Do you remember when we first met and you told me, your soon-to-be listing agent, that you need to make a certain amount of money at closing? I heard you – and I made sure we did everything in our power to at least hit that figure.

We are now at (or close to) that moment in the process when sellers learn what they will take home on their, um, home. Your escrow representative and/or listing agent will share a sharper estimate in the form of a net proceeds statement.

Also known as a settlement statement, it offers a line-by-line explanation of a seller’s credits and debits (costs related to closing and other items). Your two agents – real estate and escrow – can help explain the line items. But for your benefit here, a typical statement could include:

Sales Price – The price should appear at the top of the statement, since most home sales have one or two credits and the rest comprise debits/costs that the seller must subtract from the sales price.

Refunds – Assuming the seller paid property taxes on time, he/she should expect a refund at closing. That is just one example of how a seller’s net proceeds can increase.

Seller Financing – Should the seller agree to help the buyers by loaning some money to pay for the home, then it would be debited from the seller’s net proceeds.

Seller’s Loan – If the seller is still paying off his/her mortgage, then the bank will want to be fully reimbursed through the funds from this sale.

Commission – It is customary in the U.S. (and many other countries) for the person to pay a fee for requesting outside services to sell an item of value. That is the case in residential real estate. Buyers rarely pay a commission to agents but they will when it is time for them to sell.

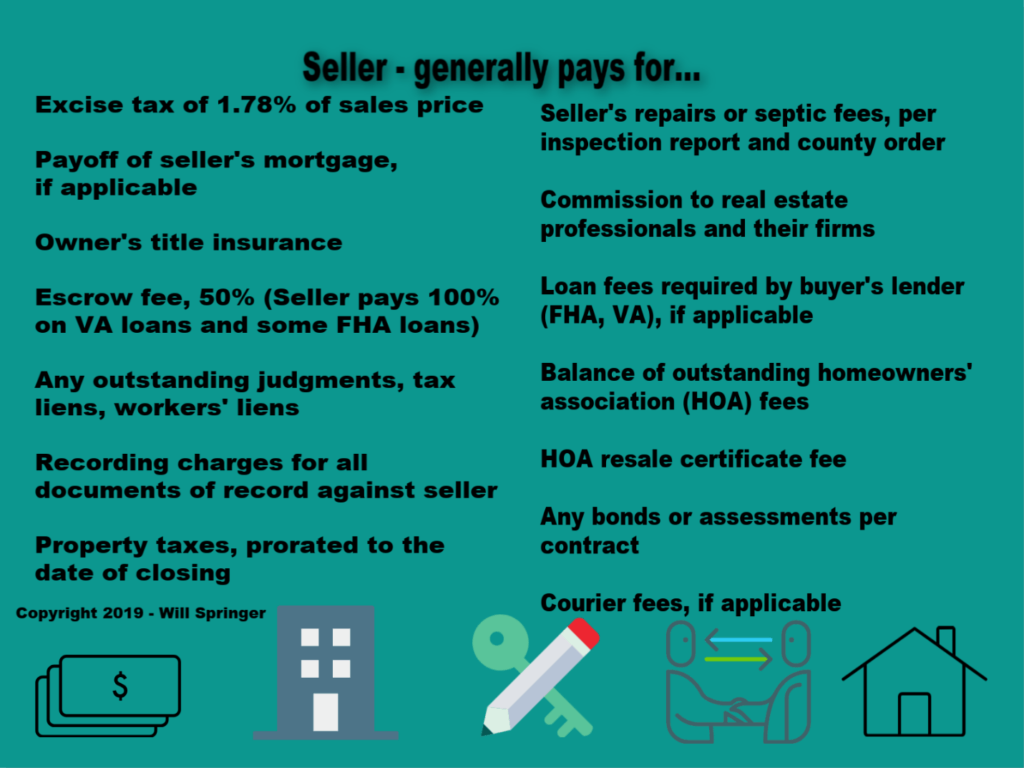

There is another set of taxes, service fees and costs for which the seller is usually responsible. Here’s a better way to look at it:

[Since this post was written in 2019, the state of Washington has revised its method to tax home sales.]

Overall, sellers in Seattle/King County typically pay about 9% of the sales price toward the costs to close on the home. That includes items that can often be forgotten such as utility bills.

The general rule of thumb that I hear other people in real estate share with clients is this: Subtract two months’ mortgage payments from the principal balance to get an estimated net proceeds. This will help you, the seller, early in the process to assess your financial position. Of course, there are apps available on your phone and websites that can also help provide you with estimates but nothing beats the information provided by your primary source: escrow, the representatives preparing to help you close on the deal.

This is the time in the selling process when there is a confluence of activities taking place to complete the deal. Picture yourself in Western Pennsylvania, where three rivers – the Allegheny, Monongahela and Ohio – all flow around Pittsburgh. That is where we are today – escrow, home inspector and appraiser – are handling their workflows until, soon, they will merge into one … just like in the Steel City, where the rivers combine into the Ohio.

We could still be working on final repairs to the home. The appraiser is finalizing a report for the lender. Escrow is coordinating credits and debits to ensure the transaction has a smooth finish and hits the closing date.

It’s all coming together, just like the three rivers.