We are at a crossroads in Seattle and in our society. The growing call for change stems from years of systemic inequality for many across most aspects of life.

We have come a long way … but we have far to go.

Real estate and mortgage lending, unfortunately, played a role in helping to create a social and financial imbalance on the lines of race, color and creed. It has been more than a half-century since the Federal Fair Housing Act came into law but, sadly, there are still examples of discrimination in our industry − Long Island being the most recent to attract national attention.

Federal laws prohibiting discrimination have been on the books since 1866, just after slavery was abolished. That’s when Congress passed the Civil Rights Act, granting all citizens the ability to “purchase, lease, sell, hold and convey real and personal property.” As freeing as the act may have read, it was mostly words on paper than actual governance. (African-Americans at that time could not vote or live and work side-by-side with white Americans.)

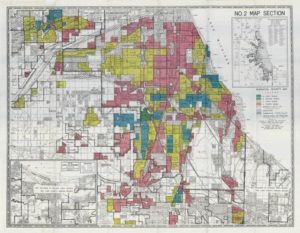

The Home Owners’ Loan Corp. (HOLC) was established during the Great Depression to help struggling mortgage holders refinance loans before potentially losing their homes. But it was this same entity that helped devise color-coded city maps to determine the creditworthiness of properties, an exercise that led to the term “redlining.”

Maps − such as this one of Chicago from the HOLC − were used for decades to discourage banks from lending or investing in neighborhoods that were predominantly non-white. Chicago area economists and real estate professionals partnered on this endeavor to develop theories that bolstered racial segregation rather than stamp it out. One local appraiser, Frederick Babcock, who used those theories for many years and wrote a book on the subject, would later become the lead appraiser at the newly created Federal Housing Administration (FHA), further propagating segregation in U.S. cities for decades. Perhaps silently acknowledging its discriminatory practices, the FHA in 1950 refused to provide mortgages to properties with racial covenants. These covenants are no longer enforceable but can still be found on deeds in our area today, a festering blemish that state and local governments and the real estate industry should swiftly remedy.

Housing discrimination was practiced widely across Puget Sound. In 1964, Seattle voters rejected an ordinance that would have opened housing to all and in any part of the city. In response, volunteer groups – from Kirkland to Federal Way – moved to integrate their areas. One group, the Voluntary Listing Service, “directly negotiated fifty-two sales [of homes to minorities] with a dollar volume over $1,000,000” by 1965, according to HistoryLink.org.

It wasn’t until 1968, exactly a week after the assassination of Dr. Martin Luther King Jr., that President Lyndon Johnson signed into law the Fair Housing Act, making it illegal to discriminate on the basis of race, color, religion, sex, national origin, disability or familial status in the sale or lease of residential property. The housing edict, part of the sweeping Civil Rights Act, also prohibits discrimination in real estate brokerage, lending and other services. Seattle City Council approved similar legislation the same month.

Four years later, the Justice Department ruled “steering” – the channeling of buyers either toward or away from certain neighborhoods based on race, religion or other protected classes – to be illegal under the same act. The ruling came after blatant examples of racial discrimination – including steering minorities away from predominantly white neighborhoods – were reported.

Laws in our state now go above and beyond federal policy, helping to (literally) open new doors to all classes and tamping down disparities in residential real estate services. They protect against discrimination in many classes:

- Race

- Color

- National origin

- Religion

- Creed

- Sex

- Disability

- Familial status

- Marital status

- Sexual orientation

- Gender identity

- Honorably discharged veteran or military

- The presence of any sensory, mental or physical disability

- The use of a trained-dog guide or service animal by a person with a disability

King County goes further by including these protected classes:

- Age

- Section 8 (housing vouchers for low-income residents)

- Use of a service or assistive animal

- Ancestry

And Seattle residents are protected against discrimination for all reasons defined by the state and county, as well as political ideology.

In Seattle, housing laws are enforced by the city’s Office for Civil Rights, which cites specific examples of prohibited discrimination in real estate, including:

- Refusing to engage in a real estate transaction with a person

- Discriminating against a person in the terms, conditions or privileges of a real estate transaction or in the furnishing of facilities or services in connection therewith

- Refusing to receive or to fail to transmit a bona-fide offer to engage in a real estate transaction from a person

- Refusing to negotiate for a real estate transaction with a person

- Representing to a person that real property is not available for inspection, sale, rental or lease when in fact it is available; or, to failing to bring a property listing to their attention; or, to refusing to permit the person to inspect real property

- Discriminating in the sale or rental, or to otherwise make unavailable or deny a dwelling, to any person; or to a person residing in or intending to reside in that dwelling after it is sold, rented or made available; or to any person associated with the person buying or renting

- Making, printing, circulating, posting or mailing, or causing to be so made or published a statement, advertisement or sign; or, to using a form of application for a real estate transaction; or, to making a record or inquiry in connection with a prospective real estate transaction, which indicates, directly or indirectly, an intent to make a limitation, specification or discrimination with respect thereto

- Offering, soliciting, accepting, using, or retaining a listing of real property with the understanding that a person may be discriminated against in a real estate transaction or in the furnishing of facilities or services in connection therewith

- Discriminating in the course of negotiating, executing or financing a real estate transaction whether by mortgage, deed of trust, contract, or other instrument imposing a lien or other security in real property, or in negotiating or executing any item or service related thereto including issuance of title insurance, mortgage insurance, loan guarantee or other aspect of the transaction

- Discriminating based on the presence of any sensory, mental or physical disability, or the use of a trained-dog guide or service animal by a person who is blind, deaf or physically disabled

- Discriminating based on the person’s health, including whether the individual has or had Covid-19 or any other serious illness

Yes, we have indeed come a long way … but we still have far to go.

For more information, check out Fair Housing resource pages for Washington and Seattle. To file a discrimination complaint to the state, contact the Human Rights Commission in Olympia. Complaints can also be lodged through the county and city.