Sellers who lived in their home at least a few years have probably seen and heard it all about their property. The basement leaks in a heavy rainstorm, critters nest in the attic or crawlspace during winter or the backyard shows signs of erosion on the edge of a former coal mine.

One might suggest that no one will know about these defects – particularly if the property is sold in dry summer months, buyers focus on the curb appeal, and want the home after losing out on multiple offers.

But sellers, my advice is blunt: Don’t try to be “smart.” Be wise!

Washington state law requires homeowners complete the Seller Disclosure Statement provided by the Northwest MLS through the listing agent. The statement is a formal questionnaire about the condition of the home inside and out, and it requires truthfulness and transparency about any defects – including those persistent leaks and pesky critters. [Disclosure statements are not required in a new-construction sale, when a relocation service completes the transaction, in a bankruptcy or estate sale.]

In general, sellers should disclose any known facts about the physical condition of the property, existence of dangerous materials or conditions, lawsuits or pending matters that may affect the value of the property and any other factors that may influence a buyer’s decision.

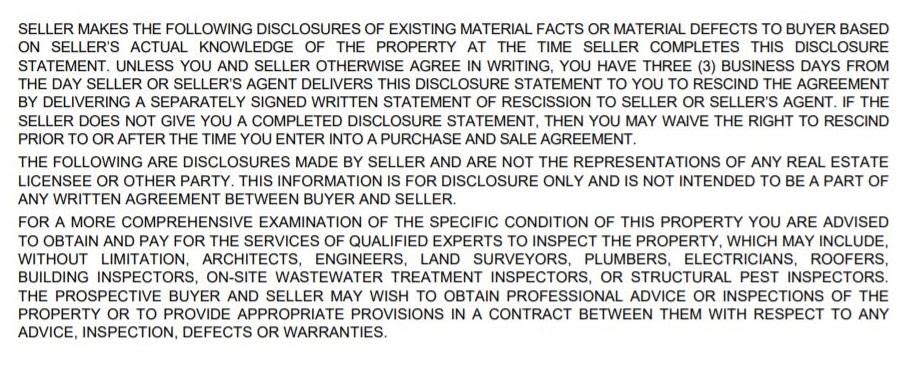

We use the term “material defect” to describe a specific issue with a system or component of a residential property that may have a significant, adverse impact on the value of the property or that poses an unreasonable risk to people. Sellers should not try to be “smart” and suffer from amnesia when completing the statement. The disclosure statement includes clear language addressed to buyers, in all caps:

“Most sellers think it is in their best interest to disclose as little as possible,” Rick Davis, a Kansas real estate attorney, was quoted by realtor.com. “In the vast majority of cases, disclosing the additional information … will not cause a buyer to back out or ask for a price reduction.”

The blatant omission of a roof leak, for example, may cost a seller far more than a repair bill. If the home is sold to an unknowing buyer and later discovers the original homeowner was previously aware of the defect, then the matter could end up in court.

A listing agent is required to share this knowledge to potential buyers through their brokers – even when a seller omits the information in the disclosure statement. While he/she cannot revise the seller statement, an agent should discuss the discrepancy with his/her clients and try to convince them of the potential financial and emotional toll it may bring.

The courts will not hold sellers accountable for failing to disclose issues they were unaware of, such as mold or termites in the walls. It would be impossible to hold sellers responsible for failing to disclose these types of unknown defects after completing the sale.

In fact, at a certain point, the burden falls on buyers to complete their due diligence to uncover any problems – either through personal tours of the property, a whole home inspection or inspection by a specialist (roof, termites, rodents).

A home warranty may reduce the odds of dealing with an after-sale dispute regarding the repair or replacement of covered home systems or appliances. And let’s be honest: A seller would rather have the new homeowners call the warranty company instead of the sellers.

When in doubt, sellers, be transparent and honest – and contact a real estate attorney when unsure what to do. A listing agent cannot practice law by providing legal advice on these matters.

“Ironically, the more disclosures you make, the less important they might become to the buyer,” Adam Buck, a certified real estate specialist with the Frutkin Law Firm in Arizona, was quoted by realtor.com.

“Think [of] prescription medication commercials,” Buck added. “When was the last time someone decided not to use a new medication because of the laundry list of side effects rattled off at the end of the TV commercial?”