The housing landscape is quite different than when this blog’s 2022 forecast was issued in December. And when the market undergoes a significant shift, it’s important to share the latest picture with consumers.

Here’s what has developed so far and what to expect for the rest of the year.

Inflation – At levels not seen in 40 years, the cost of living is much worse than any economist forecast. That has prompted the Federal Reserve to take aggressive steps to try and control rising prices on everything from groceries and gas to airfare and housing.

In May, inflation in the U.S. climbed to 8.6% on an annualized basis – the highest mark since 1981. Our metro area ranks within the top 10 for most expensive places to live, costing 51% more to reside here than in the average U.S. market. Seattle area rents are up about 8% year on year (YoY), food costs have added about 10% to their bottom line and gas at the pump is roughly $1.66, or 42%, more a gallon since last July.

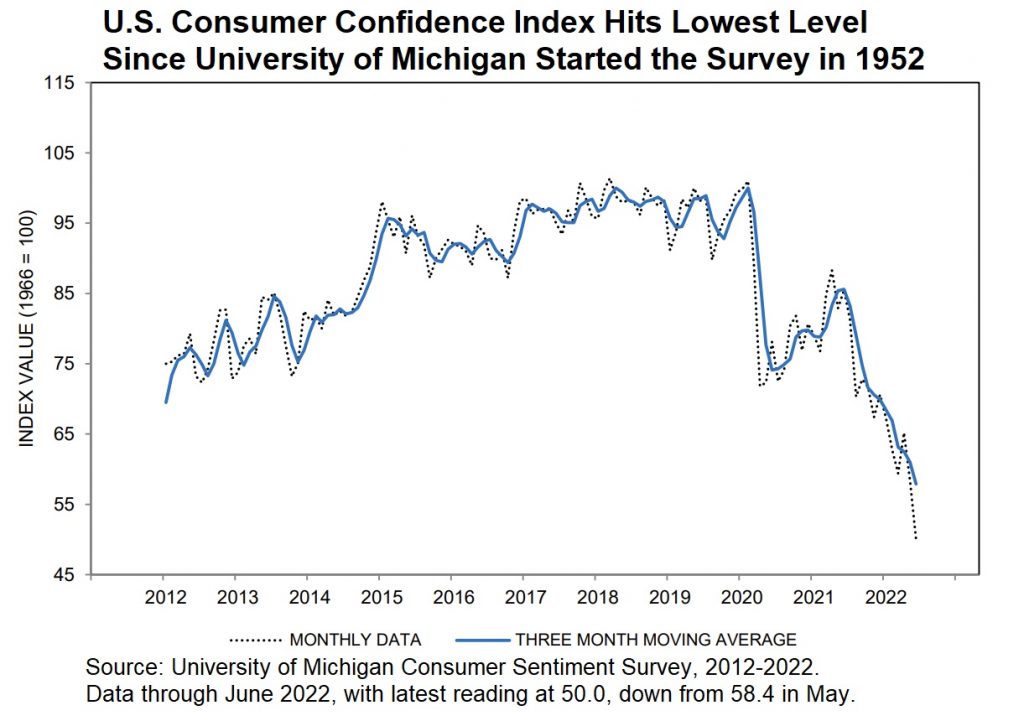

Soaring prices, in turn, have sent consumer confidence to historic lows, according to a widely tracked national survey:

Interest rates – The Fed has increased its short-term interest rate twice so far this year by a total of 1.25 percentage points with the central bank acknowledging more rate increases should be expected soon.

The Fed’s actions do not necessarily equate to higher mortgage rates. Those rates generally track the supply and demand of mortgage-backed securities, the yield on 10-year Treasury notes and other factors, as I explained in a recent post.

Most experts thought mortgage rates would finish 2022 at about 3.75%-4%. Oh, how wrong they have been! Rates started the year at 3.11%, according to Freddie Mac, and quickly jumped two full percentage points by April and have since leveled off in a wide range of 5.75%-6.75% locally (depending on a mortgage applicant’s circumstances).

Lawrence Yun, chief economist for the National Association of Realtors®, believes mortgage rates “may stabilize at 6% or 6.25%.” Speaking in late June, Yun said: “We are currently at the peak of the mortgage [rate] cycle … [and] the only way rates will rise even further is if we continue to get bad inflation numbers – month after month – in a surprising, unexpected way.”

Higher mortgage rates raise costs for buyers planning to finance a home purchase. Throw in high home prices and inflationary costs on consumer goods, new owners are facing about a 51% higher cost burden than only a year ago.

Buyers need to navigate those budget busters – such as a 6.2% cost-of-living hike in Seattle/Tacoma (April 2021-April 2022) – with wages that have increased a median of only 2% over the same period and stock investments that have lost considerable value compared to last year.

Yes, economists and other industry insiders believe we are heading toward a recession – at least two consecutive quarters of negative growth of the gross domestic product (the total goods produced and services provided in a country during a year). Many, however, believe the Fed’s actions to control inflation should help us through only a mild recession before an economic rebound.

Home prices – Prices should continue to appreciate but at a much slower pace than what we have seen since the pandemic – a forecast that remains unchanged from the previous forecast. Some are calling it the Great Deceleration – a welcomed relief for buyers.

Experts pegged U.S. home prices would rise by anywhere from 2.9% to 5.6% when forecasting in December, but they are now targeting closer to 6.6%-7.0% by year’s end. Why the increase? Consumers created an unexpected price acceleration and increased demand for homes in the early months amid fears of worsening economic conditions.

Economists projected King County home prices would rise about 6% for all home types in 2022 and about 9% for single-family residences. Through June, prices are up 9.1% YoY for all homes in King and 9.0% for single-family homes. Most here believe we reached our peak pricing in May and the rate of appreciation will ease as the year winds down.

Home sales – The pace of sales is slowing as economic conditions worsen. In December, realtor.com forecast U.S. home sales would grow another 6.6% this year; now it believes the rate will fall 6.7% from 2021. NAR is even more bearish, with a forecast decline in home sales of 13% YoY.

“Home sales will continue to go down until mortgage rates stabilize,” Yun says.

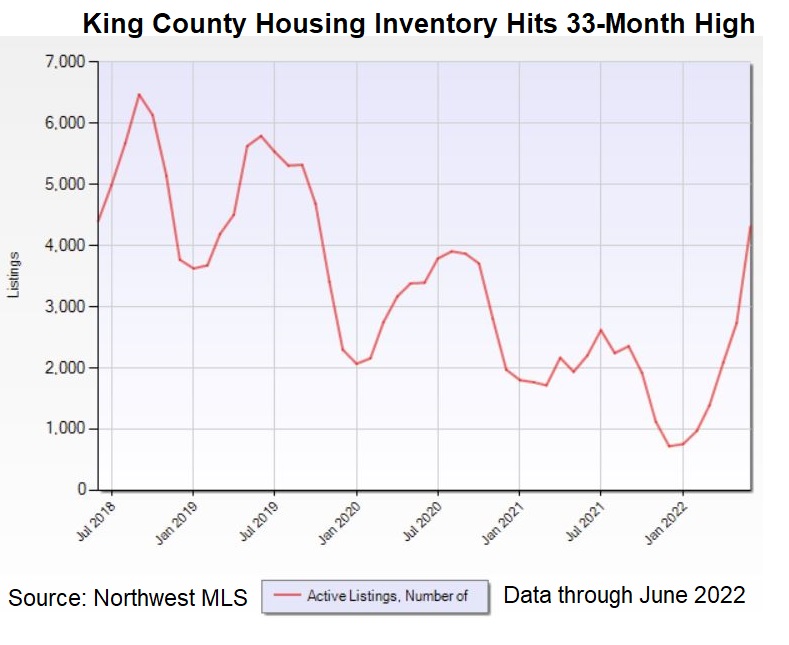

Sales for King County were expected to increase by as much as 9% YoY for 2022 on the assumption owners reticent to market their homes during the height of the pandemic were ready to sell. However, that figure will likely decline by as much as 9% – a potential 18-point swing. The supply of homes for sale is up 86% YoY and growing across King (including up a whopping 210% on the Eastside), while total transactions are down 2.8% Year to Date (YtD) compared with January-June 2021 for all homes and off 1.8% for single-family sales.

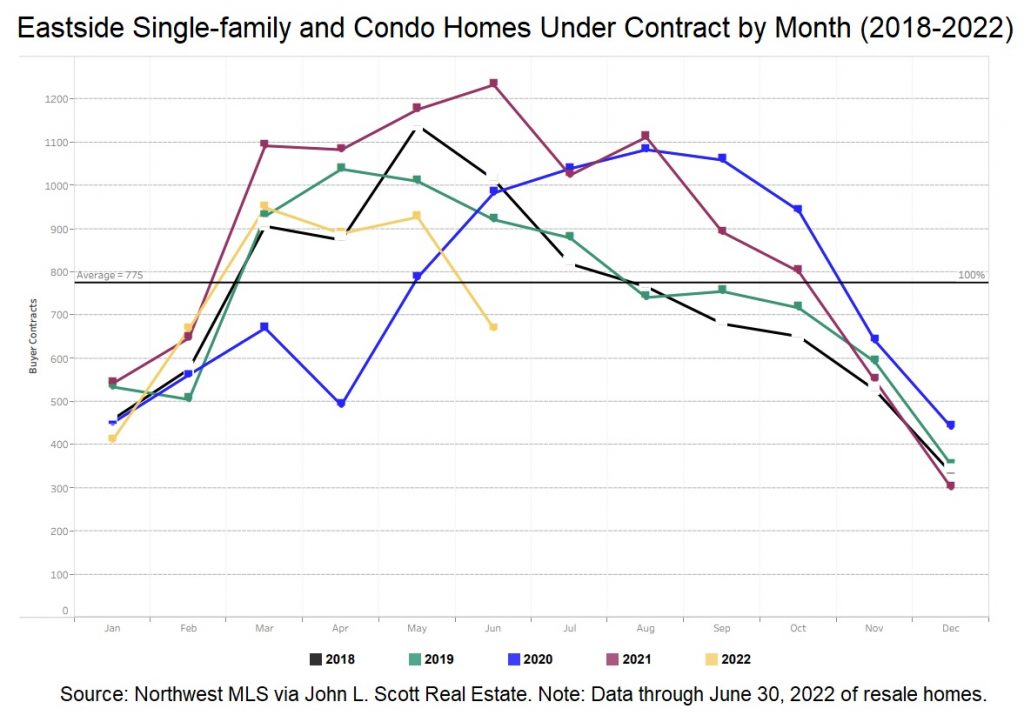

Currently, homes under contract (Pending sales) are down 19% YtD across King and by 20% for single-family homes, including down 36% in the combined neighborhoods of Magnolia and Queen Anne. The priciest sub-market, the Eastside, has slowed considerably, with 698 Pending sales of all home types in June (yellow line in chart), down 44% YoY and below the 12-month running average of 775 units under contract.

Silver lining – Make no mistake, first-time buyers have clearly been affected by recent events (and rents keep rising as well). The good news is that the pool of buyers has more options on the market and less competition. The number of homes for sale in King (4207 as of July 1) is higher than at any time since October 2019, as this chart shows.

“Homeowners [with] little or no mortgage debt (approximately half of all owner households in our region) have an extra advantage to purchasing a home in today’s market,” John L. Scott CEO Lennox Scott believes, “because they experience little impact from the higher home mortgage interest rates.” He adds: “Not only do they not have to pay premium pricing in a multiple-offer situation, they now also have selection.”

In only the last two months, we have seen more offers with contingencies and prices meeting – but not necessarily exceeding – the seller’s asking amount. The bad news, of course, is that consumers have significantly diminished buying power amid the recent economic developments.

The early 2022 forecasts included a small uptick in available inventory for the year. Now, we expect a doubling of available listings from month to month as homes linger amid a shrinking buyer pool.

Bottom line – It’s still a seller’s market in King County yet buyers can now find a more civilized approach to the offer/negotiation process. Gone – for now, at least – are the days when buyers must escalate their offer price by 20% and waive contingencies before making one of the most important decisions of their lives. Today, buyers can allow themselves to get their hopes up – visit the place more than once before deciding – and fall in love with the home they want to buy without fearing buyer’s remorse.

We are even seeing list prices drop before finding a buyer. Across the U.S., 30% of all single-family home listings have taken at least one price reduction, a figure that is expanding faster than researchers have ever seen, with one noted real estate data-watcher forecasting the figure will hit 40% of all listings this fall as seller “chase” the market.

What to watch – Keep an eye on housing supply and employment data. Months of supply help to determine the direction of price, with rising supply squeezing out the energy of rising prices. Employment losses – particularly in resilient sectors such as tech and healthcare – will signal troubles ahead and consumers will slow down big-ticket purchases – including homes – unless facing a life-changing moment (growing family, major job change, retirement).

“It’s pretty eye-popping just how drastically things have changed from a year ago,” says Danielle Hale, chief economist at realtor.com. “For home shoppers, it is a completely different ballgame than it was a year ago.”

It’s critical for consumers considering buying or selling to stay on top of the housing market and always consult their financial advisor and real estate professional before making important decisions.