This is a friendly public service announcement from your friendly real estate professional: Be extremely careful of cyber fraud when planning to buy or sell a home.

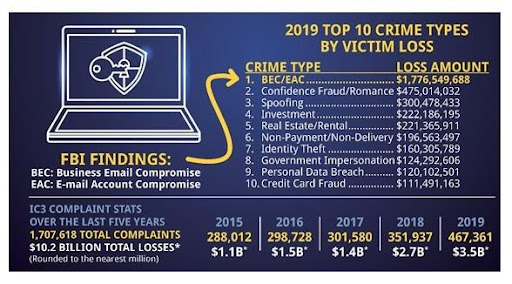

In our world of all things digital, consumers and organizations large and small find themselves entangled in various schemes to steal money. Among the more notable cases, more than $30B was siphoned from states in 2020 – including $600M in Washington – through unemployment benefits scams.While on a smaller scale, real estate also suffers various forms of financial fraud. The FBI reported that in 2019 (latest available data) more than 11,500 people were victims of wire fraud in the real estate and rental sector with losses of more than $221 million – a 48% increase over 2018. That ranks real estate No. 5 out of more than 30 types of fraud tracked by the FBI’s Internet Crime Complaint Center.

The highest reported fraud in real estate was “business email compromise/email account compromise” (BEC/EAC). Fraudsters will assume the identity on the title or of the real estate agent or closing agent (or closing attorney) and forge the person’s email and other details about the transaction. Scammers then send an email to the unknowing buyer and provide “new” wire instructions to the criminal’s bank account.

An unsuspecting buyer simply follows the revised wiring instructions and – poof! – the money is in the hands of a person in another country. Wired funds are as good as cash; there are no delays to clear funds like when writing a check.

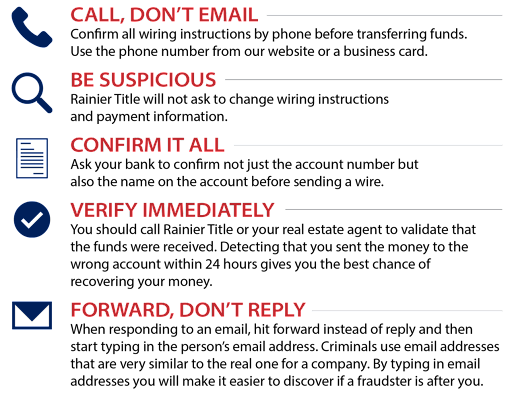

That’s why buyers and sellers alike should be on the look-out for unusual emails, text messages and other communication that appear sudden and out of place regarding their home purchase/sale. Here are some tips, courtesy Rainier Title & Escrow in the Puget Sound area:

In a separate report, the FBI warned consumers of fraud risk amid a rising use of mobile banking apps. The agency said a 50% surge in these apps since the start of 2020 will likely lead to an increase in fraud. It reported nearly 65,000 fake apps were detected on major app stores, making it one of the fastest-growing areas of fraud.

As Americans began their work-from-home environment at the start of the pandemic, security-monitoring company FundingShield cited a 62% increase in wire instruction errors, fraud and phishing attempts, and attempts to fund unauthorized third-party accounts to wire instructions.

FundingShield said the risk climbs sharply when there is an exchange of data – particularly sensitive information – and when funds are being transacted, such as digital mortgage and escrow details.

“[With] the risk from work-from-home, you’re creating more reliance on the systems and processes,” Adam Chaudhary, president of FundingShield, told HousingWire.com. Chaudhary said the risk sharply increases when exchanging data on an unsecured network such as at an airport or coffee shop.

The FBI recommends several efforts to protect sensitive information from getting in the wrong hands. They include:

- Enable two-factor or multi-factor authentication on devices and accounts to protect them from malicious compromise.

- Use strong two-factor authentication via biometrics, hardware tokens or authentication apps.

- Use multiple types of authentications for accounts, if possible. Layering different authentication standards is a stronger security option.

- Monitor where your Personal Identifiable Information is stored and only share the most necessary information with financial institutions.

At the same time, the FBI urges consumers not to:

- Click links in emails or text messages; ensure these messages come from the financial institution by double-checking email details. Many criminals use legitimate-looking messages to trick users into giving up login details.

- Give two-factor passcodes to anyone over the phone or via text. Financial institutions will not ask you for these codes via a phone.

In addition, if a banking app appears suspicious, call the bank from a number provided by the website (not through the number noted on the app or questionable email). Financial institutions may ask for a banking PIN number but will never ask for your username and password over the phone. Check your bank’s policies regarding online and app account security. If the phone call seems suspicious, hang up and call the bank back at the customer-service number posted on its website.

Be smart. Be safe.