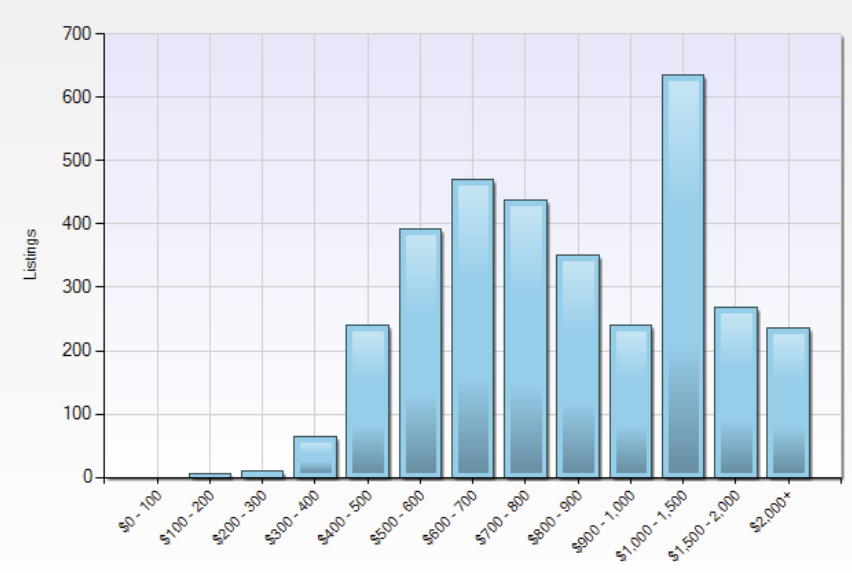

The median price of a single-family home in the U.S. is $400,000, or roughly half the median price in King County. The affordability dilemma for local residents can be shown in stark relief in this chart of single-family home sales by price range since October, according to the Northwest Multiple Listing Service. Of the 3351 King County homes sold in the last four months (through January), only 80, or 2.4%, went for $400,000 or less.

First-timers are turning to new homes, when possible, as existing homeowners are disincentivized to list their properties amid the mortgage “lock-in” effects. Owners who purchased at historically low rates are hesitant to put their homes on the market, sell and take on a higher mortgage rate.

About 770,000 single-family homes were under construction across the U.S. as of November, and builders are expected to offer incentives, such as buying down points on buyers’ mortgages, to bolster sales. Fannie Mae forecasts new home sales to decline in 2023 to 570,000 units, down 13% from 2022.