We are only a couple of weeks into 2022 and the region’s residential real estate market is already getting back in motion for what should be another year of unprecedented levels of activity and incredibly high demand.

After a cooling off period to enjoy the holidays and avoid severe weather, buyers were back on the prowl for a new home as sellers prepped their properties for the seasonal rush. The traditional spring start to residential sales should kick into gear by this time next month, though about 40% of all transactions close between April and July.

The industry is prepared for another high-demand, low-inventory year, even if conditions do not quite hit the fever pitch of 2021. Buyers will continue to outstrip sellers but with slightly less intensity than in recent years.

“The 2021 real estate market was incredibly hot and will be hard to beat,” said Lennox Scott, CEO of John L. Scott Real Estate. “Headwinds the real estate market will face in 2022 include affordability, inflation in the economy, the potential of higher taxes and additional economic factors (including supply chain issues and struggles to fill empty positions).”

The biggest variable is Covid. The outbreak of new variant strains could both impede owners from selling this year while also possibly keeping low mortgage rates in check longer than expected – though most industry followers are optimistic for extremely strong sales activity.

“We still will have three factors that will continue moving the market forward: strong regional job growth, historically low interest rates and a continued desire to lay down roots elsewhere that I call ‘The Great Reshuffle,’” Scott said.

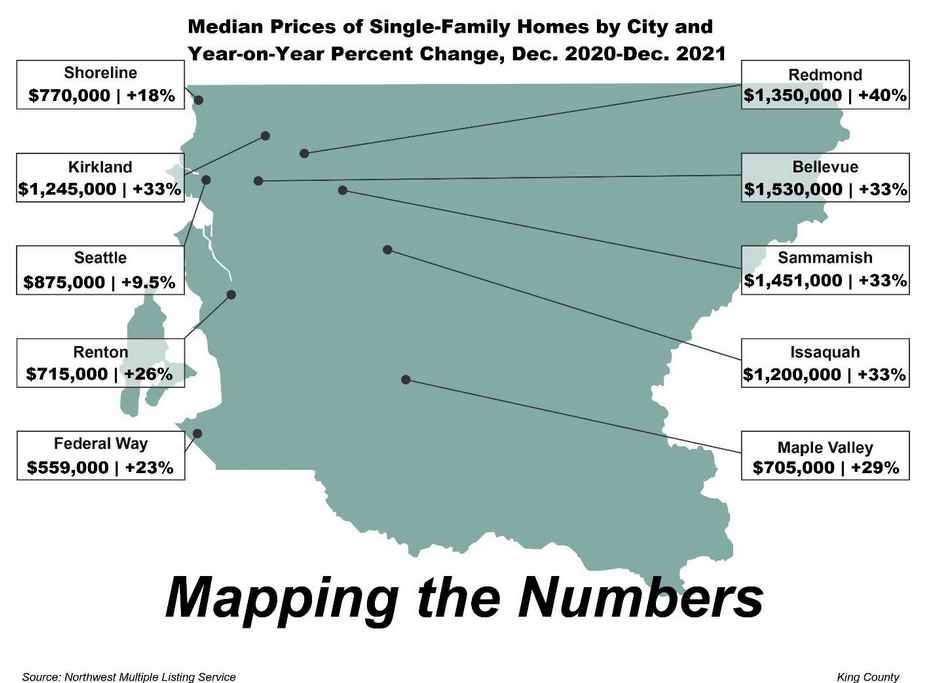

Amid a shortage of homes for sale, prices will continue to rise – likely by about 5% for all home types combined in King County and about 9% for single-family homes. Since 2016, Seattle area home prices have climbed 70% and average rents in the metro area have risen 23%.

Single-family-home price appreciation is even more pronounced in pockets of the Eastside. Sammamish, Bellevue, Redmond and Woodinville report 45%+ price growth for that category of homes in just the past two years – and there is no expectation of a significant easing in 2022.

“If affordability falls too far, some home buyers on the margin will pull back, prompting fewer bidding wars and causing house prices to moderate,” said Mark Fleming, chief economist at First American Financial, which provides title insurance and settlement services for real estate transactions. “Mortgage rates are expected to increase … [and] as the ‘big short’ in housing supply continues, it will become impossible to keep up with double-digit nominal house price growth, especially in a rising-rate environment.”

To read more about what we might expect this year across our region, check out my annual forecast blog post. Plus, John L. Scott produced its forecast report for King County. (Other regional housing forecasts for areas of Idaho, Oregon and Washington are available by contacting me.)

MEET ME IN THE MIDDLE

A lack of homes for sale in our region – and, frankly, across most of the state – has caused prices to rise to the extent that homeownership is unattainable for many. That’s despite Washington having the highest GDP growth of any state in the last five years.

You have likely read about it here: Archaic zoning policies that prohibit density in most of King County, high fixed costs to build homes and labor shortages in the construction sector all contribute to a limited supply for thousands of eager buyers. In recent years, developers have focused on building higher-priced high-rises and custom-built single-family homes instead of what most buyers need.

Without a spread of housing options at different price points, lower-income households – and particularly households of color – are priced out of the market. About half of Washington’s white residents can afford to buy a typical home, while just 32% of Black residents and 33% of Hispanics can do the same, according to research from the National Association of Realtors® (NAR).

Ever-rising demand driven by population growth and demographic shifts coupled with mismatched construction priorities have led to increasingly unaffordable housing in the Puget Sound region and other parts of the state. This has created a void known as “missing middle” housing and the crisis will only worsen without an aggressive, coordinated approach from elected leaders.

State lawmakers led by Gov. Jay Inslee introduced legislation that this year will attempt to make a dent in the affordable-housing shortage. The so-called missing middle housing legislation would legalize and incentivize multi-family housing construction on all residential land located within a half-mile of a major transit stop in our state’s larger cities. Similar, if not broader, actions to House Bill 1157 were successfully taken in Oregon and California.

(This effort would be in addition to the Biden administration’s Build Back Better plan that offers several programs aimed at increasing affordable housing. The House-supported plan provides $10B in down-payment assistance for first-generation buyers and $15B for the Housing Trust Fund to build and preserve more than 150,000 affordable homes for low-income households. The legislation remains stuck in the Senate, as of this writing.)

If we think about the housing system as a ladder – with the most expensive homes at the top and affordable housing near the bottom – rising homeownership costs relative to slowly increasing wages push potential buyers down a rung or remove the lower rungs altogether. This can lead to a lifetime of renting, displacement or homelessness.

Allowing more home choices would create additional housing in neighborhoods close to jobs, transit, schools and parks. Multi-family housing – such as duplexes, triplexes, and fourplexes – is more affordable than detached, single-dwelling houses because land costs can be shared across several households.

Additional housing located near major transit stops can help reduce our reliance on cars, cut traffic congestion and greenhouse gas emissions and create more sustainable communities. It also supports walkable neighborhoods and, unlike other states, Washingtonians are generally fine with higher-density housing to address the issue.

The proposal before state lawmakers this month is a good step towards housing equality but there is far more to be done to right the imbalance between supply and demand. We need to make significant changes in the structure of our housing market before the affordability crisis improves. Whether this means concentrating on the construction of missing-middle housing, further relaxing restrictive zoning laws or mandating developers to include lower-income options with every multi-family project remains to be discussed.

One thing is for certain: Many people who want to live in our cities are finding it more and more difficult to find a home that fits their budget. Measurable actions to accommodate Washingtonians must be taken – now.

SHORTAGES HIT BUILDERS

Just about every powered device comes with a microchip – except maybe the hairdryer (think about it!). Chips help operate our toasters, coffeemakers and PlayStations – as well as heat pumps.

Builders won an emergency ruling from the State Building Code Council after heat pumps became as scarce as a two-dollar bill. Heat pumps help deliver heating and cooling to our homes and are frequently installed to achieve energy credits required in the residential energy code.

According to the Master Builders Association of King and Snohomish Counties, home builders were concerned that projects already in construction would be unable to obtain a certificate of occupancy without the pump – a situation that could also affect a buyer’s financing if the purchase is delayed.

The council ruling specifies that homes can still receive occupancy papers and the required energy credits while waiting on installation of the outdoor compressor unit.

This is not the only shortage to affect the construction business. As noted earlier, the narrowing pipeline of skilled workers is threatening the pace of new-home growth. When surveyed, 89% of Washington contractors admitted they were having difficulty filling salaried and hourly positions, while 64% claimed they are losing employees to other construction firms.

In addition, the average age of those in the trade is about 45 and rising. Builder associations say younger workers and apprentices are ever more difficult to attract to construction training programs.

RETURN OF THE HELOC

Historically low interest rates in 2021 prompted many homeowners to refinance their mortgages. This allowed households to save thousands of dollars in lower interest, assuming owners stay in their homes for at least a few years to recover the refinance fees.

A whopping $5T in residential mortgage loans were refinanced in the last two years. Refinances, however, may fade from popularity this year if forecasts of rising mortgage rates – to as high as 4% – come to bear.

Home equity lines of credit, or HELOCs, will “come back into vogue,” predicts Dale Baker, president of home lending at KeyBank. “If a client already has 2.5% on their mortgage, and they need to borrow $100,000, do you refinance the whole thing at 3.5% or 4%? Or do you just go get a home equity loan or home equity line of credit and leave your 2.5% alone over the last several years?”

Analysts with the Mortgage Bankers Association project refinances will reach $860B this year, a 62% decline from 2021.

Talk to your financial advisor or personal banker for guidance before making any changes.

BY THE NUMBERS

>> A survey of 1500 people age 60+ showed 74% believe that purchasing a home was their best financial decision. And 55% of those seniors said they have paid off their mortgage, while 40% plan to use the equity to pay off the balance of their mortgage.

>> Over the next 20 years, Urban Institute forecasts, 70% of new homeowners will be Hispanic. The formation of 4.8M new households is more than half of the current 9M Hispanic homeowners in the U.S. (2020 data). Hispanics make up about 19% of the U.S. population.

>> Six years ago this month, there were 994,500 single-family homes on the market in the U.S., according to Altos Research, which monitors real estate transactions. As of Jan. 1, there were only 293,600 single-family homes available for sale, a decline of 70% in that period.

>> A full 91% of Washington households are connected to the internet, according to a summary report from the NAR. The report, released in December and covering 2020, also noted a 64% homeownership rate in our state and a 7.9% vacancy rate, just shy of the national low set by Oregon (7.8% vacancy rate).

>> Seattle added about 60,000 housing units in the decade ending in 2020 – including 32,300, or about 30% of the total, in Central Seattle (between the Lake Washington Ship Canal and I-90) – to roughly 368,000 units, according to U.S. Census data. While the city added 19% more homes in those 10 years, the population gained 21% to 737,000 (2020).

>> Sixty percent of single women renters now believe homeownership is out of reach, according to a Freddie Mac survey released in October. Some 82% of single female heads of household renters say they don’t have enough money for a down payment or closing costs.

>> King County has 25,388 apartment units in development (Q3 2021), up 18% from Q1 2020, at the start of the pandemic, according to data from commercial real estate agency Kidder Mathews. Monthly rent data for the county are up 9.2% in the same timeframe to an average of $1944 for a two-bedroom unit, and vacancy rates have fallen to 4.6% from 5.6%.

JANUARY HOUSING UPDATE

The latest housing data from the Northwest Multiple Listing Service uncovers a significant cooling in listing activity amid narrowly mixed price changes from November’s report. The only conclusion to be drawn from the December data is that everyone appeared to take a breather, enjoy the holidays and hunker down amid bad weather and rising Covid infections.

The home-shopping hibernation period will soon end.

Among the King County lowlights: We started January with 40% fewer homes on the market than on Dec. 1 for all home types (single-family, townhome, condo), led by a 48% decline on the Eastside (69 listings) and a 41% drop in Seattle (413). The county total (693) is 64% lower than this time last year.

Median home prices were little changed month-to-month, with a 1.2% gain across all home types in King ($749,000) and a 1.2% decline for single-family homes ($810,000). Eastside prices continue to be the outlier, with sharp appreciation this past month on all home types (6.3% to $1,276,112) and single-family properties (7.1% to $1,529,500) – both all-time highs.

Annual median prices continued to stay in and around the double-digit level. King County homes were priced 11% higher than a year ago to $676,000. Eastside prices led the way, up 34% YoY for all home types and up 37% for single-family homes. Seattle prices were up 3.7% on the year for all home types ($762,475) and 4.9% for single-family residences ($839,000).

Condo prices in the county were up 8.2% on the year to $460,000. That includes a 5% YoY gain in Seattle ($490,000), a 9.4% climb in downtown/Belltown ($709,000) and unchanged on the Eastside ($550,000).

With a lack of new inventory to help fill the housing pipeline, inventory was at impossibly low levels. Only 0.3 month’s of inventory was available for all of King County homes. That means it would take only eight days to extinguish all of the county’s homes for sale if no others hit the market. Meantime, single-family inventory was barely registering a figure in the county and in Seattle (0.2 months’ inventory each) and 0.1 (4 days) on the Eastside. Mercer Island started this month with only one home on the market. One! (This time last year there were 20 total listings on the island.)

Based on total pending sales, King County enjoyed its fifth-busiest year this century with 32,517 homes under contract in 2021, up 2.2% YoY. The typical home averaged 15 days on market, down from 21 days in 2020, and the median number of days on market fell to six from seven a year ago.

In addition to King County’s 1.2% median price month-to-month increase on all home types, to $749,000, Snohomish County saw the sharpest jump – a rise of 3.2% from November to December ($679,950). Pierce added 2.0% on its media price since November ($515,000) while Kitsap was virtually unchanged ($499,950). Single-family home prices in King fell 1.2% in a month ($810,000), while both Snohomish ($700,000) and Pierce ($520,000) rose 1% and Kitsap was flat ($500,000). Year-to-year, single-family median prices soared 22% in Snohomish, 18% in Pierce, 17% in Kitsap and 9.5% in King – well off their scintillating highs from last spring/summer.

Click here for the full monthly report.

CONDO NEWS

The options for a newly built condo home will be far fewer in 2022 than most years. Coming off the opening of three Seattle high-rises last year, the number of new unveilings in 2022 can be counted on one finger.

It is my understanding that Infinity Shore Club, located at Alki Point, will be the only new condo community to open its doors in Seattle – and it’s not even a high-rise. Doors to the 37-resident, 6-story glass and concrete beauty are targeting its opening in March.

Just up the road, The Pinnacle at Alki offers a smaller footprint – a maximum of two units per floor – and equally stunning views of Elliott Bay in West Seattle. The luxury condo includes floor-to-ceiling windows, custom fireplaces, rooftop deck with a fire table and grills. Open in 2020, only three of the 11 condo units appear to be unsold.

Not all condominiums are your traditional mid- or high-rise. Toll Brothers has introduced a wonderful condo option in The Lofts at 15th located in the Crossroads neighborhood of Bellevue.

The Lofts at 15th offers 22 luxury residences ranging from 1462 to 2258 sq. ft. and starting from $1.26M. Each of the four, 4-story buildings offers a private, two-car garage on the first floor with stair or elevator access and many units are laid out on a single floor. The community is centrally located in the Bellevue school district and close to the offices of Microsoft, Amazon, Google, Facebook among others.

Check out this video walkthrough of a sample unit. (Tip: Never visit a new construction sales gallery without your real estate broker.)

Contact me with your questions about any condo project or existing building in the Seattle area. I can help!

LUXURY LIVING

This is the quietest time of year for luxury home sales but there are always a few fresh, Instagram-worthy listings to share.

Let’s start in Clyde Hill, the tony town sandwiched between the waterfront community of Medina and the big-city brother of Bellevue. That’s where we find this 5-bedroom, 6-bath, 7360 sq. ft., Adam Leland-designed, newly constructed, two-bedroom home with finished basement. This listing would make my must-see list any month of the year. The contemporary open plan with high ceilings is vast yet cozy, seamlessly blending form and function. The one-third acre property includes a four-vehicle garage and west-facing views. Uncompromising! List price: $10.8M ($1467/sq. ft.).

If that’s out of your price range, how does a private estate for a half-million dollars less sound? It’s in the San Juans and ready for a new owner. This property features four buildings, including a pair of 2-bedroom homes with coffered wood ceilings, a stunning 1500 sq. ft. beach house, small office and four-vehicle garage on 2.2 acres along 291 feet of western waterfront on Blakely Island, where the population at last count was less than 100. Quintessentially remote, luxury living. Want more? How does an airport hangar, tarmac, 2500-bottle wine cellar and three utility vehicles sound? The sale includes all the above, plus home furnishings are subject to availability. Talk about move-in ready! Check out this stunningly produced video of the area. List price: $10.3M ($1811/sq. ft.)

We leave you with an investment property to ponder along Lake Sammamish in Issaquah. While there is a 1925-era, 2-bed, 1.75-bath, 1320 sq. ft., one-story home on the property, my suspicions are that the 1-acre dirt is more valuable and deserves a new house to better appreciate the beautiful waterfront vista. The list price may be steep – $6.85M ($5189/sq. ft.!) – but the long-term value is priceless.